Cash Store Blog

What is a Prepaid Debit Card?

Getting a credit card or debit card can be a big step in your financial future. These cards provide flexibility and freedom that you just don’t always have access to when you are limited to cash or a checkbook. But, as you can imagine, not all cards are the same. And there are some big time differences when it comes to credit cards vs. debit cards and even prepaid debit cards.

In this article, we’ll take a closer look at prepaid debit cards, why they exist, and how to maximize their potential.

What You Should Know About Prepaid Debit Cards

No matter what type of cash, currency, or card you are using, the first thing to be on top of is your financial habits. What do we mean by that? It’s important to stick to a budget, work on improving your credit score, and focus on building an emergency savings fund. These habits create a strong financial foundation, making it easier to use financial tools like prepaid debit cards wisely.

Prepaid debit cards are different from traditional debit and credit cards. Unlike a traditional debit card linked to your bank account, a prepaid debit card is loaded with a specific amount of money. You can only spend what you have loaded onto the card, making it a great tool for budgeting.

To use a prepaid debit card, you first need to load money onto it. This can be done online, through a bank, or at certain retail locations. Once the card is loaded, you can use it to make purchases or withdraw cash from ATMs, just like a regular debit card. However, once the loaded amount is spent, you need to reload the card before you can use it again. This feature helps prevent overspending and can be particularly useful for those who want to manage their finances more strictly.

Common Types of Prepaid Debit Cards

There are lots of different types of prepaid debit cards out there. Here are the most common that you might see.

General-Purpose Reloadable Cards

General-purpose reloadable cards are versatile prepaid cards for everyday expenses. You can load money onto them repeatedly, making them a convenient alternative to traditional bank accounts. These cards often include direct deposit, bill pay, and online account management.

Gift Cards

You’ve probably received a gift card or twenty at some point in your life. You know, those cards from Target, Amazon, or Visa, that allow you to spend up to a set amount? These cards are a perfect example of prepaid debit cards. As you know, they are usually restricted to a particular store or brand and can be used to purchase items up to the loaded amount. Once the balance is spent, the card cannot be reloaded. Gift cards are popular for birthdays, holidays, and other special occasions.

Payroll Cards

Payroll cards are prepaid cards that employers use to pay employees. Instead of receiving a paper check or direct deposit to a bank account, employees get their wages loaded onto a payroll card. These cards can be used to withdraw cash, make purchases, and pay bills. Payroll cards are especially useful for workers without bank accounts.

Government Benefit Cards

Government benefit cards are prepaid cards used to distribute government assistance payments, such as unemployment benefits, social security, and food assistance programs. These cards provide recipients with a safe and convenient way to access their benefits without needing a bank account. They can be used to withdraw cash, make purchases, and pay bills.

Travel Prepaid Cards

Travel prepaid cards are designed for people traveling abroad. These cards allow you to load money in different currencies, helping you avoid foreign transaction fees and exchange rate fluctuations. They are a secure way to carry money while traveling, offering protections like PIN codes and the ability to quickly block the card if it is lost or stolen.

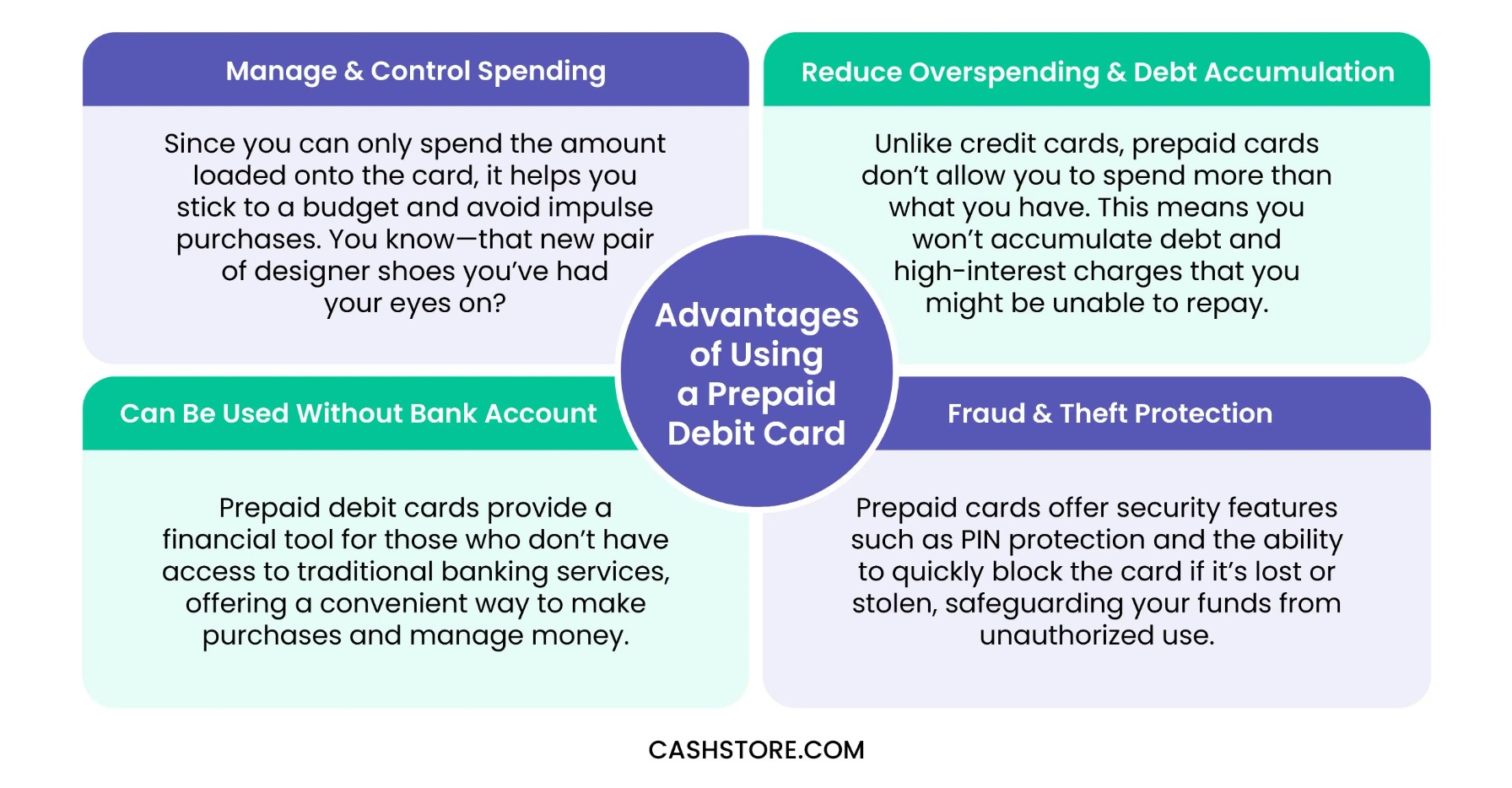

Advantages of Using a Prepaid Debit Card

Prepaid debit cards offer some pretty cool advantages. For example, they don’t require a credit check, which can be lucrative when your credit score isn’t quite up to snuff. But there are other big benefits, too.

- Helps in managing and controlling spending: Since you can only spend the amount loaded onto the card, it helps you stick to a budget and avoid impulse purchases. You know—that new pair of designer shoes you’ve had your eyes on?

- Reduces the risk of overspending and debt accumulation: Unlike credit cards, prepaid cards don’t allow you to spend more than what you have. This means you won’t accumulate debt and high-interest charges that you might be unable to repay.

- Can be used by individuals without a bank account: Prepaid debit cards provide a financial tool for those who don’t have access to traditional banking services, offering a convenient way to make purchases and manage money.

- Protection against fraud and theft: Prepaid cards offer security features such as PIN protection and the ability to quickly block the card if it’s lost or stolen, safeguarding your funds from unauthorized use.

Take Control of Your Finances Today

Prepaid debit cards are a great financial tool for managing your money, preventing overspending, and offering security against fraud. Whether you need a card for budgeting or as an alternative to a traditional bank account, prepaid debit cards provide flexibility and control.

Ready to take control of your finances? Visit Cash Store to explore your options and find the right financial tools for your needs today!