Cash Store Blog

Holiday Loans: How to Use Them Wisely

It happens every year—that desire to create the best Christmas ever for those you love. And it seems like retailers play right into that emotion, sending out those holiday toy catalogs in early October so that the kids can start circling all the items they want. And it’s not much better when buying for adults. With so many new advancements in technology, chances are that there is something new and flashy on the wish lists of those on your shopping list.

But holiday shopping can get really expensive. It can add up fast. Holiday spending in 2024 alone is expected to reach an average of $1,638 per shopper! That’s a lot of money. Unless you’ve been saving your pennies—and ten-dollar bills, ya’ll—throughout the year, the chances are that you won’t have the cash on hand to pay off those holiday-related debts.

This is where holiday loans can help. In this article, we’ll tell you how to use these loans wisely. Let’s get started.

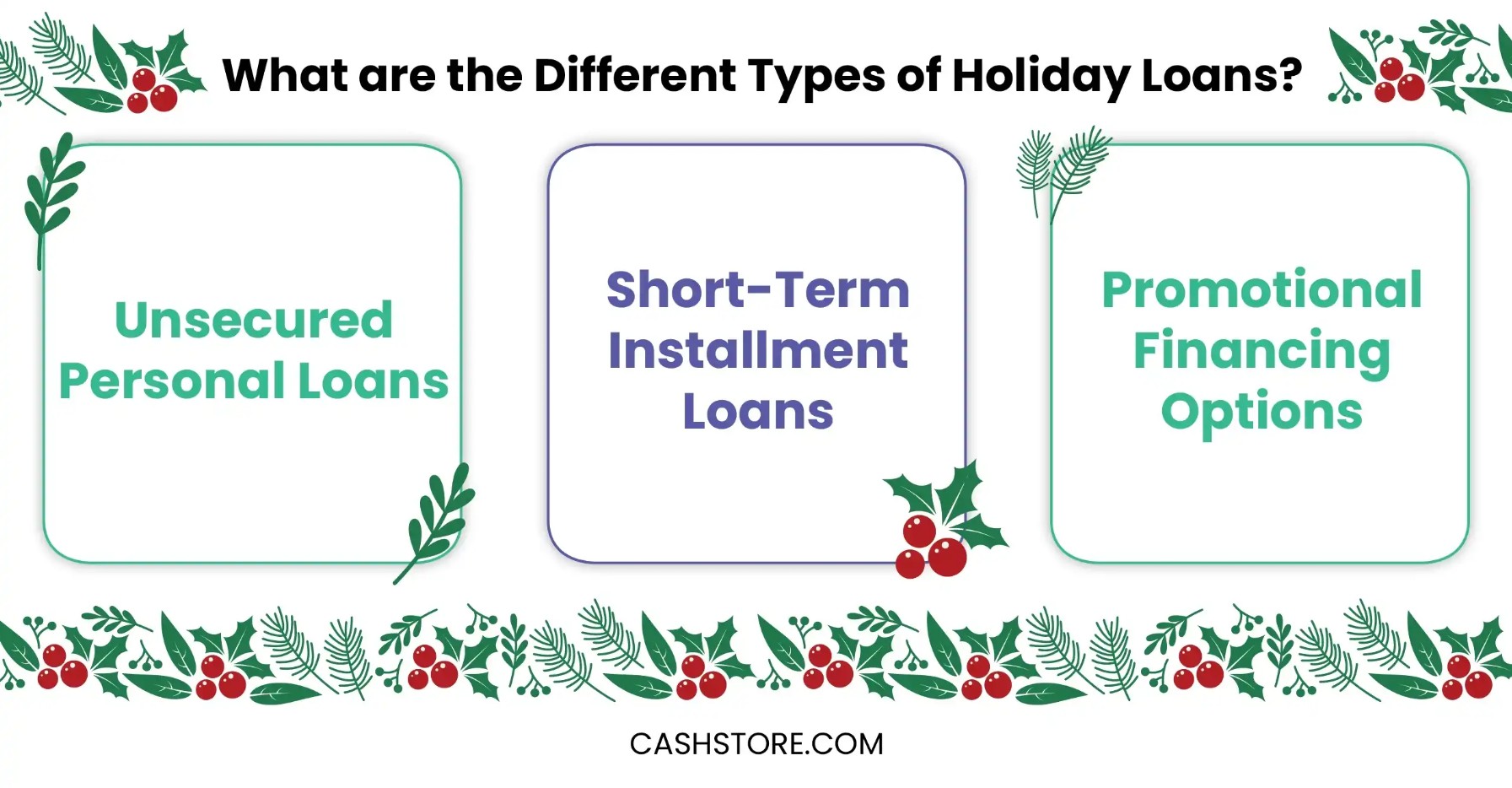

What are the Different Types of Holiday Loans?

Many people use their credit cards to pay for holiday gifts. But with high credit card interest rates, that can really add up. Plus, what do you do if you simply don’t have the available credit to buy what you want? Aside from revisiting your shopping list and practicing responsible borrowing, you may want to look at a holiday loan.

A holiday loan is a type of personal loan designed to help you cover the expenses of holiday shopping and related costs. These loans typically have fixed terms, meaning you’ll make equal payments over a set period. The loan amount, interest rate, and repayment period will vary depending on the lender, but most of these loans are unsecured, meaning you won’t need to offer collateral.

Since holiday loans are designed for short-term needs, they generally have higher interest rates than long-term loans, so it’s important to borrow responsibly and only what you can comfortably repay. Here are some common types of loans that you may use for your holiday needs:

- Unsecured Personal Loans: These loans don’t require collateral and are repaid in fixed monthly installments. They offer flexibility in how you use the funds but often come with higher interest rates due to the lack of collateral.

- Short-Term Installment Loans: Similar to unsecured personal loans, but with a shorter repayment period. Installment loans can be helpful for those looking to pay off their holiday spending over a few months rather than years.

- Promotional Financing Options (e.g., Buy Now, Pay Later for holidays): Retailers often offer promotional financing that allows you to buy gifts now and pay in installments, usually without interest, if you repay within a specified period.

Who Offers Holiday Loans?

- Banks: Often offer personal loans with competitive rates, but approval might require a higher credit score.

- Credit Unions: Typically offer lower interest rates and flexible terms to members, but you’ll need to meet their membership requirements. These requirements are typically clearly listed on the lender’s website, so you can see if you qualify for membership.

- Online Lenders: Known for quick approval processes, though interest rates may vary widely depending on your financial history.

How to Use Holiday Loans Wisely

As we implied above, holiday spending can quickly get out of control, especially when you are trying to check off everything on someone’s list. But when you spend more than you have, you can quickly set yourself up for trouble. You may be unable to make your monthly payments. Your debt-to-income ratio will rise, making it harder for you to get approved for other loan products. And your credit score may start to move in the wrong direction—south, that is.

Here are some tips to help you practice responsible spending this holiday season.

- Set a Holiday Budget: Determine how much you need for gifts, travel, food, and decor, and stick to that amount.

- Avoid Impulsive Spending: Use your loan for planned expenses only, and avoid any last-minute purchases. Make responsible spending a priority this holiday season.

- Choose the Right Loan Terms: Compare interest rates, repayment terms, and fees before selecting a loan.

- Create a Repayment Plan: Set up automated payments and prioritize paying off the loan early to reduce interest.

Cash Store Offers Installment Loans to Help You Through the Holidays

The holidays are meant to be a time of joy and celebration. But for many, this can be a challenging time, especially when finances are tight. For those who need a bit of help, an installment loan from Cash Store can help.

Combining an installment loan with responsible payment behaviors can help you get those gifts you want and all the other things you need for the holidays, without the stress of maxing out your credit cards or tapping into your emergency fund.

Complete our prequalification application today to get started.