Cash Store Blog

How to Build Your Financial Literary - Financial Terms to Know

Financial literacy is a valuable skill that can pay off in dividends (pun intended). But did you know that only 57% of Americans would consider themselves financially literate? This is a bit alarming because 43% of Americans are not financially literate. Why does that matter? It means those individuals do not grasp key financial behaviors that can impact their lives.

Being financially literate allows you to make informed decisions about spending and saving money, avoiding debt, building wealth, and planning for the future. But there are a lot of financial terms out there, and it is not easy to understand what they all mean and why they are so important. At Cash Store, we've taken the guesswork out of it for you.

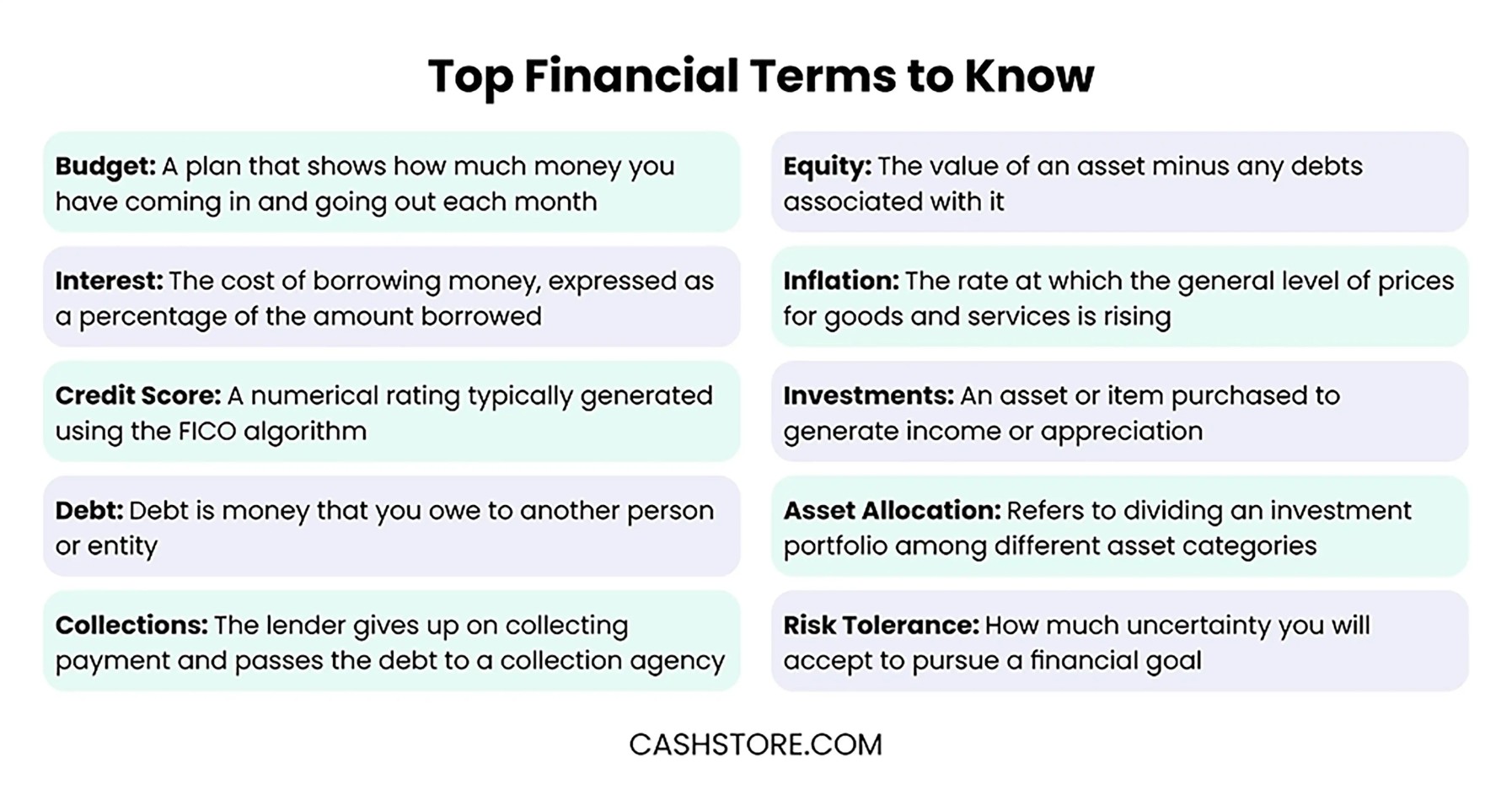

Here are some top financial terms everyone should know, especially when trying to grow your financial literacy.

Build your financial literacy with these top financial terms

The more you build your financial literacy, the better you’ll be able to master your finances. Here are the top terms you should know.

1. Budget

Your budget is a plan that shows how much money you have coming in and going out each month. And, while we know this term might be a bit obvious, we’d be remiss if we didn’t include it as a starting point. After all, setting a family budget and knowing how to allocate your net income is a big step forward in focusing the right amount on your needs, wants, and savings.

At Cash Store, we often recommend the 50/20/30 plan for budgeting. This is how it works:

- 50% of your income goes towards your needs. Think of things like your rent, car payment, and groceries.

- 20% of your income goes toward your savings and retirement. This is a great opportunity to build an emergency fund if you don’t yet have one.

- 30% of your income goes toward your wants. This would include things such as a night out on the town, buying that latest designer handbag, or planning a family vacation.

2. Interest

Interest is the cost of borrowing money, expressed as a percentage of the amount borrowed. Try playing with an interest calculator to understand better how much you might pay on your credit card balance, for your installment loan, or if you want to buy a new car.

Consider this example to see why understanding interest rates is so important. The average interest rate today on a credit card is 27.64%. But what if you could negotiate a lower interest rate on your card—let’s say 19%? This could make a big difference on a credit card balance of $5,000.

With a 27.64% interest rate on a $5,000 credit card balance, you would pay significantly more in interest over time compared to a 19% rate. For example, at 27.64%, you'd owe around $1,382 in interest over a year, while at 19%, you'd owe about $950, saving you over $400.

3. Credit score

Your credit score is a numerical rating typically generated using the FICO algorithm. Your score will fall between 300 and 850, and a good score falls within the range of 670 to 739. The average credit score in the U.S. is 714.

So why does this matter? Well, as you grow your financial literacy, you’ll see that the higher your credit score, the more doors open for you. You’ll be more likely to secure better terms and interest rates on loans. And this can even help with background checks and employment in certain industries.

4. Debt

Financial institutions look at the amount of debt you have when deciding whether or not to give you a loan. Debt is money that you owe to another person or entity. This includes balances due on installment loans, title loans, credit cards, auto loans, mortgages, etc.

As a rule of thumb and to help boost your credit score, it is recommended that you keep your credit card balances to 30% or less of your credit limit. And, keep your debt-to-income ratio at 36% or less. This means that you need to keep the amount of debt that you have at 36% or less of your total income. This can help increase your chances of approval for loans and credit cards and can help you get more favorable terms.

5. Collections

Understanding collections is an important part of financial literacy because it can have a long-term impact on your credit score and financial well-being. When an account goes into collections, it means that the lender has given up on trying to collect payment and has passed the debt to a collections agency. This can lead to increased fees, credit score damage, and stress.

To avoid having an account go into collections, here are a few steps you can take:

- Make at least the minimum payment on time each month.

- Set up payment reminders or automatic payments.

- Contact your lender if you’re struggling to make payments and ask about flexible options.

- Create a budget to manage your expenses and stay on top of your debts.

6. Equity

Equity is the value of an asset minus any debts associated with it. A common example is home equity, which grows as you make payments on your mortgage. For instance, if your home is worth $300,000 and you owe $200,000 on your mortgage, you have $100,000 in home equity. Each payment you make helps reduce your mortgage balance, increasing the equity you own in your home.

So why does this matter in financial literacy? Understanding equity is key to building wealth. As your equity grows, you can leverage it for financial opportunities, such as borrowing against your home for major expenses or selling your home for a profit. The more you know about equity, the better equipped you'll be to make smart financial decisions.

7. Inflation

A term we hear quite often in the news these days, inflation is the rate at which the general level of prices for goods and services is rising and purchasing power is falling. Consumers must pay attention to the inflation rate as it directly impacts our prices for goods and services, cost of living, and investment returns.

And we know you’re scratching your head wondering—how does this really affect me? As of right now, the inflation rate in the U.S. is 2.9%. In comparison, the rate was only 0.8% just ten years ago in 2014. Why does this matter?

Inflation affects your everyday expenses, from groceries to gas, and can reduce the value of your savings over time. The higher interest rates in 2024, intended to control inflation, can also impact consumers by making loans, credit cards, and mortgages more expensive.

This is why financial literacy is so important—understanding how inflation and interest rates work together can help you make informed decisions about borrowing, saving, and investing.

8. Investments

An investment is an asset or item purchased to generate income or appreciation. Common consumer assets include real estate, retirement accounts, education, vehicles, collectibles, gym memberships, etc.

Here are some of the common investments that consumers tend to make, especially those just starting to dip their toes in the investment space.

- Stocks and Bonds: Investing in stocks means buying a share of a company, while bonds are loans to companies or governments. You can start with an online brokerage or through a financial advisor.

- Mutual Funds: These are pooled investments where multiple investors contribute to a diversified portfolio of stocks, bonds, or other assets. You can get started by opening an account with a brokerage or financial institution and choosing a mutual fund that matches your financial goals.

- Real Estate: Buying property can generate income through rental properties or appreciation. You can begin by saving for a down payment and researching local markets.

- Retirement Accounts: Common options include 401(k) plans or IRAs. Many employers offer 401(k) plans, or you can open an IRA through a bank or brokerage firm.

- Education Savings: 529 plans allow you to save for education expenses while getting tax benefits. Most banks and financial institutions offer these plans.

9. Asset allocation

Speaking of investments, you may hear about asset allocation from your investment firm or whoever manages your retirement accounts. Asset allocation refers to dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash, to achieve a specific investment objective, such as saving for your child’s education or your retirement.

Let’s look at an example of how you might allocate your assets based on your risk tolerance. And don’t worry, if you don’t understand what risk tolerance means, we’ll cover that key financial term next.

- Low Risk Tolerance: You might allocate 70% to bonds and 30% to stocks, focusing on more stable investments with lower potential for loss.

- High Risk Tolerance: You could allocate 80% to stocks and 20% to bonds, aiming for higher returns but with the possibility of greater risk.

10. Risk tolerance

Now that you have seen how you can allocate your assets based on risk tolerance, let’s explain what that means. Your risk tolerance is how much uncertainty you will accept to pursue a financial goal.

People with a higher tolerance for risk often invest in stocks, equity funds, and exchange-traded funds (ETFs), while those who prefer less risk tend to choose bonds and income funds. In fact, investors’ appetite for risk increased during both the 6- and 12-month periods ended June 30, 2024. Despite this, many still invested heavily in money market and traditional fixed-income funds.

Why does this matter for financial literacy? Understanding your risk tolerance helps you make informed decisions about where to invest your money and how to balance risk and reward in your portfolio. But don’t worry if you still don’t get it. This is where working with a financial advisor can really help.

Know your financial terms

Understanding primary and more complex financial terms is super important to making informed decisions about your money. And, the more you understand these terms, the more financially literate you will be.

Whether managing your finances, investing for the future, or seeking a loan or credit, a solid understanding of financial concepts can help you make the most of your resources and avoid costly mistakes.