Cash Store Blog

What Actually Happens When You Cash a Check?

When you receive a check, whether it be a paycheck or a check from someone you know, the chances are you head to the bank, deposit the check, get your money, and don’t think twice about it.

We know that checks aren’t as prevalent as they used to be. However, a survey last year from the Federal Reserve of Atlanta indicated that 46% of respondents had used a paper check in the previous 30 days. That tells us that despite the rise of online banking, the use of physical checks is alive and well.

That’s why the team at Cash Store wants to take a few minutes of your time to explain all the hidden workings involved with cashing a check. There’s more to it than you might have ever realized.

Checks 101

Let’s start with the basics. A check is a written, dated, and signed paper document that advises a bank to pay a specific amount of money to the bearer. The four key components of a check are as follows.

- Date: The day the check is written.

- Payee: The person or entity to whom the check is payable.

- Amount: The monetary value, written both in numbers and words.

- Signature: The signature of the person writing the check, authorizing the payment.

Different Types of Checks

- Personal Checks: Issued by individuals from their personal bank accounts, used for everyday transactions.

- Cashier's Checks: Issued by a bank and backed by the bank's own funds, often used for larger purchases such as a deposit on a car, buying a piece of land, or paying the downpayment on a home.

- Business Checks: Issued by businesses, typically for payroll or vendor payments, and will usually prominently feature the company’s logo.

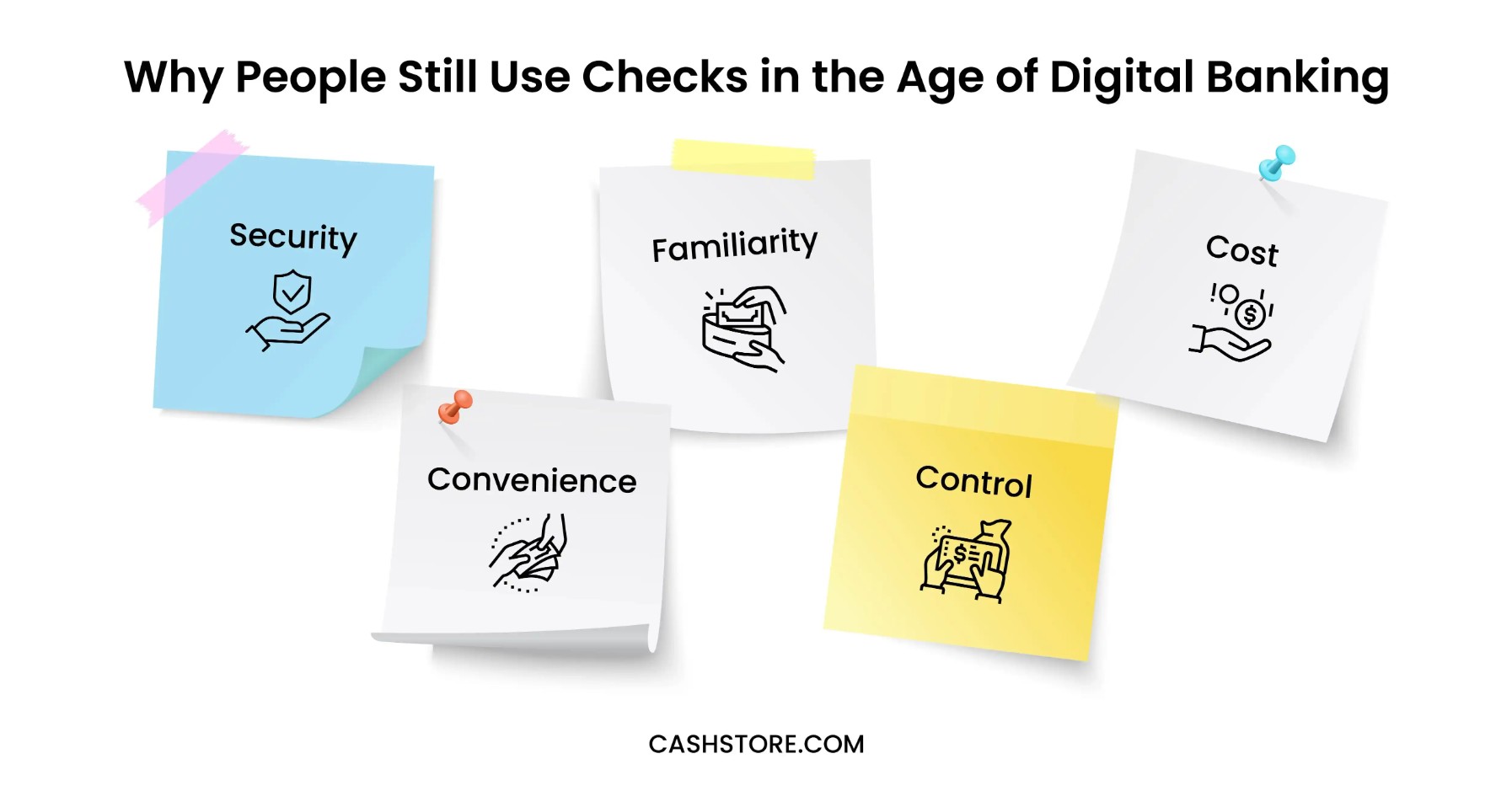

Why People Still Use Checks in the Age of Digital Banking

But with it so easy to simply transfer funds back and forth online, why do people still use paper checks? The reasons may surprise you.

- Security: Checks may feel more secure than cash because they create a paper trail that serves as proof of payment. It's also harder to cash someone else's check than to spend intercepted cash.

- Convenience: Checks are simple to use and can be written to anyone without setting up a person-to-person transfer. They may also be used to make bill payments, as gifts, or to transfer money between people.

- Familiarity: Checks have been a common payment method in the United States since as far back as 1681. Many people trust something that has stood the test of time.

- Control: Some people prefer checks because they offer more control over their finances. Writing a check allows individuals to record the transaction in their checkbook register.

- Cost: Most financial institutions don't charge for check processing, making checks a low-cost option. While some digital transactions may incur fees, checks typically do not.

What Happens During the Check Cashing Process

Though your bank makes the process look easier, there is more to the check-cashing process than meets the eye. Here’s what is happening behind the scenes.

Step 1: Endorsing the Check

Endorsing a check means signing the back of the check to authorize the bank to process the payment. To properly endorse a check, sign your name on the designated line on the back. If additional information is required, such as account numbers or "For Deposit Only," be sure to include it.

Step 2: Presenting the Check to a Financial Institution

You may present the check at a bank, credit union, or check-cashing service. Each option might have different requirements and fees. To verify your identity, you will need to show a government-issued ID, such as a driver's license or passport.

Step 3: Verification Process

When you present a check, the bank verifies it by checking the issuer's account status, confirming sufficient funds, and verifying its legitimacy. Banks consider the account status, available funds in the issuer’s account, and any potential holds that might need to be placed on the check.

Step 4: Funds Availability

- Immediate Cash: In some cases, you may receive cash immediately if the check amount is within certain limits and the bank verifies the funds quickly.

- Deposits: The timeline for funds to be available in your account varies, but it is typically within 1-2 business days for local checks and longer for non-local or large checks.

- Holds: Banks might place a hold on a check if the amount is large, if it’s an out-of-state check, or if there are concerns about the check's validity. Holds may last several days to confirm the funds are clear.

Potential Issues and How to Avoid Them

Unfortunately, some issues may arise with the use of checks. Part of this problem stems from poor money management due to the lack of a budgeting system. The lag time between cash being deposited at the bank and actually clearing may result in a false balance when looking at your funds online.

Here are some specifics on the issues that may arise.

Bounced Checks

A bounced check occurs when insufficient funds are in the issuer's account to cover the amount written. The bank cannot process the payment, and the check is returned unpaid.

Bouncing a check may lead to hefty fees for both the issuer and the recipient, negatively impacting your account. Repeated instances may harm your credit score and lead to account closure.

Fraud Prevention

Recognizing a fraudulent check is a must. Warning signs include suspiciously large amounts, discrepancies in the check's information, or checks from unknown sources.

To protect yourself from check fraud, always verify the issuer’s information, secure personal information, and use checks from reputable sources. Report any suspicious activity to your bank immediately.

Bank Policies

Bank policies regarding check processing, fees, and holds may vary significantly. Some banks may offer quicker processing times, while others may have more stringent verification processes.

To avoid surprises, familiarize yourself with your bank's specific rules. Review your bank’s policies online or speak directly with a representative to understand the details of fees, holds, and processing times.

Cash Store Offers Immediate Cash When You Need It

If you’re in a financial pinch. Cash Store may be able to help. We offer loans between $500 and $3,000 and 90% approval rates. Short on cash? Consider our alternative to a payday loan and complete your prequalification application today.