Cash Store Blog

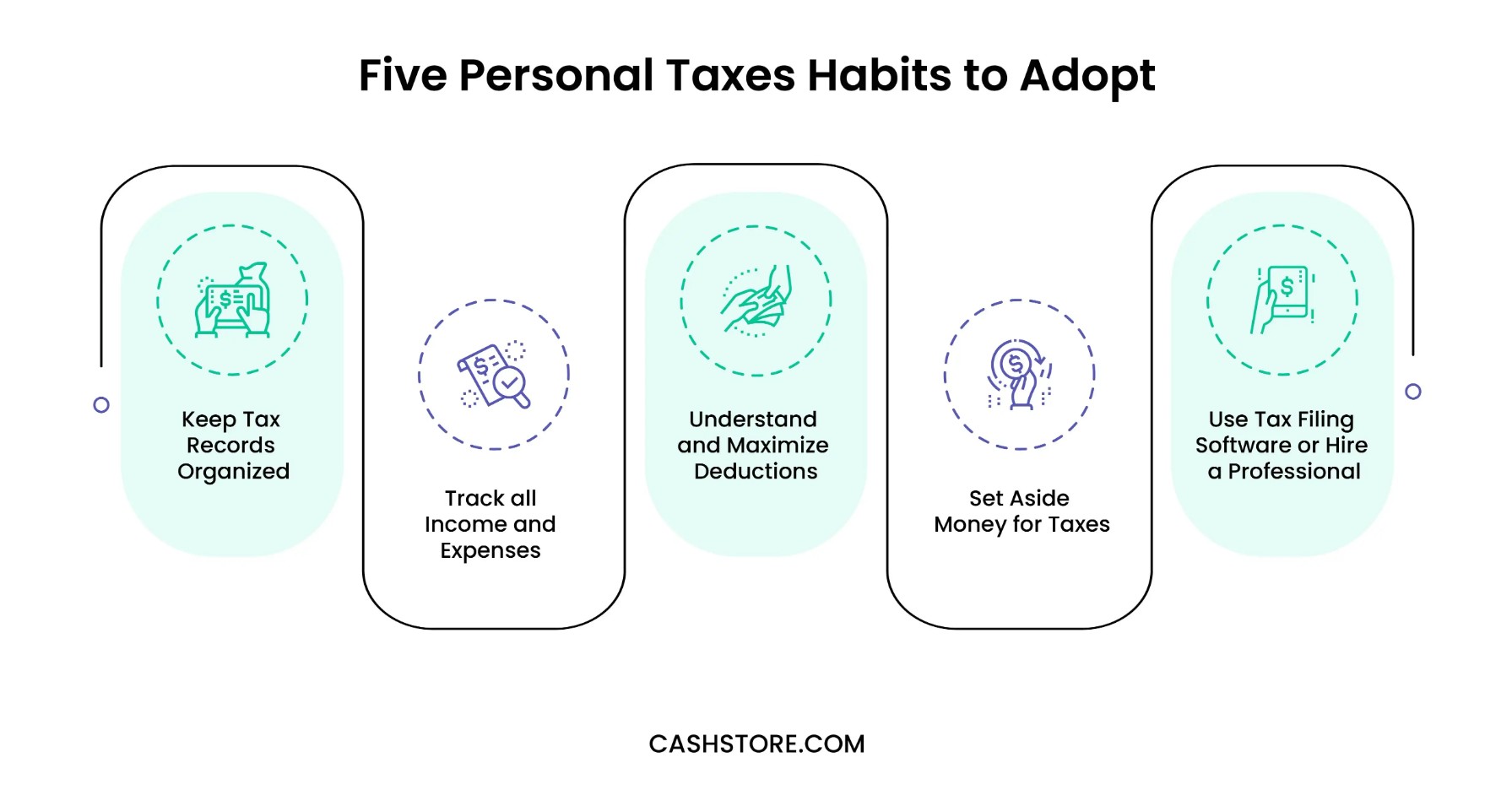

How to Make Filing Personal Taxes Easier - Five Habits to Adopt

Tax season is one of those things that none of us look forward to, unless you are an accountant. It means digging through receipts, paystubs, and bank statements from the previous year in hopes of getting a healthy return or at least breaking even. And while it is not one of the most enjoyable of adulting, taxes is one we just can’t avoid.

What if we tell you, however, there are some simple things you can do to make filing your personal taxes easier? Would you jump at the opportunity? If you’re like most Americans—at least 56% who dislike the process—we think you would totally make some changes during the year to make tax season less stressful.

This article will share five easy habits to adopt and help change the game when the next tax season rolls around.

Habit # 1: Keep Tax Records Organized

While this might seem obvious, keeping tax records organized is more challenging than many people think. However, setting up a tax organization system is relatively easy. Maintaining organized financial records, such as receipts and bank statements, simplifies tax preparation.

Use a dedicated folder or digital tool for storing receipts and documents. Regularly updating and categorizing expenses throughout the year may significantly reduce the stress of tax season. This habit saves time and makes sure you take advantage of all potential deductions, smoothing the entire process.

Habit # 2: Track all Income and Expenses

Once you have an organizational system, it's time to start organizing your income and expenses. If you are employed by an organization (not self-employed), tracking your income is pretty easy. Your employer must issue you a W-2 at the end of the taxable year. This document clearly indicates the money you made and the withholdings for social security, income tax, and Medicare tax.

And tracking your expenses doesn’t have to be difficult either. To start, understand the types of expenses you should be tracking.

- Home improvements

- Out-of-pocket expenses for healthcare, dental care, vision care, and prescriptions

- Charitable donations

- Education expenses, including tuition and student loan interest

- Childcare expenses

- Business-related expenses, if applicable

- Mortgage interest and property taxes

- Investment-related expenses, such as advisory fees

- Unreimbursed work-related expenses

To track them, do one of two things (or both).

- Create a physical file for each expense type that applies to you. Throughout the year, add receipts for that category to the applicable file folder.

- Create digital folders in your email or elsewhere on your computer's desktop for any digital receipts you might receive. Move digital copies to those folders throughout the year.

Following the steps above will make tax time much easier. Whether you do your own taxes or hire an accountant to do it for you, you’ll be glad you took the time to put this process in place.

Habit # 3: Understand and Maximize Deductions

Next up, it's time to get a firm grip on your possible deductions. Research common deductions relevant to your situation, such as mortgage interest, charitable contributions, and medical expenses. A deduction is an amount you subtract from your income when you file so you don’t pay tax.

By lowering your income, deductions reduce your tax burden. You need proper documentation which shows any expenses and losses you plan to deduct. Your tax software may take care of these calculations and enter them in the correct forms. If you file a paper return, your deductions go on Form 1040 and may require extra forms.

Keep documentation for all deductible expenses and consult a tax professional to confirm you're maximizing your deductions effectively.

Habit # 4: Set Aside Money for Taxes

While the payroll process for the company you will work for will take care of much of this process, it's a good idea to set aside extra money to make sure you are covered. The last thing you want is to be caught off guard in April and find out you actually owe money to the state or federal government. And if you are self-employed or work a side hustle, you will likely be responsible for setting aside a healthy percentage of your income to pay monthly, quarterly, or annual taxes.

To get started, do your homework on the tax brackets for your income for federal taxes. Then, understand what state taxes look like based on where you live. Adjust your personal or family budget so that you have enough to cover any shortages at the end of the year. If it turns out you didn’t have to pay any extra, you will suddenly be left with a healthy amount in your savings fund that you may choose to invest or set aside for a rainy day.

Habit #5: Use Tax Filing Software or Hire a Professional

Finally, using tax filing software or hiring a professional may significantly ease the tax filing process. Tax software programs are designed to guide you through each step, making sure you don’t miss out on any deductions and credits. They may also e-file your return, which is faster and more secure than mailing a paper return.

If your tax situation is complex or if you're unsure about any part of the process, hiring a tax professional can be a wise investment. A tax expert may provide personalized advice, help you navigate tax laws, and potentially save you more money in deductions and credits than the cost of their services.

Short on Funds? Cash Store Can Help

If you find yourself strapped for cash, either at tax time or anytime throughout the year, Cash Store can help. We offer a variety of loans that can help make personal taxes easier and we’re here to help with installment loans.

To get started, submit your prequalification application today.