Cash Store Blog

What is a Cashier’s Check, and Why Use Them?

An estimated 81.5% of Americans are considered what we call “fully banked.” And the majority of these people have checking accounts. Though the use of paper checks has stalled a bit in recent years due to the rise of online banking, the truth is that the checking industry is alive and well.

However, there are some situations when a check drawn off your checking account isn’t going to cut it. In these situations, a cashier’s check is required. In this article, the team at Cash Store will explain what a cashier’s check is, how they work, and why they are sometimes required.

What is a Cashier’s Check?

A cashier's check is a type of check that's different from the personal checks you might write from your own checking account. Instead of being backed by your personal funds, a cashier's check is backed by the bank's funds, making it a very secure form of payment.

How It Differs from Personal Checks and Money Orders

Unlike a personal check, which relies on the money in your account, a cashier's check is guaranteed by the bank. This means the funds are more secure, and the recipient can trust that the check won't bounce. Compared to a money order, a cashier's check usually allows for larger amounts and is considered more reliable because it's issued by a bank rather than a third party.

How Cashier’s Checks Work

To get a cashier's check, you request one from your bank. You'll need to provide the amount and the recipient's name. The bank will then withdraw the money from your account and issue a check in your name.

The bank guarantees the funds by taking the amount directly from your account or in cash. This means the recipient can be sure the money is available when they deposit the check. Here are the two big features that come along with cashier’s checks.

- Security: Cashier's checks are considered very secure because the bank’s funds back them. This reduces the risk of the check bouncing due to insufficient funds.

- Authentication: They come with features like watermarks, special inks, and unique serial numbers to help prevent fraud. This makes it harder for anyone to forge a cashier's check, adding an extra layer of security.

When to Use a Cashier’s Check

As far as when to use a cashier’s check, you will likely be told by the person you need to pay if one is needed. Typically, these financial instruments are used when you are making a large purchase and the risk of a bounced check is too high to take on. Typically, you’ll be required to provide a cashier’s check when making a downpayment on a house. Occasionally, you may be required to provide a cashier’s check when purchasing a car.

When Personal Checks Aren't Accepted

There are certain situations where personal checks are not accepted due to the risk of them bouncing. This is often the case for high-value transactions where guaranteed funds are a non-negotiable.

For instance, landlords may require a cashier's check for rental deposits to avoid any payment issues. Similarly, legal settlements often demand cashier's checks to make sure the funds are secure and available immediately.

International Transactions

When dealing with transactions abroad, cashier's checks can be a useful tool. They offer a way to make large payments without the complications that often come with international banking.

Using a cashier's check helps you avoid the hassle of currency exchange rates and potential delays with international wire transfers. It also provides the recipient with assurance that the funds are available and genuine, making it a reliable method for cross-border transactions.

How to Obtain a Cashier’s Check

As we suggested earlier, most banks require a visit to your local branch to get a cashier’s check. However, the process is pretty easy.

What You Need & the Process

To get a cashier's check, you’ll need a few things:

- Identification: Bring a valid ID, such as a driver's license or passport.

- Account Information: Have your bank account number or a bank card ready.

- Funds: Make sure you have enough money in your account to cover the amount of the cashier's check, including any fees. Think ahead to any near-term transactions that could lessen your balance and put you at risk for an overdraft.

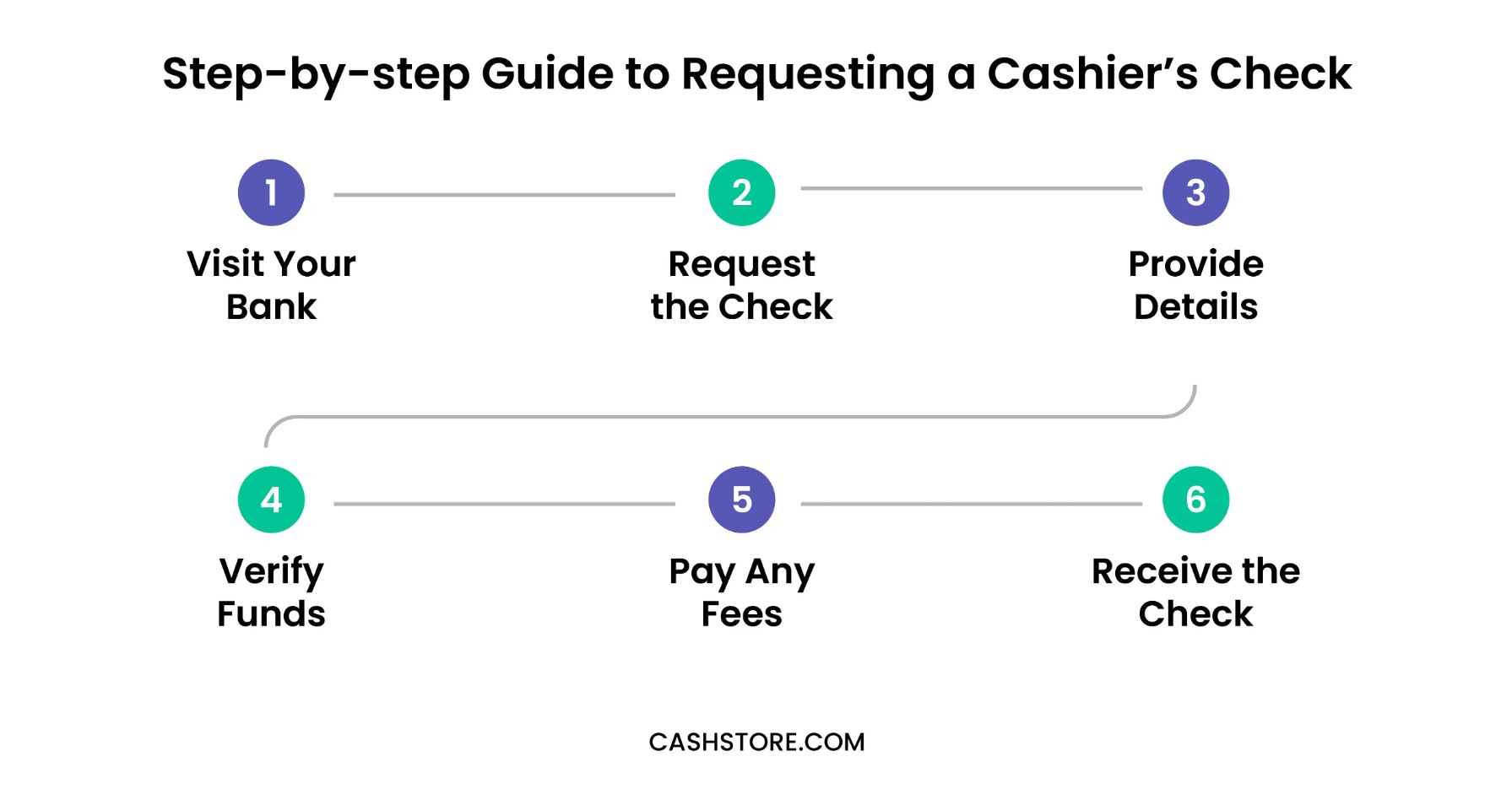

Here’s a step-by-step guide to requesting a cashier’s check:

- Visit Your Bank: Go to your local branch.

- Request the Check: Ask a teller for a cashier’s check.

- Provide Details: Give the amount and the recipient’s name.

- Verify Funds: The bank will verify you have enough funds in your account.

- Pay Any Fees: Be prepared to pay a small fee for the service.

- Receive the Check: The bank will issue the cashier’s check in its name, guaranteeing the funds.

Typical cashier check fees range from $8 to $15, depending on the bank. To minimize or avoid fees, check if your bank offers membership perks. Some banks waive fees for premium account holders or members with certain account types. It’s always a good idea to inquire about any available discounts or promotions that could save you money on obtaining a cashier's check.

Things to be Aware of When Using a Cashier’s Check

As with any financial transaction, it is important to do your homework and know the details of the process and what you might be getting into. Though cashier’s checks are used daily for big transactions in the U.S., you need to know the costs of getting one and the alternatives for smaller amounts.

Many people find obtaining a cashier’s check to be an inconvenience, especially because they need to visit their local branch. While this might not seem insurmountable, in a world where we do most things digitally, it's just one more thing you need to add to your list of things to do. However, some banks might offer more convenient options, such as getting one online. Check your bank’s website for options before you make that trip to the bank.

It’s also important to be aware of the risk of loss or theft associated with cashier’s checks. Because these are still physical checks, the risk of one of those two things happening is very real. If this happens, you need to contact your bank immediately. They may require you to obtain an indemnity bond—a type of insurance policy—before they will issue you a new cashier’s check.

Cash Store Is Here to Help

Need help with short-term cash needs? Cash Store can help. We offer installment loans to help bridge the gap when money gets tight. In fact, a loan from Cash Store can help you access the funds you need to secure your cashier’s check.

Complete our prequalification application today to get started.