Cash Store Blog

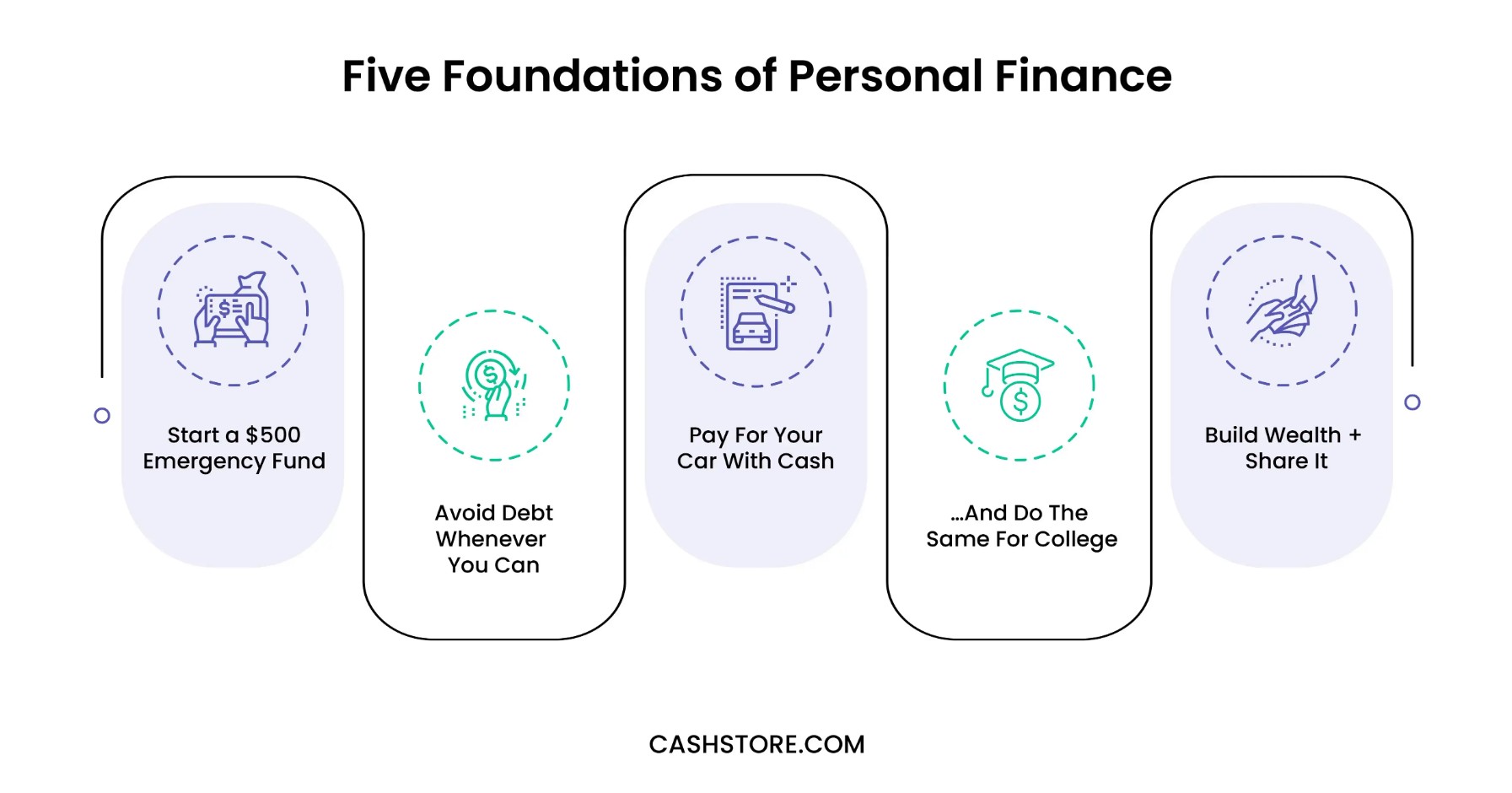

What are the Five Foundations of Personal Finance?

It seems that financial insecurity concerns are all around us. An estimated 72% of Americans say they aren’t financially secure. But what does it mean to be financial secure? And what may happen if you are not?

In this article, we’ll look at what goes into financial security and the foundational principles that may set you up for success.

Foundation #1: Start a $500 Emergency Fund

Before we get into this first foundation of savings, let’s discuss the importance of establishing a budget. We have shared many articles in which we suggest that the 50/20/30 methodology is a great place to start.

In this approach to budgeting, 50% of your income is directed towards paying for your needs. This includes things like paying your mortgage or rent, paying for related housing expenses (i.e., utilities), and groceries. Then, 30% is applied to things like your wants. That might mean going out to dinner once a week, buying a new pair of designer jeans, or taking a family vacation. This leaves the remaining 20% to be directed toward our savings funds. This may be a rainy day fund, our retirement savings, and an emergency fund.

So, why should $500 be your goal? Really, the amount may be anything you want it to be. However, many financial experts suggest at least $500 as this may cover a lot of emergency expenses that may come up—car repairs, medical expenses, and even home emergencies. Plus, once you have your budget in place, you’ll be in a position to keep growing that fund beyond that initial $500.

Here’s how to do it.

Set a Clear Savings Goal

Determine a realistic target and timeline for reaching your $500 emergency fund. Break it down into smaller, manageable milestones, such as saving $50 per month or $5 a day. Having a clear goal keeps you motivated and focused on achieving your savings target.

Find Ways to Cut Expenses

Review your budget to identify areas where you can cut back on non-essential spending. This might include dining out less frequently, canceling unused subscriptions, or finding more affordable alternatives for everyday expenses. Redirect these savings directly into your emergency fund.

Automate Your Savings

Set up automatic transfers from your checking account to a dedicated savings account. By automating your savings, you make sure that some of your income is consistently directed toward your emergency fund without the desire to spend it elsewhere. This "set it and forget it" approach helps you build your fund effortlessly.

Foundation #2: Avoid Debt Whenever You Can

A recent article from Business Insider says that the average debt in America is $104,215. While this number is spread out amongst mortgages, student loans, auto loans, and credit cards, it’s not a small number. Plus, about 66% of Americans say that they are living paycheck to paycheck, which expresses concern about the ability to take on more debt.

One key strategy in maintaining financial health is keeping your Debt-to-Income (DTI) ratio below 43%, though 35% or less is considered “good.” A high DTI ratio can limit your ability to borrow money when needed and lead to financial stress and decreased creditworthiness.

The negative impacts of debt on financial health are significant. For instance, high-interest debt such as credit cards may quickly spiral out of control, leading to mounting interest payments that eat into your income. Additionally, excessive debt may hinder your ability to save for important life events, emergencies, or retirement, creating a cycle of financial instability.

Here’s what to do.

Create a Debt Repayment Plan

Outline all your debts and prioritize them based on interest rates and balances. Having a clear plan might help you systematically reduce your debt.

Use the Snowball or Avalanche Method

The snowball method pays off the lowest balances first to build momentum. In contrast, the avalanche method targets eats away at the balances with the highest interest rates first to minimize interest payments. Choose the strategy that best fits your financial situation and stick to it.

Avoid Accruing New Debt

Resist the temptation to take on additional debt, especially for non-essential purchases. Focus on living within your means and saving for future expenses instead.

Foundation #3: Pay For Your Car With Cash

One of the most effective ways to maintain financial health is to pay for your car with cash, avoiding the burden of car loans. Car loans often come with high-interest rates, long repayment periods, and the risk of becoming upside down on the loan (owing more than the car's value).

You eliminate monthly car payments by paying cash, freeing up funds for other financial goals like saving or investing. Additionally, paying cash allows you to avoid the depreciation hit that new cars take when they leave the lot, getting you the most value for your money.

Here’s what to do.

Save for a Car Fund

Set aside a specific amount each month dedicated to your car fund. Over time, this disciplined savings approach will help you accumulate enough to buy a car outright.

Buy Used Instead of New

Consider purchasing a reliable used car instead of a brand-new one. Used cars have already depreciated significantly, offering better value for your money.

Negotiate and Shop Around for the Best Deals

Research and compare prices from various dealerships and private sellers. Don’t be afraid to negotiate to get the best possible deal on your car purchase.

Foundation #4: …And Do The Same For College

College today is expensive. When kids graduate, their average federal loan debt is about $37,853, and this doesn’t even include additional private loan balances. That’s a substantial number, especially when the average salary coming out of college is about $68,516.

Growing a college fund and avoiding student loans may significantly improve long-term financial stability. Without the burden of loan repayments, graduates can allocate more of their income towards savings, investments, and life goals such as buying a home or starting a family. Debt-free graduates have greater financial flexibility and security, enabling them to take advantage of opportunities without the constraints of monthly loan payments. Additionally, they are less likely to experience the stress and anxiety associated with managing large debt loads.

Here’s what to do.

Apply for Scholarships and Grants

Seek out and apply for scholarships and grants, which provide non-repayable financial aid. Many resources are available based on merit, need, and specific areas of study.

Work Part-Time or During the Summer

Consider working part-time during the school year or full-time during the summer to help cover tuition and living expenses. Look into gig opportunities that can give you the flexibility you need to focus on academics. This can reduce the need to borrow money and develop valuable work experience.

Attend a Community College Before Transferring

Start your higher education journey at a community college, where tuition is often significantly lower, before transferring to a four-year institution. This can drastically reduce overall education costs while still allowing you to earn a degree from a prestigious university.

Foundation #5: Build Wealth + Share It

Building wealth is not just about securing your financial future; it’s also about creating the ability to impact others positively. Long-term wealth building allows you to live comfortably, support your family, and pursue your dreams without financial constraints.

And, accumulating wealth allows you to be generous and make a difference in the lives of others. Sharing your wealth through charitable giving can bring a sense of fulfillment and purpose, reinforcing the idea that true financial success includes the ability to give back to your community and support causes you care about.

Here’s what to do.

Invest in Retirement Accounts

Contribute regularly to retirement accounts such as a 401(k) or an individual retirement account (IRA). These accounts offer tax advantages and compound interest, helping your savings grow over time.

Diversify Investments

Spread your investments across various asset classes, such as stocks, bonds, and real estate. Diversifying versus putting all your eggs in one basket can reduce risk and enhance potential returns, contributing to long-term wealth accumulation.

Make a Plan for Charitable Giving

Set aside a portion of your wealth for charitable donations. Whether through regular contributions or establishing a foundation, having a plan helps your generosity have a lasting and meaningful impact.

Cash Store Can Help with Short-Term Financial Needs

Despite your intentions, finances can get tight from time to time. And that’s where Cash Store can help. We offer installment loans to help you cover expenses, big or small. To get started, complete our prequalification application today.