Cash Store Blog

What Are My Options for Student Loan Repayment?

Just ask any high school student and about 75% of them will respond by telling you that they have dreams of going to college. While they might not know what they want to be when they grow up, they do understand the value of an education. On the flip side of that, excitement is a touch of anxiety, especially when considering that the average expenses for a year of college, including things like textbooks, supplies, and daily living costs, sits at $38,270 per student.

With the average salary straight out of college sitting at $68,516, many students don’t know how they’re going to bite off the cost of their higher education. Sure, they can take out student loans and many students do, but just how much are those student loans going to cost over time? And what are the best options for student loan repayment?

In this article, the team at Cash Store will give you insights into the best ways to pay off your student loans.

What You Should Know About Student Loans

It might feel intimidating to figure out student loans, but it doesn’t have to be. Student loans help countless students pursue their dreams of higher education. They help cover the upfront costs of the rising cost of college and the resources available, making it possible for many to access the desired education.

Why Student Loans Matter

Student loans are super important in higher education, allowing students to access the knowledge and skills needed for a brighter future. They cover tuition fees, textbooks, accommodation, and other expenses that can be challenging to manage independently. Without these loans, many aspiring students wouldn’t be able to pursue their dreams.

However, some due diligence needs to take place when exploring the types of loans available and how much you’ll be over time. When you don’t do your homework, it can lead to long-term financial challenges. Interest rates, repayment terms, and eligibility criteria can really vary among loan types. So, knowing the ins and outs of student loans gives you an educated opportunity to pursue the right options for you.

Key Concepts and Terminology

Before we get any further into student loans and how to repay them, let’s make sure we’re aligned on some key loan concepts and terms that you’ll see on lender websites and loan agreements.

- FAFSA (Free Application for Federal Student Aid): Completing the FAFSA is the first step in securing federal financial aid and grants. It helps determine your eligibility for various federal programs. In most cases, parents complete the FAFSA on behalf of their college-ready children. But students can fill out the form as well.

- Grace Period: A period after graduation during which you don't need to make loan payments. This can make things so much easier when you don’t have a job yet or when you are just starting to build a budget and emergency fund.

- Principal: The initial loan amount borrowed.

- Accrue: The process of interest accumulating on your loan.

- Default: Failure to repay the loan as agreed upon.

- Forbearance: Temporary postponement of loan payments, with interest typically accruing.

- Origination Fee: A fee charged by the lender for processing the loan.

- Deferment: A period where loan payments are temporarily delayed, typically without interest accrual.

- Promissory Note: A legal document outlining the terms and conditions of the loan.

- Consolidation: Combining multiple loans into a single new loan.

- Refinancing: Replacing one or more existing loans with a new loan, often at better terms.

Repayment Plans: Tailoring Loan Repayment to Your Needs

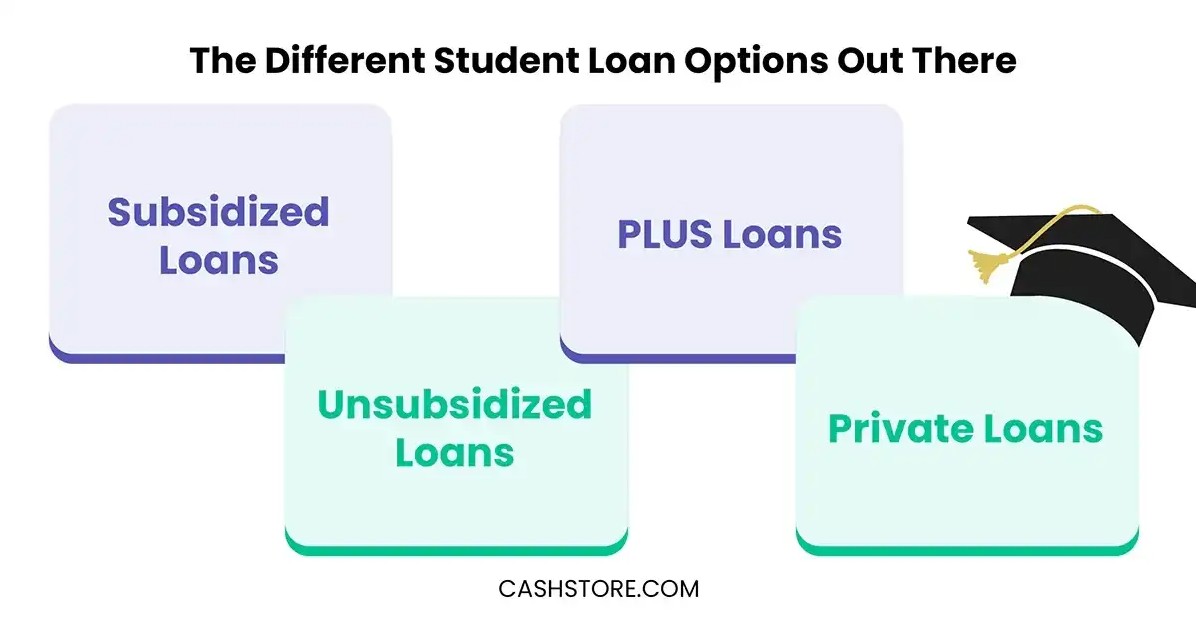

There are a lot of different student loan options out there. The most common are:

- Subsidized Loans: These federal loans are based on financial need. While you're enrolled in school at least half-time, the government covers the interest, so the loan balance doesn’t grow during this time.

- Unsubsidized Loans: Available to all students regardless of financial need, these federal loans start accumulating interest from the moment they are disbursed, even while you're in school.

- PLUS Loans: These federal loans are for graduate students and parents of undergraduates. They typically have a higher interest rate and require a credit check, offering a way to cover additional education expenses not met by other federal aid.

- Private Loans: Offered by private lenders like banks or credit unions, these loans vary widely in terms and interest rates. Unlike federal loans, they often lack flexible repayment options and may require a co-signer if the borrower has limited credit history.

Though these loans are different, they all have one thing in common—at some point, they will need to be repaid. Fortunately, various repayment plans are designed to accommodate the unique and varied financial circumstances that students face. These options include standard repayment terms, which provide a fixed monthly payment, income-driven repayment plans that adjust payments based on your earnings, and deferment and forbearance options for temporary relief.

Standard Repayment

The standard repayment plan can save you money in the long run, and it is the basic repayment plan for loans from the William D. Ford Federal Direct Loan (Direct Loan) Program and the Federal Family Education Loan (FFEL) Program. While monthly payments may be slightly higher than those of other plans, it's the quickest way to pay off your student loan and accrue the least interest over time.

Under this plan, your monthly payments are fixed at a minimum of $50 per month and extend for up to 10 years for most loan types, excluding Direct Consolidation Loans and FFEL Consolidation Loans. However, for consolidation loans, the repayment period can range from 10 to 30 years, offering flexibility for those needing a longer time to manage their payments.

Income-Driven Repayment

Income-driven repayment plans are a lifeline for borrowers seeking manageable monthly payments tailored to their financial situation. These plans set your monthly student loan payment at an amount designed to be affordable, depending on your income and family size. Generally, your payment under these plans is calculated as a percentage of your discretionary income, with varying percentages depending on the specific plan you choose.

Here's a brief overview of some common income-driven repayment plans:

- PAYE (Pay As You Earn): Generally, payments are set at 10% of your discretionary income, divided by 12, never exceeding the amount under the 10-year standard repayment plan.

- REPAYE (Revised Pay As You Earn): Payment amounts are typically 10% of your discretionary income divided by 12.

- IBR (Income-Based Repayment): New borrowers on or after July 1, 2014, usually pay 10% of their discretionary income, while those not meeting this criterion pay 15% of discretionary income. Neither of these percentages should surpass the 10-year standard repayment plan amount.

- ICR (Income-Contingent Repayment): Payments are capped at either 20% of your discretionary income or what you would pay on a 12-year fixed payment plan, with adjustments based on your income level.

Deferment and Forbearance

Deferment and forbearance temporarily alleviate the burden of federal student loan payments. The key distinction lies in how they treat interest on your loan balance. No interest accrues on your loan balance during deferment, offering a financial respite. In contrast, forbearance allows interest to accumulate, potentially increasing your overall repayment amount.

These deferment options come into play when borrowers face various life circumstances, including:

- Cancer Treatment Deferment: For those undergoing cancer treatment.

- Economic Hardship Deferment: Available in cases of financial strain.

- Graduate Fellowship Deferment: Applicable during postgraduate fellowships.

- In-School Deferment: When you return to school at least half-time.

- Military Service and Post-Active Duty Student Deferment: For active-duty military service members.

- Parent PLUS Borrower Deferment: For parents who borrowed PLUS loans during their child's education.

- Rehabilitation Training Deferment: DWhile enrolled in programs for vocational training, or treatment focused on drug, alcohol, or mental health rehabilitation.

- Unemployment Deferment: In periods of involuntary unemployment.

Further, here are some situations where someone might qualify for student loan forbearance:

- Financial hardship

- Medical expenses

- Change in employment

- Serving in a medical or dental internship or residency program

- Temporary disability

- National Guard duty

- Teacher loan forgiveness

- Military service

- Hurricanes or other natural disasters

- Mandatory medical or dental internship or residency forbearance

Loan Consolidation and Refinancing

Consolidation and refinancing are options for simplifying student loan payments and easing the repayment burden.

Loan Consolidation

Through a Direct Consolidation Loan, you can combine multiple federal loans into one, giving you access to income-driven repayment plans or extending your loan term to lower monthly payments. This approach offers a single monthly bill, a fixed interest rate, and potential eligibility for federal forgiveness programs—all helping you stay on track without juggling multiple payments.

Loan Refinancing

Refinancing allows you to replace existing loans with a new loan, potentially at a lower interest rate, through a private lender. This option can reduce your monthly payment and let you set a repayment plan that fits your financial situation. Refinancing also lets you consolidate payments into one. However, refinancing federal loans with a private lender means giving up benefits like income-driven repayment plans, so weighing your options based on your personal goals and needs is best.

Making Informed Decisions: What to Look For in Student Loans

We can’t emphasize enough the importance of doing your homework and making an informed decision. Be sure to explore both federal and private loan options and use online tools and resources like Credible and Citizens to compare interest rates, repayment options, and lender reputations.

The Federal Student Loan program’s Loan Simulator can also be helpful—it estimates monthly payments, allowing you to assess how different repayment plans might impact your finances. Taking time to compare options gives you a clearer picture of loan terms and repayment expectations, helping you make choices that align with your financial goals.

Preparing For Student Loan Repayment

When you take out a student loan, perhaps the most important thing to understand is that it is a loan—you will need to pay it back. Though some employers offer to pay off your student loans after some point, or you may qualify for a loan forgiveness program, this should never be an assumption when you first take out the loan. Always understand that you will need to budget for payments and do so accordingly.

Want more tips on setting up a college fund and growing your financial literacy? Follow the Cash Store blog for great insights.