Cash Store Blog

What is a Payday Loan, and is it Right for Me?

Sometimes, despite our best efforts, we find ourselves in a financial pinch. Maybe we’ve been faced with an unexpected car repair or a surprise medical bill when we haven’t quite met our deductible. Perhaps the plumbing in our home sprung a leak and now you’re facing some hefty repairs to get it fixed.

Whatever the case may be, know that you are not alone. Many people face unanticipated expenses from time to time. It’s just one of those things that comes with adulting. But what are you to do when your emergency fund falls short of the balance due on that bill in your hand? What happens if you are facing the electric company shutting off your power because you are late on your payment—again?

While some of these situations may indicate you are experiencing financial hardship—something we’ll talk about later in this article—for now, you need to know your options to stay afloat. And it’s possible that a payday loan might be the right option for you.

In this article, the Cash Store team will give you the inside scoop on what a payday loan is and how to know if it is the right financial solution for you.

Payday Loans: A Serious Contender When Times Are Tough

Let’s get right to it—what are payday loans? Well, most simply explained, a payday loan is a short-term loan associated with high costs, often for about $500 or less, generally due on your next payday. At first glance, a payday loan might not seem all that compelling. But for many borrowers, a payday loan can be helpful, especially when trying to get by between paychecks.

If you’re struggling to make ends meet and living paycheck to paycheck like 66.2% of other Americans, a payday loan might seem like a great option. Because let’s face it, we’ve all had financial ups and downs. Sometimes it's related to job loss. Other times it's related to a new baby in the family, an unexpected auto repair, or a medical expense. And other times, it's because our finances got away from us. Whatever the reason, sometimes we just need access to some extra money to help us make ends meet.

And that’s what payday loans are designed to do. But, as we said above, these loans come with some pretty high costs, namely in the way of interest. So, it is imperative that you do your homework and explore your options before signing on the dotted line.

Definition and Purpose of Payday Loans

As we said above, the CFPB defines a payday loan as an emergency-type loan with a low dollar amount and high-interest rate. Most of these loans are designed to be paid back within two weeks or whenever your next paycheck arrives.

Payday loans are currently available in 29 states across the U.S. The other 21 states, plus Washington D.C., prohibit payday loans because of something called usary, defined as an unreasonable and excessive interest rate.

However, payday loans can come in quite handy for some who may be facing financial hardship, especially if you want to make sure your bills are paid on time and don’t want to risk the long-term repercussions of a missed payment.

And for many Americans, financial hardships are more prevalent than we might realize. A recent article from Gallup indicates that three in five Americans say the price increases we’ve seen have caused financial hardship for their household. If that isn’t alarming enough, consider that 15% of U.S. adults say the hardship created by inflation and the state of our economy is severe enough to affect their current standard of living.

While this might demonstrate a need to evaluate your family budget and make some changes, sometimes you need access to emergency cash during the process. This is what payday loans are for. But again, is this the best option for you?

Features of Payday Loans

As we have said, payday loans are one of the various different types of loans. However, these loans are specifically designed to provide short-term financial assistance, typically to cover unexpected expenses or give you a bit of financial wiggle room until your next paycheck. To help you grasp the essential aspects, let's explore the features typically associated with payday loans as outlined by the CFPB and Experian.

- Short-Term Borrowing: Payday loans are intended for short-term use and are often due on your next payday. So, most payday loans are for about two weeks.

- Small Loan Amounts: Payday loans usually provide smaller loan amounts than traditional loans, typically ranging from $100 to $1,000.

- Quick Application Process: Payday loans offer a relatively simple application process, allowing you to apply online, over the phone, or in-store.

- Fast Approval and Funding: Payday loans often provide quick approval decisions, and often, funds are distributed into your bank account or to a debit card within 24 hours.

- No Credit Check Requirement: Some payday lenders may not require a traditional credit check, making them an option to individuals with less-than-perfect credit. For this reason, payday loans are often considered by those with bad credit.

- High-Interest Rates and Fees: Payday loans are generally associated with higher interest rates and fees than other borrowing forms, so fully understanding the terms and costs involved is super important to make sure you know what you are signing up for.

- Renewal and Rollover Options: Sometimes, payday loans can be extended or rolled over for an additional fee. However, this can lead to increased costs and a cycle of debt if not managed carefully.

How Payday Loans Work

Perhaps one of the most significant benefits of a payday loan is that you can access funds quickly. And sometimes, time is of the essence when you’re in a financial pinch, and you need money while aggressively trying to improve your credit score fast on a parallel path.

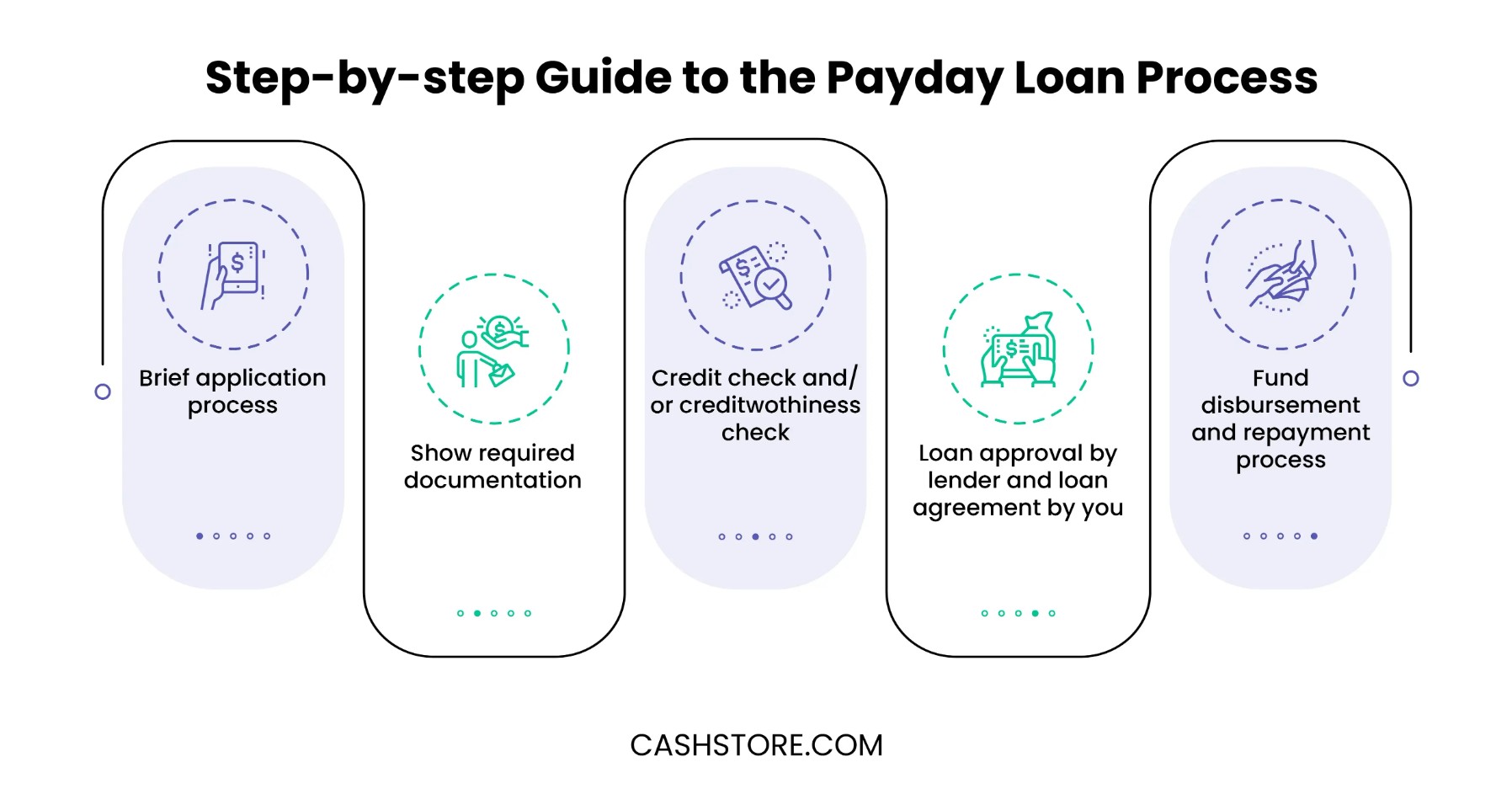

Understanding how payday loans work is a must when considering this short-term borrowing option. So, let’s take a look at the process of obtaining a payday loan, including the application process, approval, and fund disbursement.

Here's a step-by-step overview of how payday loans generally operate:

- Application Process: Applying for a payday loan typically involves completing a brief application online, over the phone, or in person at a payday lender's physical location. You'll need to provide personal information, proof of income, and details about your bank account.

- Required Documentation: The lender may require specific documents, such as a valid ID, proof of employment or income, and bank account information. These requirements may vary depending on the lender and local regulations.

- Credit Check Considerations: While some payday lenders may not perform a traditional credit check, they may still review your creditworthiness using other data sources.

- Loan Approval: After submitting your application and documentation, the lender will assess your eligibility. Factors such as your income, employment status, and ability to repay the loan will be considered. If approved, you will receive a loan offer detailing the loan amount, repayment terms, interest rates, and fees.

- Loan Agreement: If you decide to accept the loan offer, you'll need to review and sign a loan agreement. It's super important to carefully read the terms and conditions, including repayment dates, fees, and the total cost of the loan.

- Fund Disbursement: Once you've signed the loan agreement, the lender will typically disburse the funds to your bank account or a debit card. The timing of fund availability may vary, but in many cases, it can happen as soon as the same day or the next business day.

- Repayment: Payday loans are typically due in full on your next payday or within two weeks. The lender may require access to your bank account to withdraw the loan amount plus any applicable fees directly. Alternatively, you may provide a post-dated check for the loan amount.

Risks and Considerations

According to an article by Debt.org, 12 million or more Americans take out payday loans each year and spend $7 billion on loan fees. And interest rates range from 300% to 500% annual percentage rate (APR). That’s a pretty high-interest rate, especially compared to the typical APR on a credit card of 15% to 30% or a typical loan interest rate of 10% to 25%.

Payday loans may often seem like the only choice, especially when facing financial hardship. If you need help with mastering your expenses, take some time to review your budget and see where your money is going. You should change how much you spend on your wants vs. your needs. And if you do decide that a payday loan is right for you, be aware of the risks, such as the quick repayment requirements and high-interest rates.

Be aware that payday loans are commonly associated with the cycle of debt, which means that you pay off one payday loan simply to take out the next, paying fees all along the way. This can make it hard to get on top of effective money management. For this reason, consider payday loan alternatives before signing on the dotted line.

Is a Payday Loan Right for You?

At this point, we know you are trying to decide if a payday loan is right for you. And the truth is, it’s a big decision. Here are some questions to ask yourself to help you determine the answer.

- Do you have access to other borrowing options like personal loans or credit cards with lower interest rates?

- Can you borrow money from friends or family without financial strain on those relationships?

- Do you have savings that you could use instead of taking out a high-interest loan?

- Is this expense non-essential or something that can wait until you have more funds?

- Are there any less expensive borrowing alternatives available to you through your bank or credit union?

- Is your income stable and predictable enough to prioritize repayment within the loan's term without incurring additional fees or penalties?

- Do you have a financial plan in place to manage debts and avoid relying on short-term loans in the future?

If you answered ‘no’ to the questions above, a payday loan might be a good solution. However, it is super important that you take the time to reassess your budget and approach to managing your expenses. You may need to make some changes to prevent future financial pinches. For example, you may want to explore side hustles to make a bit of extra money. You might want to read up on financial literacy to increase your knowledge. The last thing you want is to find yourself in a habitual cycle of relying on payday loans—and paying the high interest rates—and taking on those costs.

Alternatives to Payday Loans

When you are in a pinch and are considering a payday loan, consider some alternatives, such as personal loans, borrowing from a credit union, and revising your budget. Exploring credit unions is an excellent starting point when searching for a small loan. These financial institutions have made joining more accessible, and their unique structure, where members serve as owners, allows them to be more flexible with loan qualification standards.

Local lenders are also viable, particularly for businesses, as they offer competitive rates for small loan amounts. Another alternative to consider is credit card cash advances. While the interest rates associated with cash advances are typically in the double digits, they tend to be considerably lower than those offered by payday lenders.

Finally, consider borrowing from a family member or friend that will not charge you interest while you refocus your money management efforts.

FAQ: Answering your Frequently Asked Questions About Payday Loans

We know that you may have questions when deciding if a payday loan is right for you. Here are some common questions that borrowers have.

What is a payday loan?

A payday loan is a high-interest loan intended to be paid off in short order, typically due on the borrower's next payday.

What credit score do I need to have to get a payday loan?

Payday loans often do not require a specific credit score, as eligibility is typically based on income and ability to repay.

When do I have to pay back my payday loan?

Payday loans typically need to be paid back within two weeks or when you receive your next paycheck, whichever comes first.

How much can I borrow with a payday loan?

The amount you can borrow varies between lenders. However, most payday loans range between $100 to $1,000 with $500 being about the average.

What happens if I do not pay back my payday loan?

If you fail to repay a payday loan, the lender may transfer your debt to collections, resulting in additional fees. To prevent collection actions, consider communicating with the store manager, financial institution, or online lender's customer service department.

Does a payday loan impact my credit?

Typically, payday loans don't affect your credit scores as they are not usually reported to major credit bureaus. Storefront payday lenders often base loan eligibility on factors other than traditional credit reports or scores.

Payday Loans Offer Benefits But Are Not the Only Choice for Financial Emergencies

Payday loans offer quick and convenient access to funds, with fast approval and flexible usage options. They are accessible to individuals with various credit backgrounds and can be obtained through online lenders.

However, for those seeking higher borrowing limits, lower APR, and more flexible terms, a Cash Store installment loan may be a better solution. Always do your homework when deciding on the right loan option for you.