Cash Store Blog

Stocks for Beginners—A Guide

Have you considered investing in the stock market? If you are like most adults, especially those hoping to supplement their retirement portfolio, you have. And why not give it a try? Savvy investors can expect to see a return of about 10% annually, and that’s far better than what you might see with bonds or interest on your savings account.

So what’s keeping you? We get it. The stock market can be overwhelming, with so many different terms and things to understand. It can be enough to make any new investor a bit crazy.

In this article, we’ve boiled down the key concepts about stocks for beginners. By the time you are done reading, you’ll have the inside scoop on what to do and how to make your stock investments a profitable venture.

What is the Stock Market?

Let’s start at the beginning. What is the stock market, and how do you invest your funds? This is a great question. Here’s what you need to know: The stock market is where you can buy and sell shares of companies. Think of it like a giant marketplace—this time on Wall Street—and instead of fruits and vegetables or a bunch of flowers for the kitchen table, you’re buying pieces of a business. These pieces are called "stocks" or "shares." You own a small part of that company when you buy a share.

Overview of How the Stock Market Functions

The stock market functions through exchanges, like the New York Stock Exchange (NYSE) or NASDAQ. Companies list their stocks on these exchanges, and investors (like you) can buy or sell them. Stock prices go up and down based on supply and demand, news, and overall economic conditions.

When more people want to buy a stock, its price goes up. When more people want to sell, its price goes down. It's that simple! By trading stocks, investors can earn money when their stocks increase in value or pay dividends.

Types of Stocks

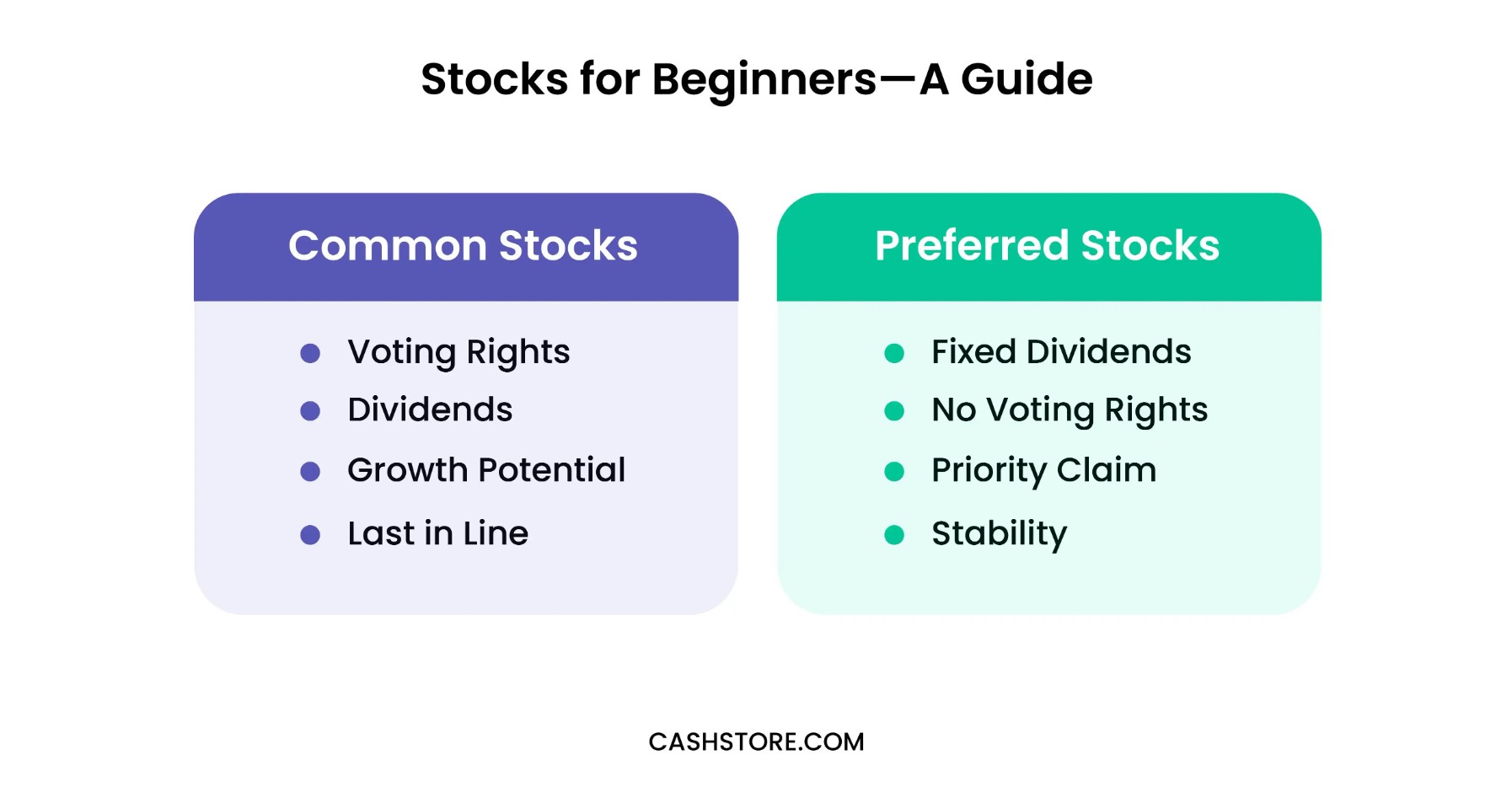

Now that you know the stock market, let’s provide some simple definitions of the two different types of stocks that you can buy.

Common stocks are shares that signify company ownership. When you own common stocks, you have a claim on a portion of the company’s assets and earnings.

They have the following characteristics.

- Voting Rights: Common stockholders often have the option to vote on company matters, such as determining and electing the board of directors.

- Dividends: Common stocks may pay dividends, which are a portion of the company’s profits distributed to shareholders. However, dividends are not guaranteed and can vary.

- Growth Potential: Common stocks have the potential for high growth and can increase in value over time, but they also come with higher risk.

- Last in Line: In the event of company liquidation, common stockholders and preferred stockholders are the last to be paid after debts.

Preferred stocks, on the other hand, are shares that offer a fixed dividend payment and have priority over common stocks in the event of company liquidation. They have these characteristics.

- Fixed Dividends: Preferred stockholders receive dividends at a fixed rate before any dividends are paid to common stockholders.

- No Voting Rights: Preferred stockholders typically do not have voting rights in company decisions.

- Priority Claim: In the event of company liquidation, preferred stockholders have more claim to assets than common stockholders but are still behind debt holders.

- Stability: Preferred stocks are generally considered less risky than common stocks and provide more predictable income, but they also offer less growth potential.

Market Indexes

Now, let’s talk about market indexes. The stock market can become a bit overwhelming for some, especially for those who are still learning about investments and growing their financial literacy. But stick with us as we’ll try to explain this as simply as possible.

- S&P 500: The S&P 500 is an index that tracks the performance of 500 of the largest companies in the U.S. It gives a good idea of how the overall stock market is doing.

- Dow Jones Industrial Average (DJIA): The DJIA, or the Dow, is an index that tracks 30 big, important companies in the U.S. It's often used to measure the health of the stock market.

- NASDAQ: The NASDAQ index includes about 3,000 companies, mainly in the technology sector. It shows how tech stocks are performing.

These indexes help track market performance by showing the average performance of the companies they include. If the index goes up, it means most of the stocks in that index are doing well. If it goes down, it means most stocks are doing poorly. Investors use these indexes to get a quick sense of how the stock market is doing overall.

Setting Investment Goals for Beginners

With all that terminology behind us, let’s talk about how to get started. And it all begins with setting some goals, determining your appetite for risk, and knowing how long you have to invest before you’ll need to tap into those funds.

Short-Term vs. Long-Term Goals

Short-term goals are things you want to achieve soon, usually within the next few years. Long-term goals are further in the future, like decades away. For example, saving for a down payment on a house is a short-term goal because you might need the money in a few years. Saving for retirement is a long-term goal because you’ll need the money many years from now. Knowing the difference helps you decide how to invest your money.

Risk Tolerance

Risk tolerance is how comfortable you are with the chance of losing money in your investments. Some people are okay with taking big risks for big rewards, while others prefer safer, more stable investments.

You can take online risk questionnaires or talk to a financial advisor to understand your risk tolerance. They can help you decide whether to invest in high-risk stocks or safer options like bonds.

Investment Horizon

Your investment horizon is how long you plan to keep your money invested before you need it. This timeline affects what types of investments are best for you.

If you have a long investment horizon, like retirement savings, you can take more risks with stocks. If you have a short horizon, like saving for a vacation next year, you should choose safer investments. Matching your investments to your timeline makes sure you have the money when needed.

How to Make Your First Investment in Stocks

Feeling like its time to invest in the stock market? If so, you’ll be joining about 61% of Americans who are already investing their hard-earned dollars into the stock market, looking to realize that 10% return.

Here are some tips to help you succeed.

Choosing Stocks

Before buying any stock, do your homework. Research the company’s financial health, its competitors, and its industry. Websites like Yahoo Finance and Google Finance offer a wealth of information.

As a beginner, consider starting with well-known companies with a stable performance history, such as Apple, Microsoft, or Coca-Cola. These companies are less volatile and are often a good starting point for new investors.

Placing an Order

To place an order in the stock market, you will typically need to talk to a stock broker who will manage your transactions. You can also use sites like E-Trade from Morgan Stanley to manage your stock purchases online. However, if you are new to investing, we recommend that you work with a professional broker.

Here are some definitions to know when placing an order.

- Market Orders: Buy or sell a stock immediately at the current day’s market price.

- Limit Orders: Buy or sell a stock only at a specific price or better. This helps you control the price at which your order is executed.

- Stop-Loss Orders: Automatically sell a stock when its price falls to a certain level, helping to limit your losses.

Monitoring Your Investments

Investing in the stock market is not really a set-it-and-forget-it type of endeavor. You need to keep an eye on what’s going on, and pay attention to the news to know of any concerns the stock market might be experiencing.

Here are some tips.

- Regular Reviews: Review your portfolio regularly, at least every few months. This helps you stay informed about how your investments are performing.

- Adjustments: If a stock isn’t performing as expected or if your financial goals change, you might need to adjust your portfolio. This could mean selling some stocks and buying others to match your investment strategy better.

Want More Great Financial Tips? Follow the Cash Store Blog

Now that you are up-to-speed on how the stock market works and what to do, its up to you on whether or not you want to move forward. Before you do, make sure you have the financial means to do so. Pay attention to your budget and make sure that you are properly balanced in the categories of needs and wants to confirm that you are ready to start investing.

Want more great financial tips? Follow the Cash Store blog today.