Cash Store Blog

What Are ACH Payments and How Do They Work?

These days, we’re seeing the rapid development of electronic transactions everywhere we go. That tap-to-pay symbol glows on pay terminals at Target, your sister is requesting a Venmo for that fast food run last week, and your payroll pops up through direct deposits to your bank account. With so many methods of sending money between phones and bank accounts and institutions, it’s important to keep track of what types of electronic payments exist and which functions each one serves.

This blog will provide a comprehensive understanding of Automated Clearing House (ACH) payments and their functioning, as well as common vocabulary used to discuss them. Cash Store cares about your financial literacy—when you’re done here, consider learning more about ACH and the wider financial world through podcasts, books, or online courses.

Understanding ACH Payments

Let’s start by explaining that term: Automated Clearing House. In its most basic form, the ACH is a network that moves money between bank accounts in the United States (as well as select territories like Guam and the Virgin Islands). Regional equivalents of ACH in other countries allow for international transfers, but for now, let’s stick to discussing how these transactions function within the United States.

ACH payments move money without using card networks, wire transfers, cash, or those paper checkbooks your kids don’t know how to use. You aren’t physically handing your money over to someone at the counter, but you’re also not relying on a credit card number. ACH uses your account numbers directly, meaning that if your credit card goes missing, recurring payments won’t be interrupted.

To understand ACH payments, know that there are two types: direct deposit or direct payment, or “push” and “pull.” When you’re the one sending money to another account, you “push” funds out of your account to be routed elsewhere. When someone else is paying you—direct deposit payroll, for example—you “pull” money into your account.

How do ACH Payments Work?

So how does the money get moved from one account to another? Essentially, initiated transactions that are sent to ACH, where they are processed and checked for fraud before being sent to the Federal Reserve and made available the next day. Initiating a transaction requires action from three parties: the originator, the financial institution, and the ACH operator.

- The Originator: Someone has to begin the interaction. Maybe it’s you setting up auto ACH payments to pay a recurring bill.

- The Financial Institution(s): The bank sending money (the originating depository financial institution, or ODFI) must compile the details—account name, account number, routing number, etc.—before sending files forward to the ACH operator. The institution receiving money (the receiving depository financial institution, or RDFI) receives a verified file from the ACH operator and can then push or pull money from the appropriate accounts.

- The ACH Operator: ACH is run by the National Automated Clearing House Association, or Nacha. They’re the point sitting between the ODFI and RDFI, verifying information, protecting against fraud, and getting information where it needs to go.

Timeline

ACH settles funds multiple times a day, but can only do so when the Federal Reserve’s settlement service is open. Nacha implemented same-day processing years ago, and although it is not available for all banks or transactions, at its best ACH can complete payments in just hours. Typically, once initiated, ACH payments will process and settle within a frame of 3 to 5 days.

Benefits of Using ACH Payments

Cost-effectiveness

Credit card payments generally charge higher processing fees than ACH, because they are based on a certain percentage of a transaction instead of using a flat rate. Some banks may not charge anything for ACH payments. This method also avoids the costs of printing and mailing paper checks. ACH is cheaper than wire transfer and often much less limited.

Convenience and efficiency

Those pesky monthly expenses are just another thing to put on your to-do list. With recurring ACH transfers, you can automate these transactions to pay your mortgage or utilities bill, saving your time and energy.

Enhanced security and reduced risk

ACH operators protect against fraud by verifying information before sending files from sending banks to receiving banks. In nature, direct electronic transfer between two accounts is less subject to risk than a check or card that can be misplaced or taken.

Broad acceptance and integration

Venmo, Cash App, PayPal, and similar money transfer apps use the ACH network, and that network extends to every bank and credit union account in the US. Almost any business can accept ACH, often without processing costs.

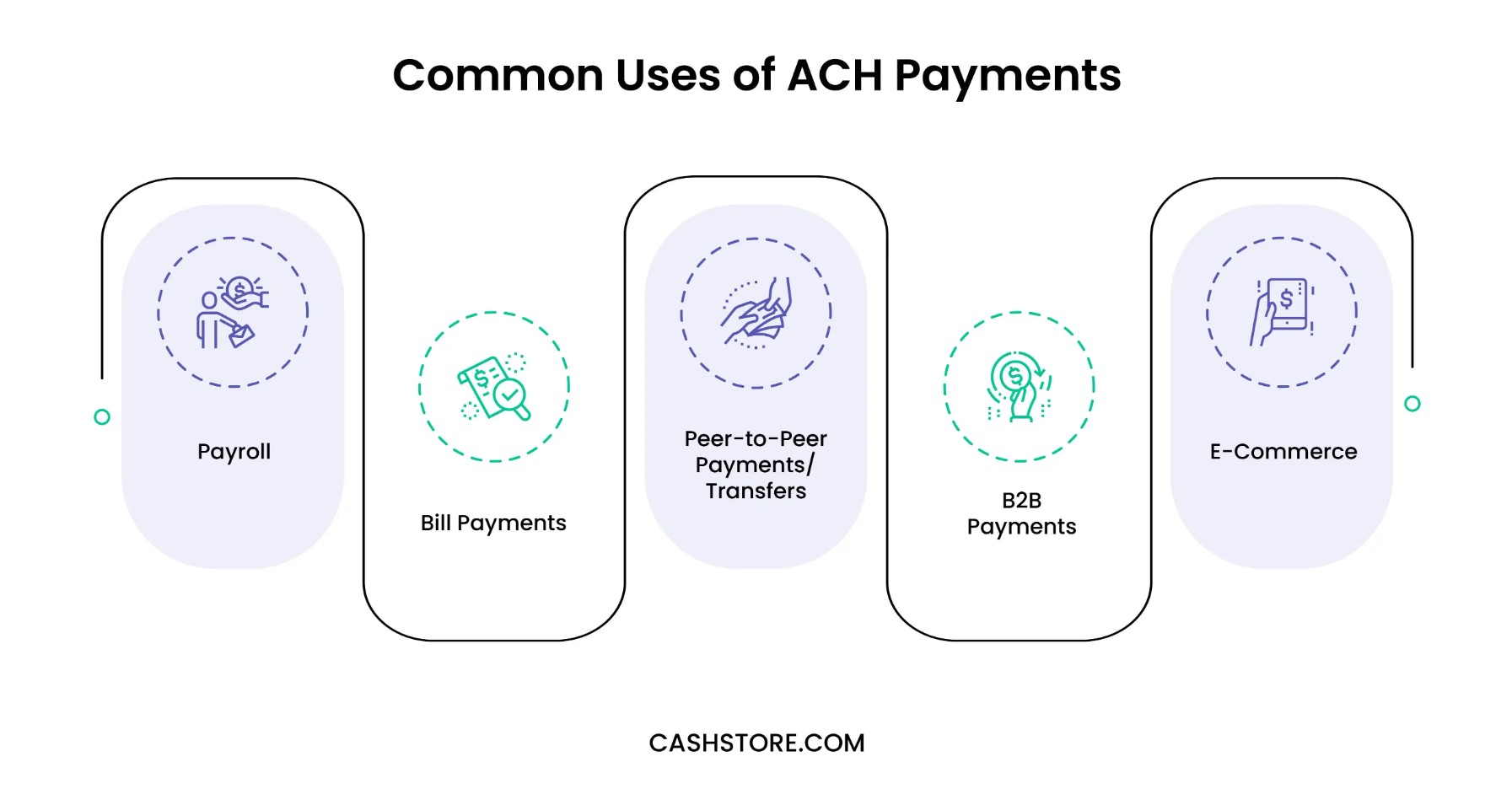

Common Uses of ACH Payments

So when should you expect to use ACH payments in your life?

- Payroll: One of the most common uses is for direct deposit of payroll and government benefits. According to Nacha, 93% of American workers are paid through the ACH network, with 95% receiving tax refunds and 99% receiving Social Security payments the same way. When payroll is distributed through ACH, you can save yourself the trouble of cashing checks—the money goes right into your account on a regular basis.

- Bill Payments: Going the other direction, you can use ACH payments to automate the paying of your bills, whether that’s your insurance, utilities, or even your Netflix subscription.

- Peer-to-Peer Payments/Transfers: Using Venmo to split the dinner bill instead of a waiter splitting checks at the table? No problem—those funds are transferred through ACH payments, too.

- Business-to-Business (B2B) Payments: From small business to national corporation, ACH payments make the business world go round. Companies can pay vendors or suppliers through ACH, or receive payment from clients.

- E-commerce: Shopping online? Web platforms can use ACH to process online payments, and many major retailers already do, including Amazon and Walmart.

ACH payments are a versatile and quickly growing form of electronic transaction that can save you a good deal of financial headache. Now that you have an idea of how the ACH network functions, look out for places you may have been using ACH payments every day without even noticing!

Apply for a loan with Cash Store today and simplify your financial life.