Cash Store Blog

The Financial Power of Saving $5 a Day: A Small Step towards a Big Change

In a world driven by consumerism, where spending habits shape our economy, the idea of saving can feel like a daunting task. Consumer spending consistently accounts for about 70% of the U.S. economy, with purchases falling into two broad categories: necessities and discretionary items.

A LendingTree survey shows that nearly 40% of Americans admit to overspending to impress others, particularly on clothing, shoes, or accessories. The desire to impress can lead to frustrating financial consequences, with over a quarter of those who overspend finding themselves trapped in debt.

But, there's a powerful alternative – the practice of saving just $5 a day. This small step can yield remarkable financial transformation over time. In this article, we'll explore the impact of daily saving and how it can change your financial landscape.

How Saving $5 a Day Can Create a Massive Financial Transformation

Have you ever thought about the impact of saving a mere $5 daily? It might not sound like much, but with the magic of compound interest, this small habit can lead to a significant financial transformation.

We'll explore the remarkable potential of daily savings and introduce you to automated tools that make it easier than you might think. Your financial journey begins with a simple, actionable step.

The Power of Daily Savings

At Cash Store, we suggest the 50/20/30 principle for personal financial management. This approach divides your income into three parts: 50% for essentials, 20% for savings and debt reduction, and 30% for personal expenses. Saving $5 a day for a year accumulates to $1,825, aiding you in getting closer to the crucial 20% savings goal.

This small but consistent habit yields substantial benefits over the long term:

- Compound interest multiplies your savings.

- It nurtures financial discipline.

- Small daily steps lead to significant wealth growth.

- Achieving financial goals becomes more attainable.

- You transition to a more savings-oriented lifestyle.

Compound Interest: The Silent Growth Engine

Compound interest functions as a silent powerhouse, magnifying your savings over time. It's the process of earning interest not only on your initial savings but also on the accumulated interest from prior periods. To grasp the full potential, let's dig a bit deeper into this scenario:

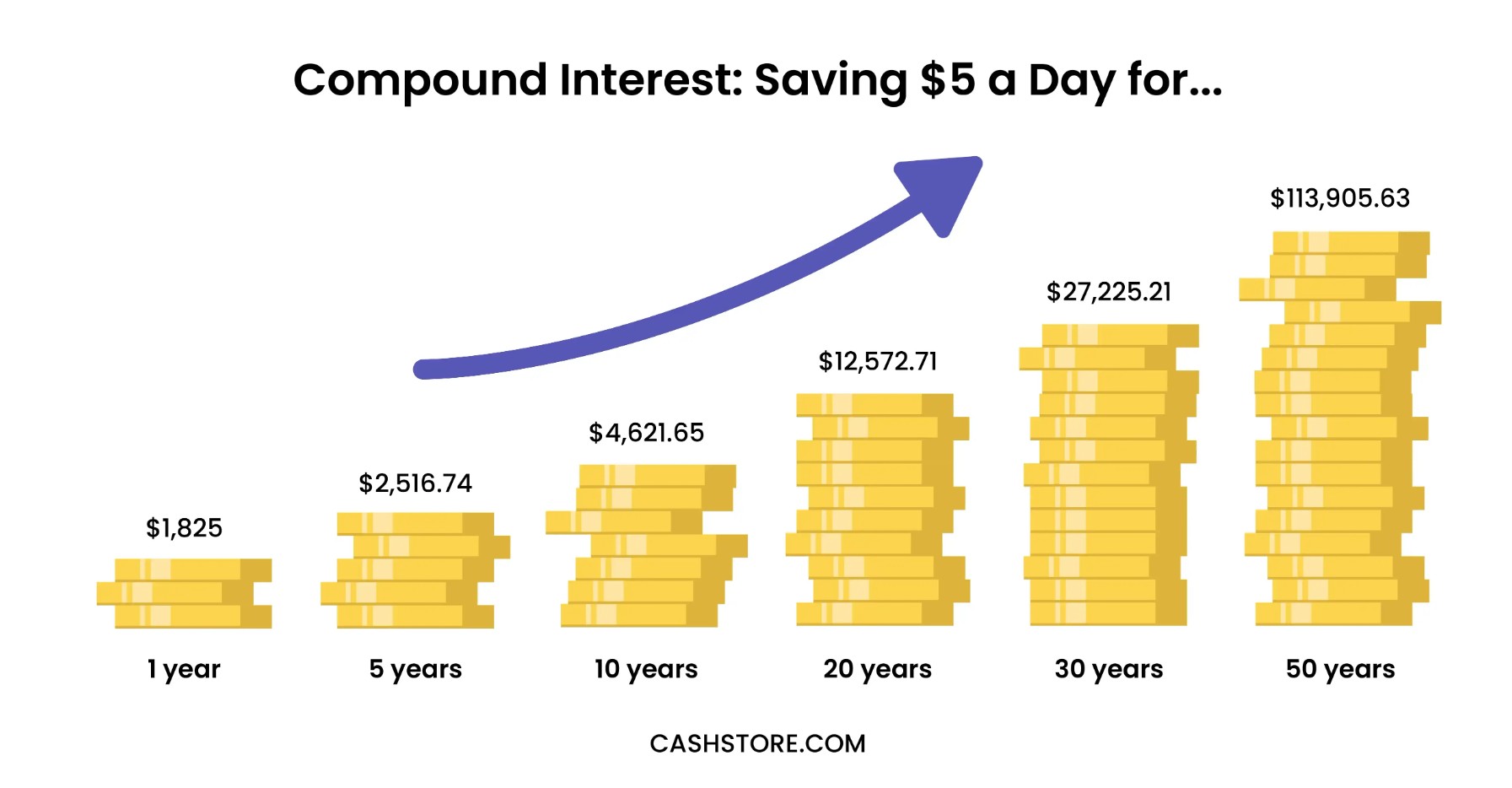

When you save $5 a day for a year, your total reaches $1,825.

However, the remarkable impact of compound interest truly shines when we consider different timeframes, assuming an average 7% annual return:

- After 5 years: Your savings swell to approximately $2,516.74.

- After 10 years: They grow even more to around $4,621.65.

- After 20 years: You're looking at an impressive $12,572.71.

- After 30 years: Your savings are up to $27,225.21.

- After 50 years: The incredible figure of $113,905.63 comes into view.

These calculations underscore how compound interest, combined with the daily habit of saving $5, can significantly transform your financial future. The longer you commit to this habit, the more remarkable the growth potential, providing you with a secure financial foundation and the means to achieve your dreams.

Tools & Resources to Help You Save

In the digital age, mastering your finances and wealth planning is easier than ever, thanks to an array of user-friendly apps. Consider apps like Mint, Acorns, and YNAB for their potential to streamline your financial journey.

The benefits of automatic savings are numerous, including:

- Ensuring consistent contributions.

- Simplifying financial goal tracking.

- Growing your savings effortlessly.

- Creating a savings habit.

- Reducing the risk of forgetting to save.

Moreover, these tools emphasize the importance of monitoring and budgeting, ensuring your financial security while simplifying the path to your goals.

Additional Benefits of Daily Saving

Beyond financial growth, saving $5 a day fosters a disciplined financial routine, leading to smarter spending decisions and improved overall financial health. By consistently setting aside a small sum, you cultivate a habit that holds significant long-term benefits.

This habit empowers you to make more informed choices, helping you achieve your financial goals and attain financial security. It's not just about the dollars saved, but the transformation of your financial habits and mindset that can make a substantial difference in your financial future.

Building a Disciplined Financial Routine

Financial discipline is a cornerstone of financial well-being. It involves setting clear monetary goals, tracking your progress, and making informed choices to achieve those goals. Daily savings foster this discipline, encouraging wiser spending decisions and improved overall financial health.

There are various paths to financial discipline, including:

- Setting Short-term, Mid-term, and Long-term Goals: Defining specific goals provides a roadmap for your financial journey. Short-term goals might involve saving for a vacation, mid-term goals could be purchasing a car, and long-term goals typically center on retirement planning.

- Creating a Family (or Personal) Budget: Budgeting ensures that your income aligns with your expenses and financial goals. It promotes better spending and saving decisions.

- Paying Down Existing Debt and Improving Your Credit Score: Reducing debt and enhancing your credit score are essential steps toward financial independence.

- Opening a High-Yield Savings Account: High-yield savings accounts offer the potential for significantly higher interest rates than traditional savings accounts. The FDIC notes that the national average interest rate on savings accounts as of August 21, 2023, was 0.43% annual percentage yield (APY). In contrast, high-yield accounts can yield 4.00% APY or more, typically found at online banks.

- Seeking Out a Financial Planner: Professional guidance can be invaluable in creating and implementing a sound financial plan tailored to your individual goals and circumstances.

Incorporating these approaches into your financial routine fosters discipline, helping you make well-informed choices and work toward financial independence and security.

Preparing for Emergencies with an Emergency Fund

Daily savings can help you create and maintain an emergency fund, which provides a safety net in unexpected situations. Here are some common financial emergencies where having savings can be a lifesaver:

- Medical expenses

- Car repairs

- Home repairs

- Job loss

- Legal fees

Achieving Larger Financial Goals with Ease

Whether it's buying a home, starting a business, or going on a dream vacation, daily savings can significantly contribute to reaching these goals. The discipline you develop from daily saving can be applied to more extensive financial endeavors. For example:

- Retirement: Saving for a comfortable and secure retirement is a significant long-term financial goal.

- Homeownership: Purchasing a home and paying off the mortgage is a substantial financial milestone.

- Higher Education: Saving for your child's education, such as college or postgraduate degrees, can be a major financial goal.

- Continued Education: Pursuing your own education and personal development, which might include courses, certifications, or further degrees, can enhance your skills and career opportunities.

- Starting a Business: Entrepreneurship and starting a business often require substantial financial investment.

- Debt-Free Living: Approximately 23% of Americans have achieved the significant financial milestone of being debt-free, according to the latest available data from the Federal Reserve. This statistic encompasses various types of debt, including credit card balances, student loans, mortgages, car loans, and more. It reflects a noteworthy portion of the population that has successfully managed their finances to eliminate these financial obligations, contributing to their overall financial security and independence.

- Dream Vacation: Planning and funding a dream vacation to an exotic destination or a special travel experience. In fact, the prevailing retirement aspiration, held by 70% of American workers, is to explore the world, as revealed by the 18th Annual Transamerica Retirement Survey. Yet, there's a catch: Traveling entails expenses, often substantial ones.

The key is consistency. Daily savings, even in small amounts, pave the way for financial security, empowerment, and the capability to handle both the expected and unexpected financial challenges life may throw your way.

Embarking on Your Financial Transformation with $5 a Day

Daily savings, even as modest as $5 a day, can ignite a profound financial transformation. By building a disciplined routine, preparing for emergencies, and fueling your aspirations, you're setting a course towards financial security and independence.

Remember Warren Buffett's wisdom, "Do not save what is left after spending, but spend what is left after saving." Take action today, start your saving journey, and witness the remarkable changes daily savings can bring to your financial future. Your transformation begins with the first step—start saving now.

Looking for more financial insights? Follow the Cash Store blog!

FAQs

How much can I really save in a year with $5 a day?

Saving $5 a day over a year amounts to $1,825. This seemingly modest daily habit can yield a substantial sum, offering a strong foundation for your financial future and transforming your approach to savings and wealth building. Furthermore, simply being mindful of this daily saving goal may lead to additional savings, like forgoing your daily coffee run.

Are there tools to help me save $5 automatically daily?

Absolutely, several apps are specifically designed to help you save $5 daily automatically. Apps like Oportun (formerly called Digit), Qapital, and Chime offer features that automate daily or periodic transfers from your checking account to your savings, making it easy to consistently save small amounts without lifting a finger.

These tools streamline the process and encourage regular savings habits. Additional apps like Mint, Acorns, and YNAB can also help to streamline your financial journey.

How does this daily saving compare to large monthly savings?

Daily saving of $5, or approximately $150 a month, is a wise approach to building retirement savings. By consistently saving $5 a day, you'll have $1,825 in a year. With an average 7% annual return and the magic of compound interest, this amount could grow to over $2,500 in five years and more than $4,600 in a decade.

This small daily saving habit can have a big impact on your financial future. If you can save more, it's an opportunity to accelerate your wealth accumulation. Every bit counts.

Can daily savings help in emergencies or only for long-term goals?

Daily savings serve a dual purpose. While they're certainly instrumental in achieving long-term financial goals, they also act as a valuable safety net in emergencies. Building a savings habit ensures you're better prepared to face unexpected financial challenges.

Whether for retirement or unexpected events like medical expenses, car repairs, or job loss, daily savings provide a buffer for both short-term and long-term financial security.

Should I put the $5 in my savings account or in my retirement account?

Deciding whether to put your $5 in a savings account or a retirement account depends on your financial goals. A savings account offers easy access to your funds for short-term needs but typically provides lower interest.

A retirement account, like a 401(k), offers tax advantages and is designed for long-term savings. However, early withdrawals from a 401(k) may incur penalties and taxes, making it super important to consider your timeline and goals when making this decision.