Cash Store Blog

What Are Personal Finance Apps and Which One Is Best for Me?

If you feel stressed about managing your personal finances, know that you are not alone. At least 72% of adults have said that they sometimes feel stressed about money. And unfortunately, stress and money management come hand in hand for many people.

About 66.2% of Americans are living paycheck to paycheck. And an article from CNN suggests that 35% of adults have had to take on extra work to make ends meet. So the blinding truth is definitely right in front of us.

But why is managing our money so challenging, and why are so many people in this situation? Sure, inflation is definitely a contributor since it seems like everything we need costs more these days. The other side of it, however, is that many people don’t have a great way to stay on top of their income and finances. And before you know it, their debt-to-income ratio gets pretty far our of whack.

This is where personal finance apps can really come in to save the day. By taking advantage of our love for technology—specifically smartphones and tablets—we can now access intuitive and user-friendly apps designed to help manage and understand our budgets. These innovative tools have totally changed the way we handle our finances. They provide real-time insights, budget tracking, expense categorization, and much more.

But which personal finance app should you choose? This article will give you Cash Store’s suggestions on the five best personal finance apps of 2024. We’ve taken the time to carefully select these apps because we feel they best cater to the needs of those seeking financial stability and improved money management.

So, let’s jump into the topic of finance apps so that you can decide which one is best for you.

What to look for in a personal finance app

Okay, so we want to push pause just for a moment and talk about what to look for in a personal finance app, before we sing all those praises. The thing here is that what might work for someone else might not work for you. Though the apps we are going to suggest have some similarities, as you will see in the benefits we shared below, they all work a bit differently.

So, when looking for the best personal finance app, decide on which of the following things is important to you.

- User-Friendly Interface: Easy navigation is key. An app that's simple to use can make managing your money less of a chore.

- Budgeting Tools: Look for apps that help you create and stick to a budget. This is far more efficient than using paper and pencil or old spreadsheets.

- Expense Tracking: Select an app that automatically tracks your spending. This feature helps you see where your money goes each month.

- Investment Monitoring: If you invest, find an app that tracks your portfolio’s performance in real time.

- Security Features: Make sure the app has strong security measures to protect your financial data.

- Custom Alerts: Apps with customizable alerts for due bills, low balances, or unusual activity can keep you informed and help avoid financial pitfalls.

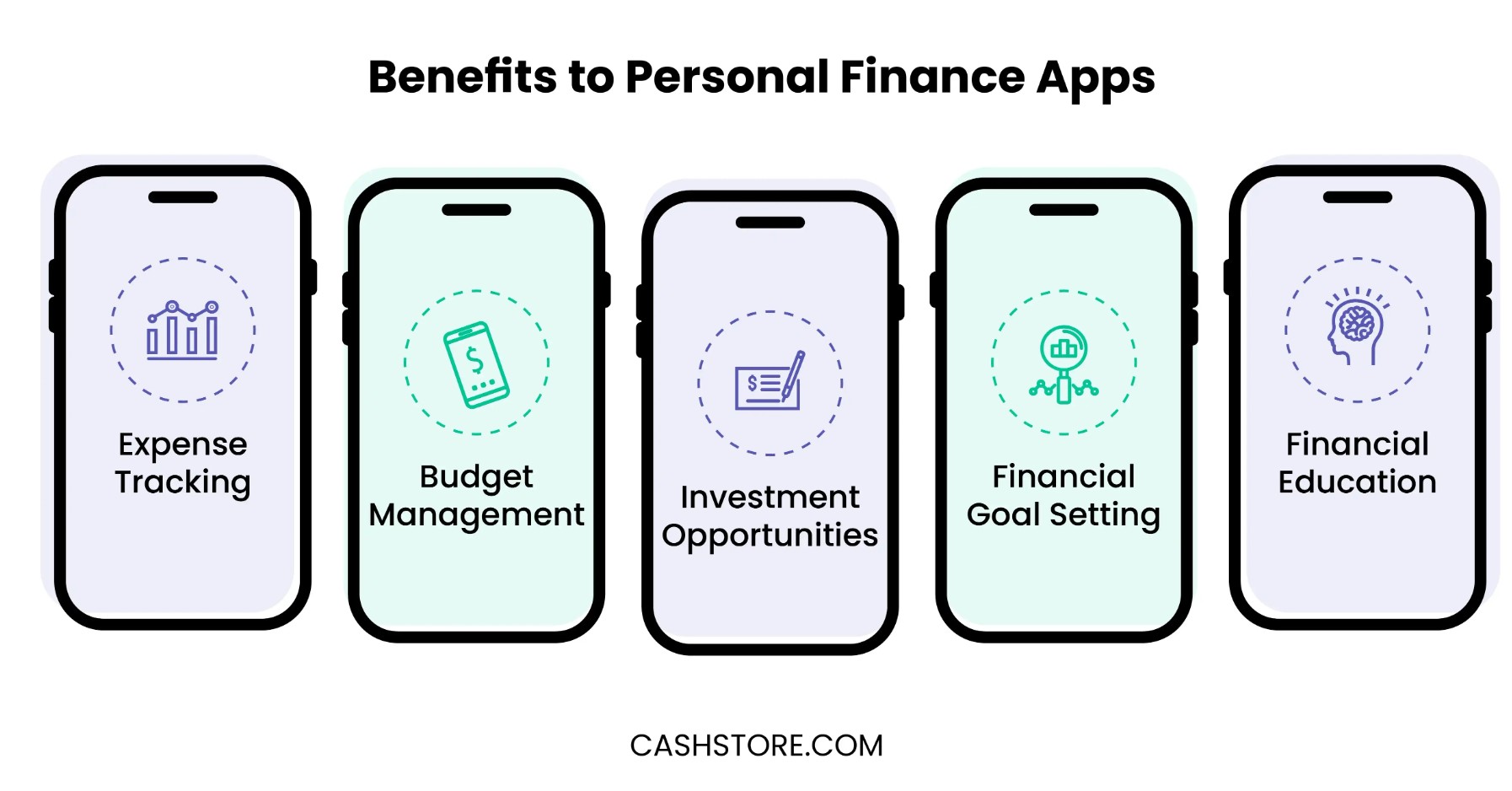

The benefits of personal finance apps

Personal finance apps have become invaluable tools for individuals seeking to take control of their financial well-being. These apps offer many benefits, empowering users to track their expenses, manage budgets, make informed investment decisions, and achieve financial goals. Let's take a look at the advantages that personal finance apps bring to the table:

- Expense tracking. We mentioned this above and we want to talk about it again because this is the primary reason that people use personal finance apps. If your expenses get out of control, it can wreak havoc on your lifestyle and ability to make ends meet. So, personal finance apps provide a convenient and simplified way to track every penny spent. The result? A comprehensive overview of your financial transactions.

- Budget management. These apps enable users to set up budgets, categorize expenses, and monitor their spending patterns in real time, helping to identify areas where adjustments can be made.

- Investment opportunities. Many personal finance apps offer features that allow individuals to explore investment opportunities, providing valuable insights, analysis, and even automated investment options.

- Financial goal setting. With personal finance apps, setting financial goals becomes more tangible and attainable. Users can define specific objectives, such as saving for a down payment or paying off debts, and track their progress.

- Financial education. These apps often offer educational resources, articles, and personalized tips to enhance users' financial literacy, enabling them to make more informed decisions.

What are personal finance apps?

As we said earlier, personal finance apps have totally changed how we manage our finances by connecting with our bank accounts and offering features to help us stay on top of our spending. These apps go beyond expense tracking, providing comprehensive insights into our financial habits and empowering us to make informed decisions.

These apps have become indispensable tools in mastering our finances, from monitoring spending categories to making bill payments and even keeping tabs on credit scores and investment portfolios.

The best money management apps offer many features to simplify and optimize our financial management. Some of the key functions and features include:

- Email reminders. These apps provide timely email reminders for bill due dates, helping users avoid late payments and potential penalties.

- Expense categorization. Personal finance apps categorize expenses, allowing users to identify areas where they spend the most and adjust their budget accordingly.

- Subscription tracking. Users can track and manage their subscriptions in one place. And when it is to easy to sign up for subscription services these days, it can be so nice to have everything organized in one place.

- Shared wallets. Some apps offer shared wallet functionality, enabling users to collaborate with family members or partners in managing joint finances.

- Cross-platform availability. Many apps are available on both iOS and Android platforms, providing you with accessibility regardless of your smartphone type.

With the help of these powerful personal finance management apps, mastering your finances is now easier than ever before.

Our recommended personal finance apps for 2024

So, what apps do we think you might want to consider in 2024? These apps have proven their worth in helping individuals to get a handle on their finances. And we think you’ll see why. Plus, by the end of this article, we think you’ll be able to decide on which personal finance app is best for you.

Let’s get to it.

1. Mint

With its user-friendly interface and comprehensive budgeting tools, Mint is an excellent choice for individuals seeking control over their finances. It offers expense tracking, bill reminders, credit score monitoring, and personalized money-saving tips.

2. YNAB (You Need a Budget)

YNAB is all about proactive budgeting. The app emphasizes financial awareness and goal setting. Its unique methodology helps users assign every dollar a purpose, track spending in real time, and make informed decisions to achieve their financial objectives.

3. Empower

Empower, formerly known as Personal Capital, combines budgeting tools with robust investment tracking and retirement planning features, ideal for those focusing on investment management. It offers a complete view of your financial picture, allowing you to monitor your net worth, analyze investment performance, and plan for the future.

4. Cashphlow

Designed to simplify and streamline your financial management, Cashphlow offers powerful budgeting tools, expense tracking, and goal-setting features. It helps you stay on top of your finances by providing real-time insights and personalized recommendations for smarter money management, especially when managing a family budget.

5. Spendee

With its visually appealing interface and intuitive expense tracking, Spendee makes managing your finances a delightful experience. It allows users to create custom budgets, track shared expenses, and generate insightful reports to understand their spending habits better.

These recommended personal finance apps offer distinct features and advantages, catering to various financial goals and preferences. Choose the ones that align best with your needs and embark on a journey toward financial mastery and success.

Choosing the right personal finance app

When selecting a personal finance app, it's essential to find the one that aligns with your needs and preferences. With many options available, considering a few key factors can help you make an informed decision. Here are some tips to guide you in choosing the best personal finance app for your financial journey:

- Security. Make sure that the app you choose prioritizes the security and privacy of your financial data. Look for apps that have encryption and two-factor authentication to keep your personal information safe.

- Compatibility. Check if the app is compatible with your devices and available for both iOS and Android platforms.

- Features and Functions. Look for tools such as budget tracking, expense categorization, bill reminders, investment tracking, and financial goal setting.

- Pricing Models. Determine the pricing structure of the app. Some personal finance apps offer basic features for free, while others may have subscription plans with additional benefits. Assess whether the app's pricing is reasonable and offers value for the features provided.

- Customer Support. Check if they offer reliable support channels such as email, live chat, or community forums to address any queries or concerns that may arise. The last thing you want is to have a problem and not be able to get a hold of anybody to help you.

- User interface and ease of use. Look for an intuitive design that makes working through the app and accessing key features super easy.

- Reviews and ratings. Take the time to read reviews and ratings from other users. Their experiences can provide some super helpful insights into the app's strengths and weaknesses. And, you may feel better about making an app purchase when you know others found it helpful.

Financial planning apps make budgeting for your future easier than ever

Personal finance and wealth management apps are invaluable tools for effective money management. These savings and expense-tracking apps offer many benefits that simplify the complexities of financial management and empower individuals to take control of their financial well-being.

Whether tracking daily expenses, monitoring investments, or setting financial goals, personal finance apps simplify the entire process and alleviate the stress of managing one's finances.

We encourage you to explore this article's suggested personal finance apps to enhance your financial well-being. From Mint's comprehensive budgeting tools to YNAB's proactive approach, Personal Capital's investment management features, Cashphlow's simplified financial management, and Spendee's intuitive expense tracking. Each app offers its own unique advantages. So, one may be better for you than another.

Don't let financial management keep you up at night. Embrace the power of personal finance apps and set yourself on the path toward mastering your finances. Take control of your financial future, make smarter financial decisions, and set yourself up for a more secure and prosperous life.