Cash Store Blog

How Should I Use Credit Monitoring Software?

Do you know what your credit score is? And perhaps more importantly, when was the last time you checked your credit score and your credit report to make sure that nothing is amiss? If your answer is—I have no idea—you’re not alone. A study by badcredit.org suggests that nearly 31% of Americans don’t know their credit score.

This is a rather alarming statistic. Paying attention to your credit is just one of those things we need to do to stay on top of our financial health. Thankfully, knowing your credit score and activity is easier than you think. And credit monitoring software can come to your rescue, alerting you to big changes and letting you know when you need to take action.

What is Credit Monitoring Software?

Just as it sounds, credit monitoring software keeps an eye on your credit activity. It tracks changes in your credit report, including updates to your credit score, new accounts opened in your name, and any suspicious activities that could indicate identity theft. By using this software, you get real-time alerts when something significant changes in your credit profile.

How Does It Work?

Credit monitoring software works by regularly checking your credit reports from the three major credit bureaus: Experian, Equifax, and TransUnion. It looks for changes that could affect your credit score or signal potential fraud. If it detects anything unusual, such as a new credit card or a large increase in debt, it sends you an alert so you can take action quickly.

Free vs. Paid Services

There are both free and paid credit monitoring services available. Free services, like Credit Karma, provide basic monitoring and alerts for changes in your credit report and score. They are a good starting point if you’re just beginning to keep an eye on your credit.

Paid services, such as LifeLock, often offer more comprehensive monitoring, including identity theft protection, insurance, and access to a team of specialists to help resolve any issues that arise. Additionally, the credit bureaus themselves, Experian, Equifax, and TransUnion, offer their own monitoring services, which can provide direct and detailed insights into your credit.

Benefits of Using Credit Monitoring Services

It is possible to keep tabs on your credit score without these services. However, doing so requires diligence. Many financial institutions and credit card issuers now offer access to your credit score as part of your membership benefits. So, if you are in the habit of checking your score monthly, you can see if something changes significantly or doesn’t seem quite right. If something is off, you can order a copy of your credit report from annualcreditreport.com to get the detail you need to make sure you haven’t been the victim of fraud, missed a payment. Etc. But again, this practice puts the responsibility wholly on you, and you need to make sure you are checking in on your credit score often.

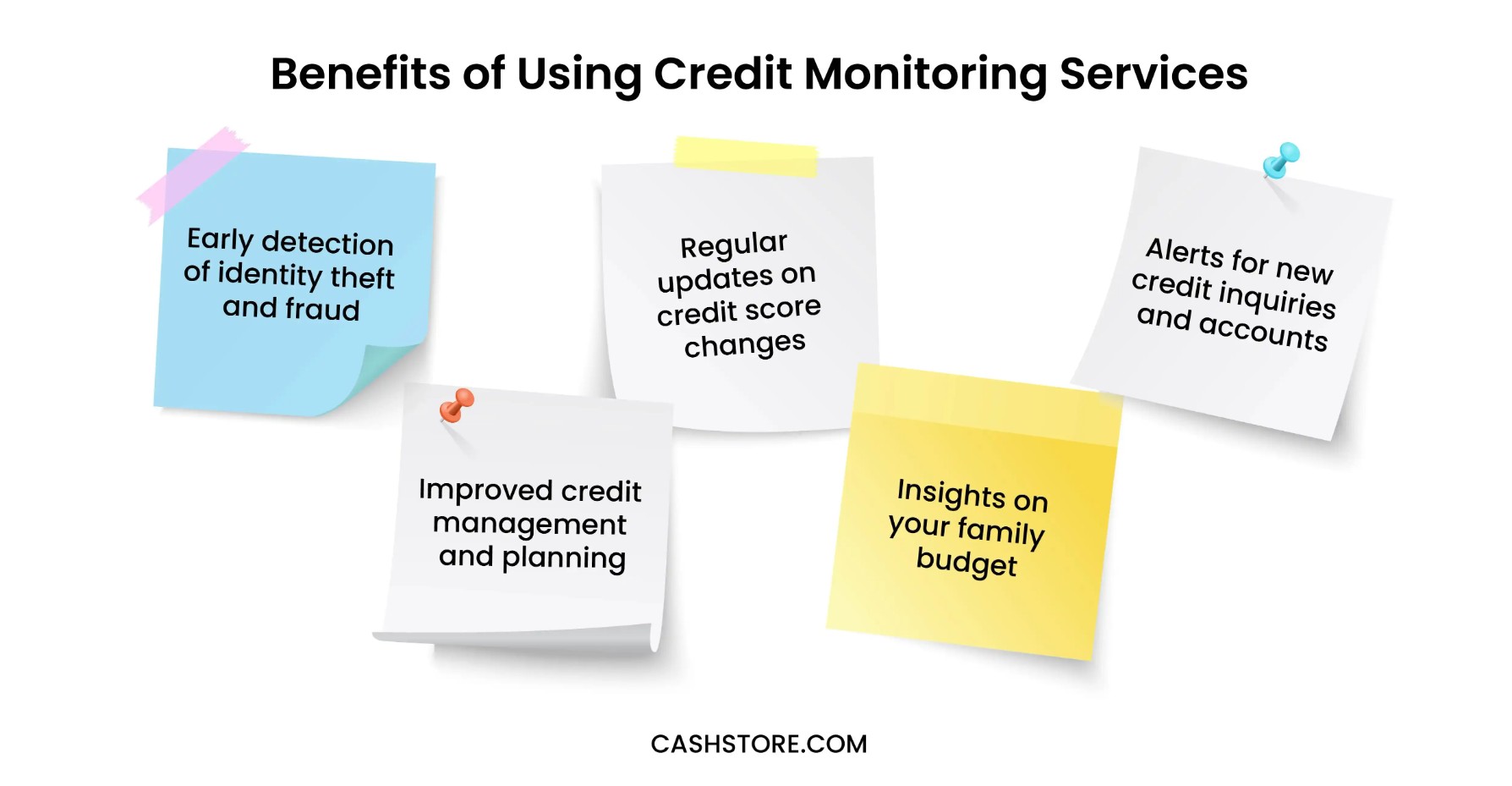

That’s why so many consumers opt for credit monitoring services that do the checking for them. Here are the benefits you can anticipate.

- Early detection of identity theft and fraud

- Regular updates on credit score changes

- Alerts for new credit inquiries and accounts

- Improved credit management and planning

- Insights that might suggest you need to make a change to your family budget

How to Choose the Best Credit Monitoring Software

It’s important to know that not all credit monitoring tools are the same. Some simply provide you with access to your credit score. Others will go above and beyond with some advanced features that you might appreciate. Here are the things we suggest you look for when evaluating the best credit monitoring software.

- Real-time alerts

- Comprehensive credit report access

- Credit score tracking

- Identity theft protection and recovery services

- User-friendly interface

- Considering costs and subscription options

- Customer support quality

- Integration with other financial tools

- Detailed monthly reports

- Multi-bureau monitoring (i.e., Experian, Equifax, and TransUnion)

Choosing the right credit monitoring software involves comparing these features to ensure you get the protection and peace of mind you need.

Sign Up for Credit Monitoring Software to Protect Your Credit Score

Your credit score is integral in your financial endeavors. A high credit score will provide you with more flexibility when it comes to borrowing money—higher borrowing limits, lower interest rates, and better overall loan terms. So, if your credit score isn’t where it needs to be, take the steps to give it a boost. And, sign up for credit monitoring to make sure that you are protected and aware if something goes wrong.

If you are in need of fast funds for an emergency expense, Cash Store can help. Get started with your prequalification application today.