Cash Store Blog

Unlocking Financial Flexibility: A Comprehensive Guide to Loans Using Your Car as Collateral

This article explores a practical approach to securing loans by using your car as collateral. As people look for various financial options, tapping into the worth of their vehicles can offer a solid avenue for borrowing.

Collateral, essentially an asset offered as security for a loan, plays a crucial role here. Think of mortgages and car loans – both are examples of loans where the property itself serves as collateral. We'll walk you through the ins and outs of this process, highlighting its benefits and important factors to consider.

Understanding Secured Loans

Secured car loans and borrowing against your car offer a dependable means of obtaining financial assistance, particularly in times of need. These loans fall under the category of secured loans, which are a fundamental aspect of the financial landscape.

Secured loans are backed by collateral, such as a car or a property. This collateral serves as a safety net for lenders, reducing the risk of lending money to borrowers. For instance, if a borrower defaults on their loan, the lender can seize the collateral (in this case, the car) to recoup their losses.

Here's a breakdown of the key differences between secured and unsecured loans:

- Secured loans require collateral, while unsecured loans do not.

- Secured loans typically have lower interest rates compared to unsecured loans.

- Secured loans often allow for larger loan amounts since valuable assets back them.

- Secured loans generally have longer repayment terms than unsecured loans.

Understanding these distinctions is crucial when navigating the borrowing landscape, as it influences the terms and conditions of the loan and the level of risk involved for both the borrower and the lender.

The Mechanics of Using Your Car as Collateral

Collateralized loans, particularly vehicle collateral loans, offer a practical solution for individuals seeking financial assistance while leveraging the value of their cars. You must have equity in the vehicle to utilize your car as collateral for a secured loan. Equity represents the disparity between the car's value and the outstanding loan balance. For instance, if your car holds a resale value of $8,000 and your remaining loan balance is $4,000, your equity is $4,000.

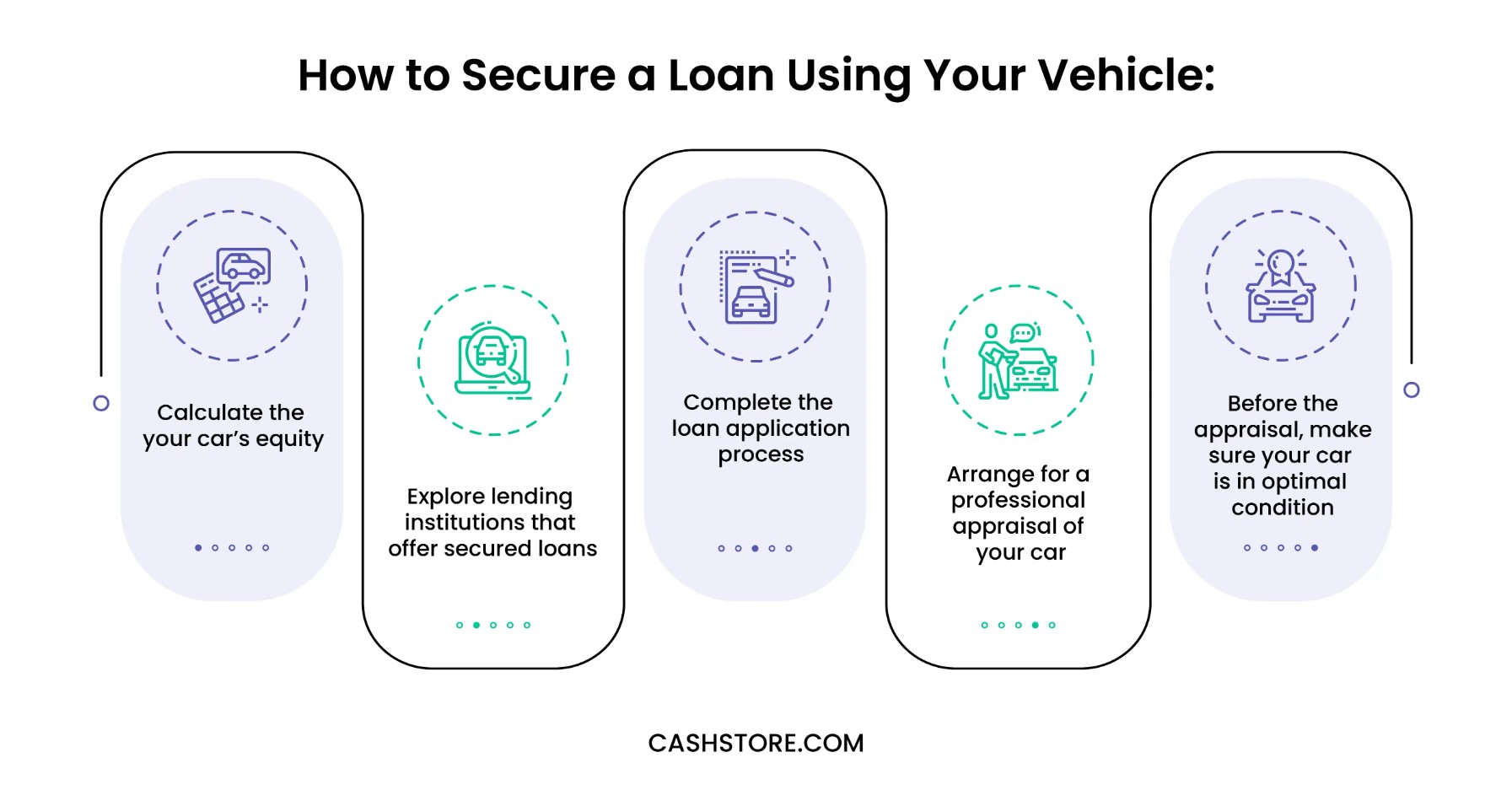

Here's a step-by-step guide to securing a loan using your vehicle:

- Assess Equity: Calculate the equity in your car by determining its current market value and subtracting any outstanding loan balances.

- Research Lenders: Explore lending institutions that offer secured loans against vehicle collateral.

- Application: Complete the loan application process, providing necessary personal and vehicle information.

- Appraisal: Arrange for a professional appraisal of your car. This appraisal evaluates factors like make, model, condition, mileage, and market trends to ascertain its value. You may need to fill out an online appraisal form or visit a designated service center recommended by the lender.

- Prepare Your Vehicle: Before the appraisal, ensure your car is in optimal condition. Consider minor repairs, clean the interior, and wash the exterior to enhance its appeal, potentially influencing the appraisal value positively.

Understanding this process and ensuring your car meets the necessary criteria can streamline the loan approval process and maximize the value of your vehicle collateral.

Pros and Cons

As of the third quarter of 2023, 23.2 million Americans had a personal loan, marking a 5.5% year-over-year increase from the previous year's 22.0 million. Personal loan debt constitutes 1.4% of outstanding consumer debt, representing 5.0% of non-housing consumer debt. In comparison, credit card debt in the U.S. totals $1.079 trillion, accounting for 6.2% of overall debt. Americans do have a habit of taking on debt via loans.

This said, there are plenty of reasons why a loan might be the best solution. Whether you are in need of car repairs, want to do some home improvements or renovations, or want to take that dream vacation, sometimes you just don’t have the cash on hand.

Using your car as collateral for a loan offers several advantages. Firstly, it may lead to lower interest rates than unsecured loans, making repayments more manageable. Additionally, secured loans often allow for larger loan amounts, providing access to more substantial funds when needed. However, there are risks involved. The primary concern is the possibility of losing your vehicle if you default on the loan.

Despite the risks, using your car as collateral can be a good choice in certain circumstances. For individuals with a stable income and the ability to repay the loan, leveraging vehicle collateral can provide access to necessary funds for significant expenses such as home repairs, medical bills, or debt consolidation. However, it's crucial to weigh the benefits against the risks and consider alternative options before committing to a secured loan arrangement.

Choosing the Right Lender

When seeking collateralized loans, choosing the right lender is paramount to ensuring a positive borrowing experience and avoiding potential pitfalls. Here are some tips to consider when selecting a reputable lender for secured car loans:

- Compare Interest Rates: Research and compare interest rates offered by different lenders to secure the most favorable terms.

- Review Loan Terms: Scrutinize the terms and conditions of the loan, including repayment terms, fees, and any additional charges.

- Assess Customer Reviews: Look on Google and TrustPilot for customer reviews and testimonials to gauge the lender's reputation for transparency, reliability, and customer service.

- Check Lender Credentials: Verify the lender's credentials, including licensing and accreditation, to ensure compliance with regulatory standards.

- Evaluate Communication: Pay attention to the lender's communication style and responsiveness to inquiries, as clear and open communication is crucial throughout the loan process.

Recognizing predatory lending practices is also important in safeguarding against exploitation and financial harm. Predatory lenders disregard a borrower's ability to repay debt and exploit their lack of financial literacy. They often target vulnerable populations such as minorities, the elderly, and the less educated, offering immediate cash for emergencies while trapping borrowers in a cycle of debt.

Signs of predatory lending include excessively high interest rates, hidden fees, aggressive sales tactics, and pressure to make quick decisions. By staying informed and vigilant, borrowers can protect themselves from falling victim to predatory lending schemes.

Using Your Car as Collateral May Increase Chances of Loan Approval

Leveraging your car as collateral for a loan can be a viable solution for accessing financial assistance, but it's crucial to proceed with caution and make informed decisions. Throughout this guide, we've explored the mechanics of secured car loans, the pros and cons, and tips for choosing the right lender.

Remember to assess your financial situation carefully, considering factors like interest rates, loan terms, and potential risks. By staying informed and vigilant, you can navigate the borrowing landscape responsibly. For further insights and tips on enhancing your financial literacy, we encourage you to follow the Cash Store blog.

Empower yourself with knowledge to make sound financial choices and achieve your goals with confidence.