The Art of Budgeting: Mastering Your Finances in Every Season

We understand that managing your money can be an intimidating and overwhelming experience. But it doesn’t have to be that way! Our mission is to guide you through the process, from understanding the basics to mastering your finances in every season of life.

Throughout this article, we will introduce you to the 50/20/30 budgeting methodology, a straightforward approach to managing your income. We'll also explore the essential steps to creating an emergency fund, ensuring you're prepared for unexpected financial challenges. And, to top it all off, we'll dive into two powerful strategies for paying down your debt – the avalanche and snowball methods – so you can achieve financial freedom sooner than you think.

So, grab your financial compass and get ready to embark on this enlightening journey towards a brighter financial future. Let's get started!

Understanding the Basics of Budgeting

Budgeting is the foundation of financial success. Think of it as a roadmap guiding you through the process of managing your money. Simply put, it's a plan that helps you allocate your income wisely, ensuring every dollar has a purpose. Let's explore why budgeting is so crucial.

The Risks of Not Following a Budget

Living outside your means is a perilous path many fall into when they neglect to budget. Without a budget, you might spend more than you earn, leading to financial stress and debt piling up like an unstoppable snowball. It's a risky game that can jeopardize your financial well-being, making it challenging to meet even basic needs, let alone achieve future retirement goals.

Growing your debt instead of paying it down is another pitfall. Interest fees can spiral out of control, chaining you to financial burdens for years. Budgeting is your shield against this peril, helping you allocate funds to debt repayment and break free from this cycle.

The Role of Budgeting in Achieving Financial Goals

Budgeting is not just about restriction; it's about empowerment. It puts you in control of your finances and allows you to work toward your financial goals. Whether you dream of a comfortable retirement, buying a home, or going on that dream vacation, budgeting tips the scales in your favor.

Financial planning becomes achievable through budgeting as well. You can allocate some of your income to savings and investments, steadily building the wealth you need to realize your dreams. Money management, an essential aspect of budgeting, helps you track your expenses and identify areas where you can cut back or allocate more funds toward your goals.

In the next sections, we'll explore specific budgeting tips, get deeper into financial planning strategies, and hone your money management skills.

Creating a Personalized Budget

Budgeting is not a one-size-fits-all approach. It's a highly individualized process that considers your unique financial situation, goals, and needs. In this section, we'll explore the importance of tailoring a personalized or family budget to your circumstances and introduce you to the 50/20/30 budget methodology, a versatile tool for achieving financial stability.

The Importance of a Personalized Budget

A personalized budget is perfectly fitted to your financial profile. It ensures that your hard-earned money is allocated where it matters most. By customizing your budget, you can align it with your financial goals, whether that's paying off debt, saving for a dream vacation, or building a robust retirement fund.

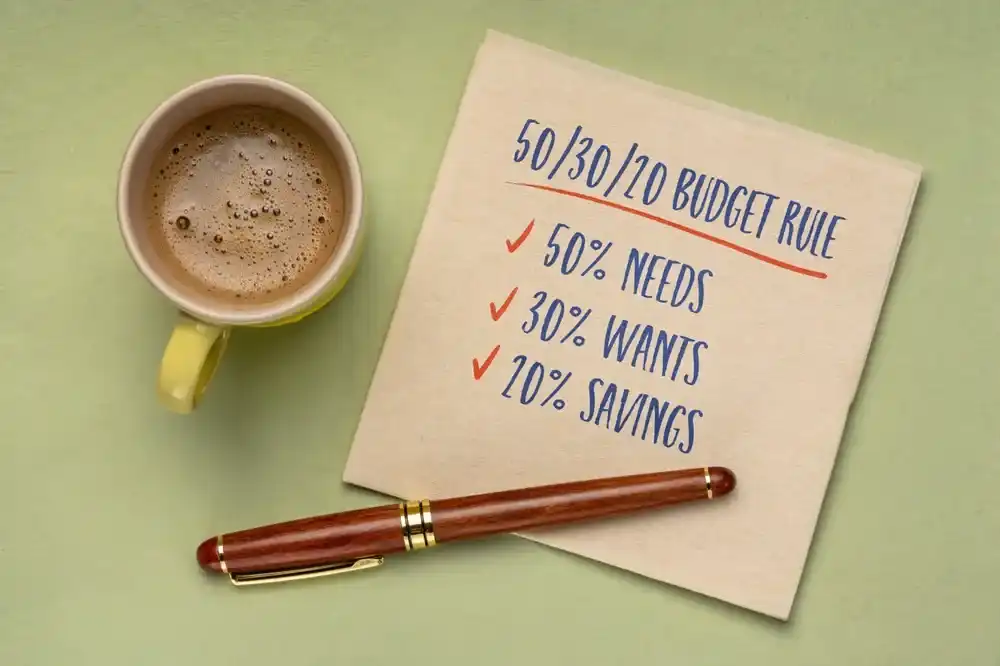

The 50/20/30 Budget Methodology

Created by Elizabeth Warren, the 50/20/30 rule is a fantastic budgeting strategy that simplifies the budgeting process. It divides your monthly income into three categories:

- 50% for Needs: This category covers essential expenses like mortgage or rent, utilities, groceries, and transportation. These are non-negotiable expenses necessary for daily living.

- 20% for Savings and Debt: In this category, allocate 20% of your income to savings, investments, and paying down debt. This step is vital for building an emergency fund and achieving long-term financial goals.

- 30% for Wants: The final category is for discretionary spending – things you want but don't necessarily need. This includes dining out, entertainment, hobbies, and other enjoyable activities.

Step-by-Step Budgeting Instructions

Creating a personalized budget doesn't have to be overwhelming. Here's a step-by-step guide to get you started:

- Calculate Your Monthly Income: Determine your total monthly income, including your gross salary, dividends or bonuses, and any additional sources of revenue.

- List Your Expenses: Jot down your monthly expenses, such as rent or mortgage payments, utilities, and insurance, and other costs such as groceries and entertainment.

- Apply the 50/20/30 Rule: Allocate your income into the three categories based on the 50/20/30 rule.

- Track Your Spending: Monitor your actual spending to ensure you stay within your budgeted categories. Consider an expense tracker app to make it easy to watch what you are spending, especially when you’re on the go.

- Adjust as Needed: Life is dynamic, so your budget should be too. Adjust your budget as your financial situation and goals evolve.

By following these steps and tailoring your budget to your needs, you'll be well on your way to mastering your finances and achieving your financial goals.

Budgeting for Every Season

As we all know, life is filled with different seasons, regardless of where you live. And each season is accompanied by its own unique financial demands. To master your finances and the art of budgeting, you will need to adapt your financial plan to the changing seasons of your life.

Seasonal Expenses: What to Expect

Here are some examples of seasonal expenses that you need to prepare for in your budget.

- Home Improvements: Spring and summer often bring a desire for home improvements. Budget for repairs, renovations, or landscaping projects to enhance your living space.

- Planning a Family Vacation: Summer vacations are a cherished tradition. Set aside funds throughout the year to make your dream getaway a reality without straining your budget. Consider that the average cost for a vacation for a family of four can range from $4,100 to $5,100. That’s no small chunk of change. So, why not consider a staycation this year to help you keep expenses in check?

- Property Taxes: Property taxes are due at specific times of the year—budget for these expenses by setting aside a portion of your income monthly or as needed.

- Tax Season: Be prepared for tax season, whether you anticipate a refund or owe taxes. Planning ahead can prevent any surprises.

- Holiday and Birthday Spending: The holiday season and birthdays can increase spending. Create a separate fund for gifts, decorations, and festivities.

- Kids' Sports Fees: If your children are involved in sports, there may be fees associated with their activities—budget for these costs in advance.

Adapting to Financial Seasons

Budgeting for different seasons requires flexibility and foresight. Assess your financial calendar, identify upcoming expenses, and allocate funds accordingly. By planning for seasonal expenses, you'll maintain financial stability throughout the year, preventing unexpected financial strain and helping you achieve your financial goals. Remember, mastering the art of budgeting means being prepared for all the seasons life has in store.

Emergency Funds and Contingency Planning

Unexpected expenses can come knocking at any moment. These financial curveballs can throw even the most meticulous budget off track. That's where emergency funds and contingency planning come to the rescue.

To set the stage, consider that a 2023 survey revealed some eye-opening statistics: only 30% of adults have some emergency savings, which is only a modest increase from 27% in 2022. Even more concerning, one in four U.S. adults admit to having zero emergency savings. It's a stark reality that 57% of U.S. adults presently lack the financial capacity to navigate a $1,000 emergency expense without strain.

Life's surprises can include home repairs, medical bills, car troubles, or unexpected job loss. Without a safety net, these situations can lead to financial turmoil. That's why at Cash Store, we advocate for setting aside at least three to six months' worth of living expenses in an emergency fund.

Tips for Building and Maintaining Your Emergency Fund

Here are some practical steps to build and maintain your emergency fund:

- Start Small: Even small, regular contributions add up over time. Begin by setting aside a manageable amount each month.

- Automate Savings: Make saving effortless by setting up automatic transfers to your emergency fund.

- Cut Unnecessary Expenses: Evaluate your spending habits and identify areas where you can cut back to redirect funds into your emergency fund.

- Use Windfalls Wisely: When you receive unexpected money, such as tax refunds or bonuses, consider adding some of it to your emergency fund.

- Avoid Temptations: Remember, your emergency fund is for genuine emergencies, not impulse purchases or vacations.

An emergency fund is your financial lifeline, providing peace of mind and stability during challenging times. Don't wait for an emergency to strike – start saving and planning for the unexpected today.

Debt Management Strategies

It's no secret that debt can be a heavy burden. In fact, the average American carries a staggering $90,460 in debt, which includes various consumer debt products such as credit cards, personal loans, mortgages, and student debt. If left unchecked, debt can hinder your financial well-being. Thankfully, there are effective strategies to manage and eliminate it.

The Avalanche Method

Imagine you're standing at the base of a mountain of debt, each debt source represented by a different peak. The avalanche method advises tackling the highest interest rate debt first, like conquering the tallest peak. You can save money on interest in the long run by directing extra payments towards the high-interest debt while paying the minimum on others.

Consider the following hypothetical example:

- Credit Card A: $5,000 at 18% interest

- Credit Card B: $4,000 at 12% interest

- Student Loan: $10,000 at 6% interest

In this scenario, you'd prioritize paying off Credit Card A first, as it carries the highest interest rate.

The Snowball Method

Picture a snowball rolling downhill, gradually gaining momentum. The snowball method suggests starting with the smallest debt balance and paying it off first, regardless of interest rates. This creates a sense of accomplishment and motivation as you see debts disappearing one by one, building momentum to tackle larger debts.

Consider the following hypothetical example:

- Credit Card A: $3,000 at 18% interest

- Credit Card B: $5,000 at 12% interest

- Personal Loan: $7,000 at 8% interest

In this case, you'd begin by paying off Credit Card A, then move to the next smallest debt.

By employing these debt reduction strategies, you can pave your way toward financial freedom, one payment at a time. Choose the method that aligns with your financial goals and preferences, and start chipping away at that mountain of debt today.

Smart Spending Habits

One of the key pillars of a successful budget is smart spending. By adopting frugal living and budget-friendly habits, you can stretch your hard-earned dollars further and achieve your financial goals more quickly.

To start, scrutinize your spending and identify areas to cut back. Start by distinguishing between needs and wants. While needs are non-negotiable, wants can often be trimmed down. Consider canceling unused subscriptions, eating out less frequently, or finding more affordable alternatives for your daily expenses.

Mindful Spending

Practicing mindful spending means knowing where your money goes and making intentional choices. It's about asking yourself whether a purchase aligns with your goals and budget. Before hitting that "buy" button, pause and consider if it's truly necessary or just a fleeting impulse.

Grocery Store Cashback Apps

One practical way to save on everyday expenses is by using grocery store cashback apps. These apps offer discounts and cashback rewards on your groceries, helping you save money with every purchase. By incorporating them into your shopping routine, you can make your grocery budget go further without compromising on quality.

The Impact on Your Credit Score

Excessive spending can have a detrimental effect on your credit score. High credit card balances relative to your credit limit can negatively impact your credit utilization ratio, a significant factor in your credit score calculation. Keeping your spending in check benefits your wallet and safeguards your creditworthiness.

Incorporating these smart spending habits into your daily life will keep you within budget and contribute to your financial stability and long-term success. Embrace frugal living, make mindful choices, and watch your financial goals become more attainable than ever.

Reviewing and Adjusting Your Budget

Your budget isn't intended to be a one-and-done static document. It is intended to evolve with you through the inevitable changes that life throws your way. Regularly reviewing and adjusting your budget is crucial for staying on track and achieving your financial goals.

As we all know, life is unpredictable, and financial circumstances can change in the blink of an eye. A budget review acts as your financial compass, helping you assess your progress and make necessary adjustments. It ensures that your financial plan remains aligned with your current situation and goals.

Guidelines for Adjusting Your Budget

Consider the following guidelines for adjusting your budget throughout life’s changes.

- Life Changes: Whenever a significant life change occurs, such as getting married, having a child, or changing jobs, it's time to reassess your budget. Your income, expenses, and financial goals may shift with these changes.

- Income Changes: If your income goes up, allocate some extra money towards savings or debt repayment. Conversely, if your income goes down, adjust your budget to accommodate the new financial reality.

- Expense Fluctuations: Keep an eye on your spending patterns. If you notice certain expenses consistently exceeding your budget, find ways to cut back or reallocate funds from other categories.

- Financial Goals: Your goals may evolve over time. Reevaluate them periodically to ensure your budget supports your aspirations, whether that's buying a home, saving for retirement, or taking a dream vacation.

- Emergency Fund: Ensure your emergency fund remains robust. If you dip into it for unexpected expenses, make a plan to replenish it as soon as possible.

Remember, your budget is a flexible tool designed to work for you. By regularly reviewing and adjusting your financial plan, you can adapt to life changes and stay on the path to financial success.

Tools and Apps for Effective Budgeting

Managing your finances has never been easier, thanks to various budgeting tools and financial apps. These user-friendly applications can revolutionize the way you track, plan, and manage your money. Here are just a few examples of technology-based financial apps that can help you with your budget.

- YNAB (You Need A Budget): YNAB is a budgeting powerhouse that helps you give every dollar a job. With its user-friendly interface and educational resources, it's a great choice for those looking to master their finances.

- EveryDollar: Developed by Dave Ramsey, EveryDollar follows a zero-based budgeting approach. It lets you assign every dollar you spend to specific categories, ensuring your budget is meticulously planned.

- Empower Personal Wealth: Empower is a comprehensive financial app that tracks your spending, provides personalized insights, and helps you find extra savings.

- Honeydue: Designed for couples, Honeydue simplifies financial management by allowing you and your partner to track expenses, set financial goals, and stay on top of bills together.

These budgeting tools and apps leverage technology to provide real-time insights into your financial health. They can sync with your bank accounts, credit cards, and investment portfolios, making tracking your income and expenses easy. Additionally, many of them offer budgeting tips, financial goal-setting, and even investment advice.

By incorporating these technology-driven solutions into your financial management, you can gain better control over your money, make informed financial decisions, and work towards your financial goals with greater confidence.

Get Started with Your Budget Today

One thing is clear: budgeting is a non-negotiable for responsible money management. We've explored the art of budgeting, from understanding its fundamental principles to mastering it in every season of life. Remember, budgeting is not a one-time event but an ongoing, adaptable process.

Keep in mind the importance of personalized budgeting, emergency funds, debt management strategies, and smart spending habits. Regularly review and adjust your budget to stay on track. Embrace technology with budgeting tools and apps to simplify the process.

Now, it's your turn to take action. Implement these tips and watch your financial well-being flourish.

The content on this page provides general consumer information or tips. It is not financial advice or guidance. Each person’s circumstances are unique. The Cash Store may update this information periodically. This information may also include links or references to third-party resources or content. We do not endorse the third-party or guarantee the accuracy of this third-party information. There may be other resources that also serve your needs.

More Articles

What to Know About Crypto-Backed Loans

Curious about using your crypto as collateral? Discover how crypto-backed loans work, their benefits, risks, and what to consider before borrowing.

Read More >How Does Installment Loan Approval Work?

Curious about how installment loan approval works? Learn about the key factors lenders consider, the application process, and tips to improve your chances of approval.

Read More >Is it Better to Get an Installment Loan or Line of Credit?

Installment loan or line of credit—which is right for you? Learn the key differences, pros and cons, and how to choose the best option for your financial needs.

Read More >Loan Amount is subject to loan approval. Loan terms and availability may vary by location. Approval rate based on complete applications received across all Cash Store locations. Customers can typically expect to receive loan proceeds in less than 20 minutes; however, processing times may vary. Loans / Advances are provided based on approved credit. Each applicant for credit is evaluated for creditworthiness.

Please see the Licenses and Rates page for additional product details.

Cash Store offers consumer credit products that are generally short-term in nature and not intended for long-term borrowing needs.

In Texas, Cash Store is a Credit Services Organization. Loans are provided by a non-affiliated third-party lender. Please see the Licenses and Rates page for links to Consumer Disclosures and choose the one for the product and amount that most closely relates to your loan request.

Customer Portal residency restrictions apply. Availability of funds may vary by financial institution.