Cash Store Blog

Budget-Friendly Home DIY Projects + How to Finance Them

In recent years, Americans have increasingly poured money into upgrading their living spaces. And while the budgets for home improvements have grown, the cost to execute these projects has stayed high. This makes finding budget-friendly ways to spruce up your home more important than ever. Enter Cash Store: with smart financing options, making your dream home upgrades affordable is within reach.

With the average home renovation costing around $51,336 and projects ranging anywhere from $19,504 to $86,917, as per recent data from Angi, it's clear that costs can vary widely. But don't let the price tags deter you. By exploring cost-effective DIY projects and utilizing Cash Store's financing solutions, you can tackle those home improvements without breaking the bank.

House Renovations and Why Financing Home Improvements is the Way to Go

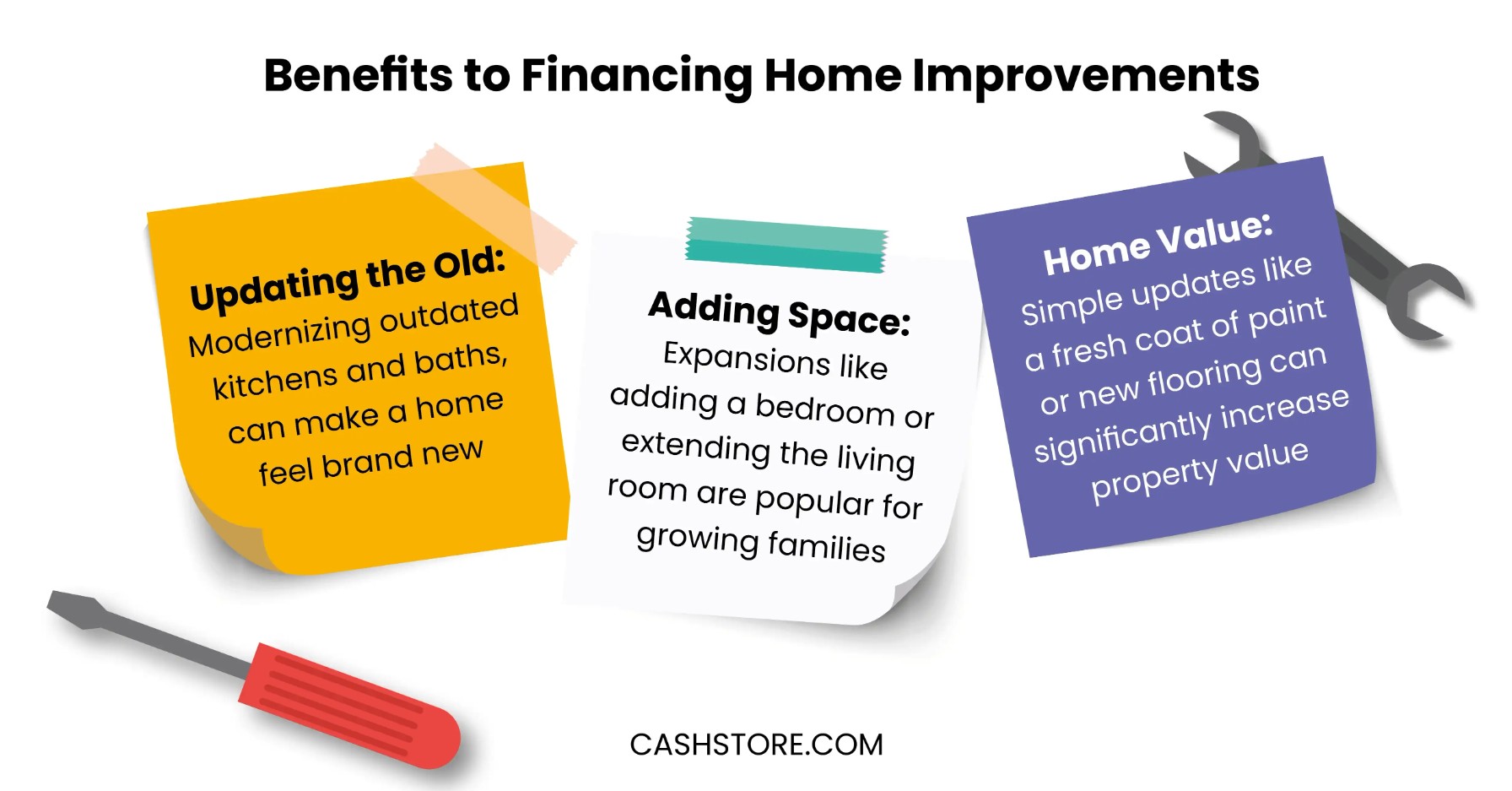

Renovating your home can feel like giving it a fresh breath of life, transforming everyday spaces into something new and exciting. And, homeowners jump into renovations for all sorts of reasons:

- Updating the Old: Many choose to modernize outdated kitchens and baths, making a home feel brand new.

- Adding Space: Expansions like adding a bedroom or extending the living room are popular for growing families.

- Growing Home Value: Simple updates like a fresh coat of paint or new flooring can significantly increase property value.

While these renovations can bring great joy and added functionality to your home, the reality is that not everyone has the cash on hand to fund these projects. This is where smart financing becomes invaluable. But that isn’t to say that you should just take out a loan for everything that you want to do all at once.

Planning Your Home Improvement Projects

When planning your home improvement projects, it's smart to start with a clear look at what you need versus what you can afford. First things first—figure out what changes you want to make. Maybe it's fixing up the kitchen or updating the bathroom. Whatever the area, list them all.

Ask yourself a few key questions:

- What's my budget? Can I afford this project now, or should I save up a bit more?

- Is it urgent? Does it need to be done now, or can it wait?

- What's the return on investment? Will this add value to my home or just personal satisfaction?

Once you've got your list, dig into the costs. Research how much materials and labor will run, and don't forget to factor in a little extra for those just-in-case scenarios. Set a budget that fits with your financial situation—remember, even with financing options like those from Cash Store, it's all about what you're comfortable with.

To keep costs down, consider which projects you can DIY, negotiate with contractors, or choose more affordable materials. It’s all about smart planning and knowing your limits, financially and practically.

Budget-Friendly DIY Projects

DIY or "do-it-yourself" is all about rolling up your sleeves and tackling home improvement projects on your own, without calling in the pros. This approach is not only budget-friendly, but it also lets you put a personal stamp on your space. Here are some great DIY projects that can transform your home without draining your wallet:

- Painting Walls: Give your rooms a makeover with a new coat of paint. It’s amazing how different a room can look with just a change in color. Painting yourself might cost around $1 to $2 per square foot, and you can save even more if you’re just focusing on an accent wall or touch-ups.

- Installing Shelves: Grow your storage with some shelves. Whether in the living room for books or in the kitchen for spices, shelves are practical and can improve any room’s decor.

- Upcycling Furniture: Instead of buying new, why not refresh what you already have? Refinishing a piece of furniture can give it a whole new life and make it a unique feature in your home.

- Installing a Backsplash: Add some pizzazz to your kitchen or bathroom with a new backsplash. Peel-and-stick tiles make this a surprisingly simple and affordable update.

- Weatherstripping: Seal up those drafts around doors and windows to improve your home’s energy efficiency. This small fix can pay off quickly in lower utility bills.

- Landscaping: Get your hands dirty and boost your curb appeal with some basic landscaping. Even just a few flower beds or a small vegetable garden can make a big difference in how your home looks and feels.

- Installing Ceiling Fans: These are both decorative and functional, helping to circulate air and reduce energy costs in warmer months.

- Updating Cabinet Hardware: A quick swap of knobs and handles on cabinets can instantly modernize an outdated kitchen or bathroom.

Many, if not all, of the projects listed above, can be funded with cash or a credit card purchase to pay it off in a short period of time. That said, always be thoughtful when using your credit card to pay for things that you can’t pay back within a month. Before long, you could find yourself wracking up debt that you aren’t in a position to pay off.

Budgeting for Big-Scale Home Renovation Projects

Okay, we know that you just went through that list above and you have a bigger project in mind. You’re thinking of a bathroom remodel or a kitchen redesign. And though these types of renovations can indeed be done with a do-it-yourself approach, they still come with a higher price tag.

A kitchen remodel can easily cost $12,000 to $60,500. And a bathroom remodel? You could be looking at $2,000 to $18,000—though most bathroom remodels cost about $5,000. If your heart is set on one or more of these types of big-scale projects, it’s likely that you don’t have the cash on hand to fund it upfront.

So, if taking out a loan is what you’re thinking, let’s take a step back and look at how you can drive down these renovation costs before you get started.

Here are some tips on how to manage those expenses, figuring out what you can DIY, and knowing when to call in the experts:

- Plan and Prioritize: Break down your project into manageable tasks. Prioritize what you absolutely need over nice-to-haves. For instance, updating faucets and lighting can make a big impact for less money.

- DIY What You Can: Simple tasks like painting, changing hardware, and even installing a backsplash are all manageable for most DIYers. Videos and tutorials can guide you through these steps.

- Shop Deals: Keep an eye out for sales on materials and tools. Big-ticket items like appliances can sometimes be found at a significant discount during sales events.

- Reuse Materials: Before you tear down and throw out, see what you can reuse or repurpose. Old cabinets can be refreshed with paint and new hardware instead of being replaced.

- Professional Help for Big Jobs: For electrical and plumbing work, it’s safer and often more cost-effective in the long run to hire professionals. They can make sure the work is done correctly and up to code.

- Get Multiple Quotes: If you do need to hire professionals, get several quotes to compare prices and services. Don’t just go with the first contractor you talk to.

- Consider Phasing Your Project: If the total cost upfront is too much, consider breaking the project into phases. This can spread out the expense over time, making it easier to handle financially.

Smart Financing Options for Your Home Improvement Project

Home renovations in the U.S. come with a big price tag. So, if you want to move forward but need to seek out financing, you need to do your homework. Credit cards, home equity loans, and personal loans are popular choices, accounting for 37.4%, 8.6%, and 8.5% of all financing options, respectively.

Choosing the best method for financing home improvements depends on individual needs, financial circumstances, and the scale of the project. Consider the following financing options for your home improvement project:

- Personal Loans: Ideal for smaller renovations, personal loans offer fixed interest rates and predictable monthly payments.

- Home Equity Loans: Suited for larger projects, these loans use your home's equity as collateral, offering competitive rates.

- Home Equity Lines of Credit (HELOC): Similar to a credit card, HELOCs allow you to borrow against your home's equity as needed during the draw period.

- Credit Card Advances: Useful for minor projects, credit card advances offer convenience, but be mindful of higher interest rates.

- Cash Store Installment Loans: Fast and flexible, Cash Store's installment loans provide quick access to cash with manageable repayment terms.

Whichever option you choose, be sure to stick to your budget. Home improvement projects fall within the wants category of that family budget. So, make sure your needs are covered and that you are still saving and investing based on 20% of your income before you pursue a large-scale project.

Hiring Contractors on a Budget

While DIY projects can save money, certain home improvements, such as plumbing and electrical work, are best left to professionals. Additionally, lack of time, skills, or interest may lead homeowners to opt for hiring contractors.

If you're considering the contractor route but want to stick to a budget, here are some helpful tips for finding affordable and reliable professionals for your projects.

- Research and Compare: Obtain quotes from multiple contractors and compare their services and pricing. Check sites like Thumbtack, TaskRabbit, Angi, and HomeAdvisor to find reputable contractors.

- Check References: Seek recommendations from friends, family, or online reviews to gauge the contractor's reputation and work quality.

- Verify Credentials: Check that the contractor is licensed, insured, and bonded for added protection. And don’t take their word for it—check it for yourself with your local department of labor.

- Negotiate Prices: Don't hesitate to negotiate prices and inquire about discounts to get the best value for your money.

- Obtain Detailed Contracts: Request comprehensive contracts that outline the project scope, timeline, and payment terms.

- Local and Established Contractors: Opt for local, well-established contractors who may offer competitive rates and faster response times.

- Material Costs: Discuss material costs upfront to avoid unexpected expenses and explore options for cost-effective materials.

- Timing: Schedule your project during off-peak seasons when contractors may offer more competitive rates.

- Payment Schedule: Avoid large upfront payments; negotiate a payment schedule tied to project milestones.

- Open Communication: Maintain open communication with the contractor throughout the project to address any concerns promptly.

Prioritizing High-Impact Improvements

Want to do some home improvements, but you aren’t sure how to prioritize them? We get it—many homeowners are in the same boat. We suggest choosing projects that offer the most value for money and can give you an uptick in your home’s resale potential.

Here’s a list of some of the best renovations you can make to improve your home’s value.

- New Garage Door: Upgrading your garage door can significantly improve curb appeal and security.

- New Entry Door: A sturdy and stylish entry door makes a strong first impression and can improve home security.

- Stone Veneer: Adding a stone veneer to your home's facade offers a luxurious look and can dramatically increase curb appeal.

- Kitchen Remodel: Modernizing your kitchen with new appliances, countertops, and cabinets can greatly increase your home’s value.

- New Siding: Replacing old siding improves your home's appearance and insulation, which can be a big selling point.

- Deck Addition: Adding a deck expands your living space and provides an attractive outdoor area for relaxation and entertainment.

- Bathroom Remodel: Updating fixtures, tiles, and lighting in the bathroom can significantly impact your home’s overall appeal.

- HVAC Conversion: Installing a more efficient HVAC system can reduce energy costs and is a strong selling point for potential buyers.

Deciding on the Best Financing Option For Your DIY Home Improvement Project

Now that you have narrowed down what you want to focus on and assessed your budget to decide what you can afford to take on each month, it’s time to start looking at different lending options. Refer back to those financing options we mentioned earlier, and next, start looking at the following for each.

- Interest Rate: Check the interest rates offered by different lenders. Lower rates mean you'll pay less over the life of the loan, keeping your monthly payments more manageable.

- Loan Terms: Look at how long you have to pay back the loan. Longer terms can lower your monthly payments but might lead to higher total interest costs.

- Credit Score Requirements: Different loans have different credit score requirements. Knowing where your credit stands can help you determine which loans you're more likely to qualify for.

- Prepayment Penalties: Find out if there are any penalties for paying off the loan early. Choosing a loan without these fees gives you the flexibility to pay it off sooner if you can.

- Fees and Other Costs: Be aware of any additional fees that could apply, like origination fees or application fees, which can add to the total cost of your loan.

Cash Store Can Help With an Installment Loan for Your Home Improvement Needs

At Cash Store, we’re happy to offer installment loans to qualifying borrowers. These loans are up to $3,000, which is perfect to help you tackle some of the smaller projects mentioned above. Ready to get started? Complete our prequalification application today.