Cash Store Blog

Strategies to Protect Your Personal Financial Information

Consider this—every year, there are over 100,000 personal data breaches and cases of identity theft in the U.S. That’s a pretty alarming statistic, especially since recovering from such an incident can take months, if not years. Yet, despite the prevalence of these crimes, many Americans aren’t taking the appropriate steps to protect their financial information. And quite frankly, you’re opening yourself up to become the next victim without taking the steps for financial information protection.

In this article, we’ll tell you what you need to know to protect your data. After all, the more careful you are, the less likely you’ll be a target.

What is Personal Financial Information?

Personal financial information includes any details that can be used to access or manage your money. This encompasses your bank account details, credit card numbers, Social Security number, and even your online banking passwords. Basically, it’s all the sensitive data that keeps your financial life secure.

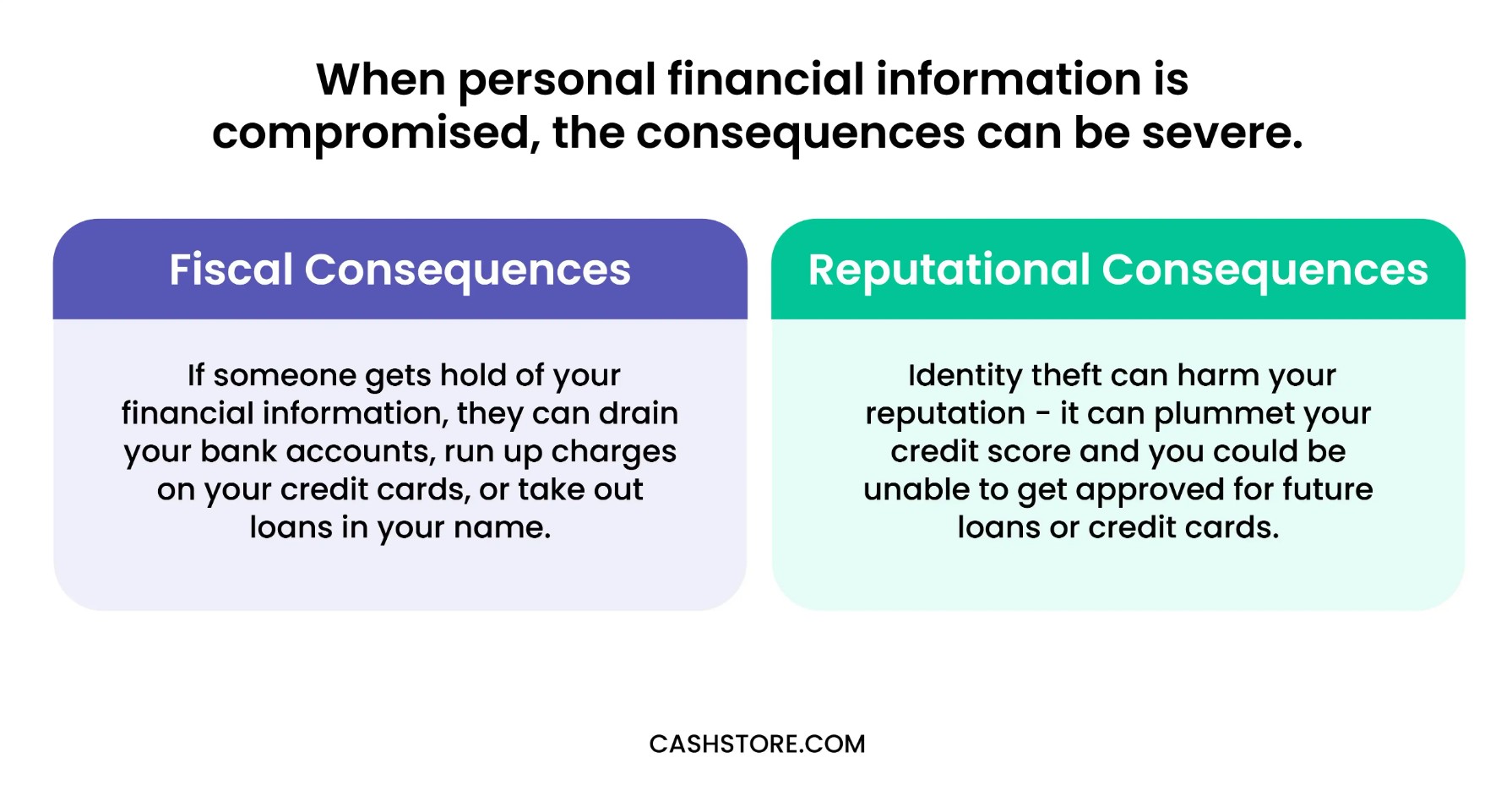

When this information is compromised, the consequences can be severe.

- Fiscal Consequences: If someone gets hold of your financial information, they can drain your bank accounts, run up charges on your credit cards, or take out loans in your name. Recovering from this type of theft can be difficult and time-consuming, often taking months or even years to resolve fully.

- Reputational Consequences: Identity theft can also harm your reputation. If thieves use your identity to commit crimes or fraud, the result can be a plummeting credit score and the inability to get competitive interest rates on future loans or credit cards—if you can get approved at all. Clearing your name and restoring your credit can be a long and frustrating process.

Protecting your personal financial information is so important to avoiding these headaches and safeguarding your financial future.

Common Threats to Personal Financial Security

While we all like to believe the best in others and the technology devices that we use, the fact is that we are potential targets at all times. And often, when we are at the biggest risk is when we might least expect it.

Here are the common threats to your personal financial security.

Identity Theft

Identity theft occurs when someone steals your personal information, such as your Social Security number or bank details, to commit fraud. Thieves can use this information to open accounts, make unauthorized purchases, or even file taxes in your name, leading to significant financial and reputational damage.

Phishing Scams

Here’s another statistic for you—so far, in 2024, 94% of organizations have been the victim of phishing attacks. But these attacks don’t only happen in the workplace. Phishing scams involve fraudsters pretending to be trustworthy entities, like banks or government agencies, to trick you into revealing personal information. They often use emails, texts, or fake websites that look legitimate. Falling for these scams can result in your financial information being stolen and misused.

Data Breaches

Data breaches happen when hackers infiltrate systems to steal sensitive information from companies or organizations. Your personal financial information, such as credit card numbers or account passwords, stored by these entities can be exposed. This information can then be sold or used to commit financial fraud.

Skimming Devices

Skimming devices are small tools criminals attach to ATMs or card readers to steal your card information. When you swipe your card, the device captures your data, which can then be used to create fake cards or make unauthorized transactions. Always inspect card readers for tampering before use.

Malware and Ransomware Attacks

Ready for another alarming statistic? In 2023, ransomware attacks affected 66% of organizations. Malware and ransomware are malicious software programs that can infect your devices. Malware can steal sensitive information, while ransomware locks you out of your system until you pay a ransom. Both types of attacks can lead to loss of financial data and potentially significant financial losses.

Best Practices to Protect Your Personal Information

By no means are we trying to suggest that you can’t trust anybody out there, or that every email should be scrutinized to see if it is coming from the right place. But, we are suggesting some diligence to protect yourself. Here’s what you can do.

Online Security

Use strong, unique passwords for all financial accounts to keep them hard to guess. Enable two-factor authentication (2FA) for an extra layer of security, requiring both a password and a second form of identification. Avoid using public Wi-Fi for financial transactions, as these networks are less secure.

Regularly update your software and antivirus programs to protect against new threats. And by all means, do not write down passwords on a piece of paper tucked under your keyboard—this is the perfect invitation for bad behavior. Always be cautious of phishing emails and suspicious links to avoid falling victim to scams.

Physical Documents

Shred sensitive documents before disposal to prevent dumpster divers from accessing your information. Small shredders are more affordable than ever and can be purchased online, at your local Target store, or at your local office supply store.

Store important financial documents, such as extra checks, financial statements, and even your passports, in a secure, locked location, such as a safe. This helps protect them from theft and loss. Limit the amount of physical financial information you carry, and only take necessary cards and documents. Think minimal when heading out for the day. This reduces the risk of losing valuable information if your wallet or purse is stolen or misplaced.

Social Media

We spend a lot of time on social media channels these days—about 143 minutes a day. And every minute of that activity puts you at risk. But perhaps what’s worse is that you remain a target even when you are not active on these platforms. So, be mindful of the information you share on social media platforms.

Personal details can be used by thieves to steal your identity. Adjust your privacy settings to limit who can see your information, ensuring only trusted contacts have access. Avoid sharing sensitive details like your birthdate, address, or financial status publicly, as this information can be used to guess passwords or security questions.

Stay Vigilant for Financial Information Protection

Keeping tabs on your personal financial information can help you prevent issues before they start and recover from them quickly if they occur. Practicing financial information protection is essential in today’s digital age.

Get started today with Cash Store for a secure loan process that prioritizes your safety. By staying vigilant and taking proactive measures, you can safeguard your financial future and enjoy peace of mind.