Cash Store Blog

What does refinancing a loan mean?

Sometimes you have to take out a loan for a certain purchase or expenditure at a time that is not the most opportune. Perhaps interest rates are high. Maybe your credit score isn’t where you want it to be. Whatever the reason, sometimes those loan terms aren’t what you were hoping for.

Thankfully, you don’t have to be stuck with disadvantageous loan terms for the life time of the loan. Refinancing a loan is often an option that you can pursue to save money and get to a payment that is more desirable. In this article, we’ll provide a comprehensive guide on what refinancing a loan really means. We’ll get into how it works and why you might want to check out your options.

What Does it Mean to Refinance a Loan?

Refinancing a loan is pretty much what it sounds like—taking the balance you owe on your loan and reassessing it for different loan terms. More specifically, the process is all about replacing your existing loan with a new one, ideally with better terms such as a lower interest rate, a different repayment period, or both. The primary goal of refinancing is to make the loan more manageable or to save money over the life of the loan.

The basic concept of refinancing is simple: you pay off your existing loan with a new one. This new loan typically comes with terms that are more favorable, allowing you to reduce your monthly payments, pay off your loan faster, or save on interest costs. Refinancing is different from loan consolidation or loan modification. Loan consolidation combines multiple loans into one single loan with a single monthly payment, while loan modification involves changing the terms of your existing loan without replacing it.

You can refinance various types of loans, including:

- Mortgages: Homeowners often refinance to secure a lower interest rate or change from an adjustable-rate mortgage to a fixed-rate mortgage. With interest rates currently sitting around 7.02%, you may want to refinance your home at a lower rate if and when those interest rates come back down.

- Auto loans: Car owners might refinance to lower their monthly payments or reduce the total interest paid over the life of the loan. Refinancing your auto loan by extending the term of your loan from 36 months to 60 months, for example, can lower your monthly payments, making it easier to stick to your family budget.

- Student loans: Graduates can refinance to get a lower interest rate or to combine federal and private loans into one payment.

- Personal loans: Refinancing can help you secure better terms and reduce the overall cost of borrowing.

- Business loans: Business owners might refinance to improve cash flow or take advantage of lower interest rates.

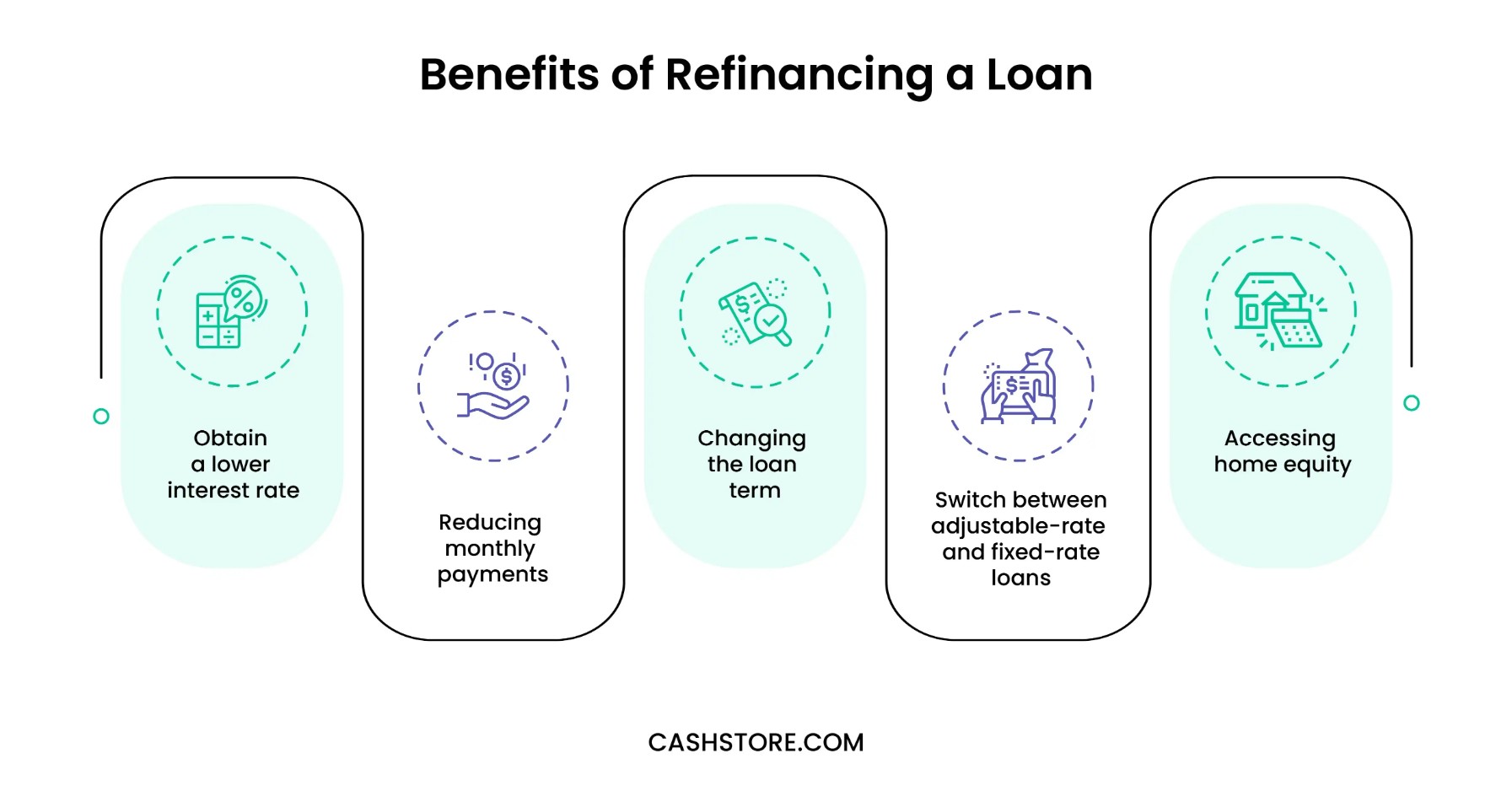

Benefits of Refinancing a Loan

As you are starting to see, there are many advantages to refinancing a loan. Let’s summarize all the benefits you might experience, just to make sure we’re all on the same page:

- Obtaining a lower interest rate: Getting a lower interest rate and APR (annual percentage rate) can save you a lot of money over the life of the loan.

- Reducing monthly payments: Lower payments can make it easier to manage your budget.

- Changing the loan term: You can either shorten the term to pay off the loan faster or extend it to lower your monthly payments.

- Switching from an adjustable-rate to a fixed-rate loan or vice versa: This can provide more stability or take advantage of lower rates.

- Accessing home equity (cash-out refinancing): This allows you to use the equity in your home for other expenses like home improvements or paying off debt.

Refinancing can hurt your credit score a bit initially, but it might actually help in the long run. Refinancing can significantly lower your debt amount and/or your monthly payment, and lenders like to see both of those. Your score may experience a slight dip of a few points. However, it can bounce back within a few months as long as you are making your monthly payments on time.

Costs and Fees Associated with Loan Refinancing

While refinancing a loan can indeed help you to save money in the long run or make it easier to pay your monthly payments, the process does often come with some costs. These fees shouldn’t necessarily dissuade you from refinancing, but you need to be aware of the costs you are responsible for.

Here are the most common costs and fees associated with refinancing a loan.

- Application fees: This is the fee you pay to apply for the new loan. It covers the cost of processing your application and checking your credit.

- Appraisal fees: If you're refinancing a mortgage, an appraisal is often required to determine the current value of your home. This fee, which typically runs around $500, covers the cost of the appraisal.

- Origination fees: These are fees charged by the lender for processing the new loan. They are usually a percentage of the loan amount.

- Closing costs: These are various fees associated with finalizing the loan, such as title insurance, attorney fees, and recording fees.

- Prepayment penalties (if applicable): Some loans have penalties for paying off the loan early. If your current loan has a prepayment penalty, you may need to pay this fee when you refinance. While these fees can vary, prepayment penalties are typically around 2% of your loan balance.

Refinancing Provides Short-Term (and Long-Term) Financial Security

Refinancing a loan is a common way to set yourself up for better financial security. It’s a good way to make your loan more manageable so that you don’t need to dip into your emergency funds. However, if you are in need of some quick cash to help cover short-term expenses, please know that Cash Store can help.

To get started, complete our prequalification application today.