Cash Store Blog

Understanding Auto Equity Loans: How to Leverage Your Vehicle’s Value

If you’ve been following the news, you may know that there is a substantial projection—11.6% to be specific—for year-over-year U.S. new-vehicle sales, and with Americans holding onto their cars for an average of eight years, the road ahead is promising.

So where are we going with this, and what does one have to do with the other? 80% of Americans prioritize cost when acquiring a new car, revealing a conscientious approach to personal finance. And with car sales on the rise, car manufacturers may capitalize on the trend, not necessarily lowering those new car prices.

Further, the longer you hold onto a well-maintained car, the more equity you can build. So, instead of heading to the dealership to trade that car in for a new, shinier ride, consider the other goals you are looking to accomplish. Why? Because that vehicle you own may offer you enough equity to help fund those other financial goals. In fact, it could be a financial asset waiting to be unlocked through an auto equity loan.

Your Vehicle’s Value May Make You Eligible for an Auto Equity Loan

An auto equity loan is more than a financial transaction; it's a potential solution for vehicle owners seeking extra funds without parting ways with their trusted wheels. Essentially, it involves borrowing against your car's equity, or the appraised value minus any outstanding loans.

However, before embarking on this financial journey, it's important that you can comprehend key financial terms like equity, interest rates, credit score, debt, and budget. Equity represents your ownership stake, interest determines the cost of borrowing, credit score influences loan approval and interest rates, while debt and budget are vital components of your overall financial health.

Being well-versed in these terms ensures you make informed decisions, steering clear of potential pitfalls. As with any financial commitment, understanding the terrain is a must—navigating the nuances of auto equity loans empowers you to make sound choices aligned with your financial goals and circumstances.

What is an Auto Equity Loan?

As mentioned in the previous section, an auto equity loan enables you to leverage the value of your vehicle to secure funds. Unlike other loans, it hinges on the equity you've accumulated in your car, calculated as the appraised value minus your outstanding loan amount. This form of financing doesn't interfere with your existing car loan.

To grasp the mechanics, consider this: if your car holds a market value of $20,000 and your outstanding loan amounts to $10,000, you may be able to borrow as much as $10,000 against the equity. This distinctive feature sets auto equity loans apart, providing a flexible and accessible means to access cash without jeopardizing your primary auto loan, and typically at a far lower interest rate than what you can obtain through a credit card advance.

Understanding these nuances is fundamental, ensuring you navigate the financial landscape with precision and clarity.

Eligibility for an Auto Equity Loan

Qualifying for an auto equity loan is often more attainable than securing unsecured loans, given the lender's reduced risk due to the collateral involved. The fundamental eligibility criteria vary among lenders, but the overarching principle remains: your vehicle's equity is the determining factor. This secured loan model hinges on the notion that if a borrower defaults, the lender can seize and resell the vehicle to mitigate potential losses.

The importance of equity in your vehicle is also important to remember. Equity, the difference between your car's market value and the outstanding loan amount, determines the borrowing capacity. The higher the equity, the more funds you can access. This factor enhances eligibility and influences the interest rates and terms lenders offer.

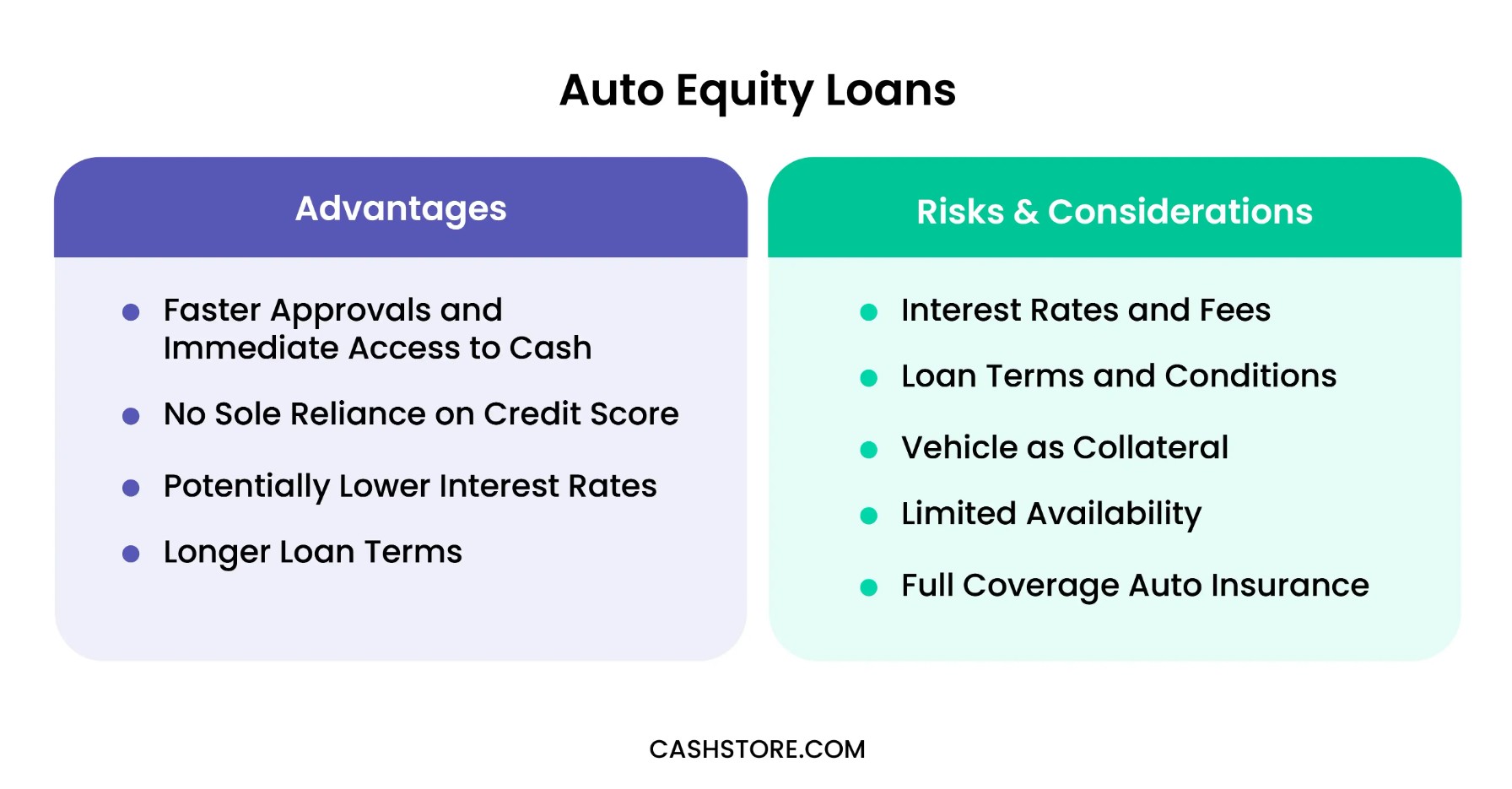

Advantages of Auto Equity Loans

Considering an auto equity loan? If you have equity in your car and can comfortably manage monthly payments, this unique financing option may offer distinct advantages.

Here's why it could be the right fit for you:

- Faster Approvals, Immediate Access to Cash: Unlike the prolonged processes associated with traditional loans, auto equity loans often boast faster approval times, providing you with swift access to the funds you need.

- No Sole Reliance on Credit Score: Auto equity loans consider your vehicle's equity as collateral, meaning your credit score isn't the sole determinant. This makes it a viable option for individuals with less-than-ideal credit histories.

- Potentially Lower Interest Rates: Comparatively, auto equity loans may offer lower interest rates than unsecured loans, making them an economically appealing option.

- Longer Loan Terms: Auto equity loans provide the flexibility of extended loan terms, ranging up to 84 or even 144 months. This extended timeframe can result in more manageable monthly payments, accommodating a variety of financial situations.

Before venturing into this financing avenue, make sure you meet the prerequisites, such as having ample equity and conducting a practical evaluation of your payment capabilities. This ensures you can fully leverage the benefits offered by auto equity loans and fortify your financial well-being.

Risks and Considerations

While auto equity loans can offer a lifeline for those seeking quick funds, navigating the potential risks and considerations associated with this unique financing option is a must.

Here's what you need to keep in mind:

- Interest Rates and Fees: Auto equity loans may come with higher interest rates and additional fees. Understanding the full financial picture, including the cost of borrowing, is paramount to avoid unexpected financial strain. Note: We understand that we also included interest rates as a potential benefit. The message here is that the interest rate you qualify for can vary greatly depending on your credit score, the equity in your car, and other factors that may vary from lender to lender.

- Loan Terms and Conditions: Carefully scrutinize the terms and conditions of the auto equity loan. Be aware of any hidden clauses or unfavorable terms impacting your repayment plan.

- Vehicle as Collateral: An auto equity loan utilizes your car as collateral. If you fail to make payments, the lender can repossess your vehicle to recover losses. This underscores the importance of diligent financial planning to ensure consistent payments.

- Limited Availability: Auto equity loans are not as commonplace as traditional loans. Check with your bank or credit union first, as they may provide the service or partner with lenders. This rarity in the financial landscape demands thorough research to secure suitable options.

- Full Coverage Auto Insurance: Lenders typically mandate full coverage auto insurance when your vehicle is collateral for a loan, including auto equity loans. This requirement may increase your monthly insurance premium, adding to your monthly expenses. Assessing the impact on your budget is crucial before committing to such loans. Understanding and mitigating these risks will empower you to make informed decisions regarding auto equity loans, safeguarding your financial stability in the process.

How to Apply for an Auto Equity Loan

An auto equity loan might be the right move for you if you have financial needs like dealing with unexpected emergencies, consolidating debt, or funding a significant purchase. When seeking quick and accessible funds, Cash Store offers a straightforward application process across multiple locations in Idaho, Texas, and Wisconsin.

Here's a step-by-step guide:

- Start Your Application Online: Save time with Cash Store's short, secure online form. This initial step streamlines the process, allowing you to provide essential information conveniently.

- Gather the Required Documents: To facilitate a smooth application process, gather the necessary documents, including a recent paycheck stub or proof of income, the most recent checking account statement (open for at least 30 days), a valid driver’s license or state-issued ID, and, crucially, the clear and free title of the vehicle for which you seek the loan.

- Visit a Cash Store Location: Bring your gathered documents to a Cash Store location. The benefit? Unlike traditional loans, there's no overnight wait. You can pick up your cash the very same day, providing a swift solution to your financial needs.

Cash Store's presence across Idaho, Texas, and Wisconsin ensures accessibility for individuals seeking reliable and efficient financing solutions. Remember, before embarking on this financial endeavor, carefully assess your needs and repayment capabilities to maximize the benefits an auto equity loan can provide.

Alternatives to Auto Equity Loans

Typically, auto equity loan interest rates fluctuate between 6% and 36%. The importance of scrutinizing various lenders cannot be underestimated, as it directly impacts the rate you secure. To ensure you secure the most favorable terms, comparing offerings from different lenders is a must.

This diligent comparison process empowers you to make an informed decision, potentially saving you money and enhancing the overall affordability of your auto equity loan. Remember that even a seemingly small difference in interest rates can lead to significant savings over the life of the loan.

While auto equity loans are a great option for accessing funds, some alternatives may better suit your financial needs.

Consider these three options:

Home Equity Loans or HELOCs

Utilizing the equity in your home as collateral, a home equity loan or line of credit (HELOC) can provide a potentially more favorable interest rate and a higher loan amount, contingent on factors like your credit score and available equity. However, the risk lies in the potential of home loss through foreclosure if repayment becomes unmanageable.

Cash-Out Auto Loan Refinance

If you're reluctant to use your vehicle's equity directly, a cash-out auto loan refinance allows you to apply for a new loan to settle your existing car loan. Qualifying for more than the original loan payoff amount may result in receiving the surplus as a check or bank deposit, offering flexibility in fund utilization.

Personal Loans

Personal loans, especially for those with good or excellent credit, present an alternative to auto equity loans for a versatile borrowing option. The absence of collateral might be appealing, but bear in mind that individuals with lower credit scores may encounter higher interest rates and less favorable terms with this financing type.

Exploring these alternatives empowers you to make informed decisions aligned with your financial circumstances and goals, ensuring that the chosen financing avenue complements your needs without compromising your financial well-being.

Navigating Your Financial Journey: Is an Auto Equity Loan Right For You?

In the landscape of financial solutions, auto equity loans are a valuable resource for individuals searching for prompt access to funds by leveraging their vehicle's equity. Offering advantages such as expedited approvals and potentially lower interest rates, these loans require a comprehensive understanding of key terms like equity, interest rates, and credit scores for effective navigation. Acknowledging that your vehicle, serving as a significant asset, acts as collateral, influencing both eligibility criteria and loan terms is crucial.

Before applying for a car equity loan, consider the following key factors.

- Assess your vehicle's equity

- Evaluate your financial capability for monthly payments

- Explore alternative financing options.

For those pondering, "Where can I get a loan using my car as collateral?" thorough research into reputable lenders is imperative. Utilize keywords like "Auto Equity Loans," "Vehicle Equity Loan," and "Collateral Loan" in your search.

Whether you're looking for "Bad Credit Car Loans" or considering a "Refinance Car Loan," being well-informed ensures a smoother ride toward financial empowerment.

FAQ

What are the risks associated with an auto equity loan?

Auto equity loans pose risks such as higher interest rates, potential repossession if payments are missed, and fees. The vehicle serves as collateral, making it vulnerable to seizure. Borrowers may face financial strain if unable to meet repayment terms, impacting credit and overall financial stability. Understanding these risks is crucial before opting for an auto equity loan.

Is it a good idea to get an auto equity loan?

Whether an auto equity loan is a good idea depends on individual circumstances. It can provide quick funds using your vehicle's equity, but carries risks like higher interest rates and repossession if payments falter. Consider your financial situation, alternatives, and the ability to meet repayment terms before deciding if an auto equity loan aligns with your needs.

Can I borrow against the equity in my vehicle?

Yes, you can borrow against the equity in your vehicle through an auto equity loan. This involves using your car as collateral to secure funds. The equity determines the loan amount—your car's appraised value minus the outstanding loan. Before opting for this financing option, consider interest rates, repayment terms, and potential risks.