Cash Store Blog

What Type of Loan is Best for Me?

Have you ever thought about all the options there are out there to borrow money? From credit cards to loans, and probably some less-familiar options, if you need money, the chances are that there is a way to get it.

But here’s the thing. Not all borrowing options are the same. And some options may be better for your needs than others. For example, a credit card can help you with smaller daily purchases when you don't have cash. They're convenient to use, and making one payment to pay off the card at the end of the month is often easier than having cash on hand for this purchase or that. Plus, many credit cards offer perks and can help you save money, get access to discounts, and even get free gifts now and again.

What about those sizeable purchases? Think of things like paying for a dream vacation or a home renovation. Or, maybe you just want to consolidate your debt. In these cases, a loan might be a better option. But the world of loans can be confusing, especially if you don't know the types of loans available.

At Cash Store, not only do we offer a great alternative to payday loans with cash when you need it, but we also want to help educate consumers on great financial habits. And here, we want to help you answer the question—what type of loan is best for me?

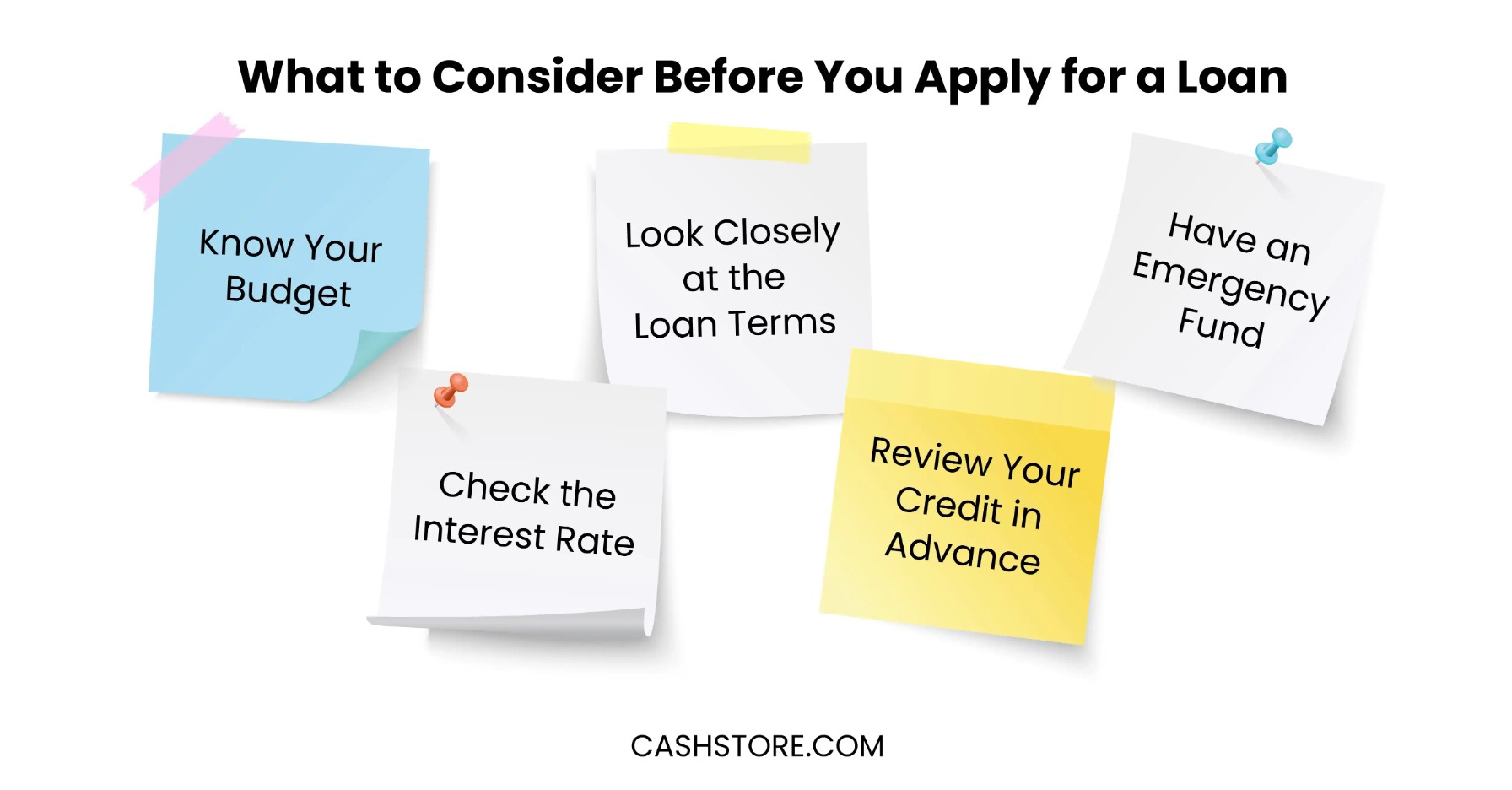

What to Consider Before You Apply for a Loan

As we said earlier, we want to help educate customers on great financial habits. That’s why, in this article, we want to talk about more than just deciding on the type of loan that is best for you. We want to take some time to provide you with some helpful tips that will pay off—pun intended—no matter what choice you make.

It’s estimated that 23.5 million Americans have at least one loan in their name. And, they owe a collective $245 billion. Yikes! To make matters a bit worse, about 2.68% of consumer loans from commercial banks are delinquent. This means that borrowers aren’t meeting their end of the loan obligation.

Why is that happening? In many cases, it means people have borrowed more than they can manage, they haven’t done their homework on the best loan to meet their needs, or their financial circumstances have changed, and they don’t have an adequate emergency fund set aside to help them through.

To keep this from happening to you, consider the following:

- Know Your Budget: Understand how much you can afford to borrow and repay each month without straining your finances.

- Check the Interest Rate: A higher rate means you'll pay more in the long run, so compare rates from different lenders.

- Look Closely at the Loan Terms: Make sure you know how long you'll be paying back the loan and if there are any fees for paying it off early. Some lenders charge prepayment penalties, so be sure to read the fine print. Be in the know before you sign on the dotted line so you don’t end up with some unexpected—and unfortunate—surprises.

- Review Your Credit in Advance: A good credit score can help you get better loan options and save a lot on interest rates. For example, a good credit score can save you a point or two on interest, which can add up to some big-time savings. Use a credit score calculator to see how much you can save.

- Have an Emergency Fund: Set aside savings to cover unexpected expenses so you don’t rely on loans for emergencies. An emergency fund can be tapped into if you are ever coming up short on making a loan payment. This is a far better option than missing a payment and seeing your credit score start to plummet—or worse—see your account get turned over to a collections agency.

Deciding on the Right Loan for Your Financial Needs

Now that you are armed with some simple tips to set you up for success, just how do you go about finding the right loan that is best for you and your financial needs? It all starts with what it is that you want to accomplish.

Are you looking to go back to school to complete your education? If so, a student loan might be best suited for you. Are you looking to go on that dream vacation or fund that new kitchen project? If so, a personal loan might be the better option. Looking to buy a new car to get you to and from work or school safely? This is where an auto loan comes into play. Ready to buy your first home, you know, the one with the white picket fence and tire swing in the backyard? In this case, a mortgage is your best bet.

As you can see, different loans serve different purposes. So now, let’s make sure you are in the know about the most common types of loans out there so that you can decide the right one for you and whatever it is that you want to do.

Be in the Know on These 8 Loan and Borrowing Options

As we saw above, not all loans are the same. Each type of loan, and even certain credit cards, are designed to help you meet a certain goal. Let’s dig into the most common borrowing options and give you the lay of the land.

1. Personal Loans

Personal loans can be used for things such as debt consolidation, home repairs, or major purchases. These loans are typically unsecured, meaning you don’t need to provide collateral, such as your car or home, to borrow the money. As of September 4, 2024, the average interest rate for a personal loan is 12.35%. However, your interest rate can vary based on your credit score, the loan amount, and the repayment term.

Borrowers with higher credit scores generally get lower rates, while those with lower credit scores might see higher rates. Personal loans are best suited for people who need a lump sum of money and plan to pay it back over time.

2. Auto Loans

Auto loans are secured and used specifically for the intention of buying a vehicle, with the car serving as collateral. While you could use a personal loan or even a credit card to buy a car, an auto loan is often the better option. Auto loans generally offer lower interest rates—around 6.73% for new cars and 11.91% for used cars—because they are secured by the car itself.

Additionally, auto loans usually have longer repayment terms than personal loans, allowing you to spread out payments over several years. This makes the monthly payments more manageable than using a personal loan or a credit card, which typically have higher interest rates and shorter repayment terms. So, an auto loan is usually the most cost-effective choice if you're buying a car.

3. Home Loans

Home loans, also known as mortgages, are secured loans used to purchase a new or existing home, with the property serving as collateral. Common types include fixed-rate mortgages, adjustable-rate mortgages, and home equity loans. If you default on the loan, the lender can foreclose on your home to recover their losses.

Mortgages are typically larger than other loans since homes are much more expensive than cars or personal purchases. As a result, repayment terms can be much longer—often up to 30 years or more. However, mortgage interest rates tend to be lower than personal or auto loans. As of now, the average mortgage interest rate is around 6.37%, though it changes daily.

Because of the extended loan term and the lower interest rate, if you are looking to buy a home, a mortgage is by far your best solution.

4. Credit Cards

Credit cards are a type of revolving credit that allows you to make purchases up to a specific credit limit. Interest is charged on any balance carried over from month to month. Although credit cards are not a type of loan, they are worth mentioning as many consumers use them to fund larger purchases than just their day-to-day expenses.

Unfortunately, credit card debt is currently at an all-time high. And with an average credit card interest rate of 27.64%, consumers spend a lot of interest to finance those purchases. For this reason, personal loans are often a much more financially sound decision when funding larger purchases.

5. Payday Loans

Payday loans are a type of short-term loan that is typically due on the borrower's next payday. They often have high interest rates and fees and are intended for emergency expenses. With such high interest rates and quick repayment times, it is usually better to borrow from a family member or friend or look for an installment loan option. However, payday loans are only legal in thirty-seven states. Be sure to do your homework carefully before deciding if a payday loan is best for you.

6. Cash Advance Loans

A cash advance loan is a short-term loan that provides borrowers with immediate access to cash. These are an excellent alternative to payday loans. For example, Cash advance loans are typically offered by lenders like Cash Store and are intended to be repaid on the borrower's next payday. This means similar terms to a payday loan but a lower interest rate.

Cash Store offers cash advance loans to borrowers in certain states and can be a good option for those who need a small amount of cash quickly. These loans are typically repaid within a few weeks and can be used for various expenses, such as unexpected bills or emergencies. Cash advance loans usually come with lower interest rates than payday loans.

7. Installment Loans

Installment loans are loans that you repay over a set period with regular monthly payments. They can be either secured or unsecured and are commonly used for bigger purchases like furniture or appliances. Cash Store offers installment loans in states like Idaho, Texas, and Wisconsin, making them a good option for those who need a larger loan amount and prefer to spread the payments over time.

Unlike personal loans, which are often unsecured and used for a variety of purposes, installment loans are typically used for specific purchases and can offer lower interest rates. The main benefit of installment loans is that the monthly payments are predictable, making it easier to manage your budget. You might choose an installment loan if you need a larger loan and want the stability of fixed payments over a longer period.

8. Student Loans

Last but not least, let’s talk about student loans for educational purposes. If you are graduating from high school soon and want to pursue an undergraduate education, the chances are that you nor your parents have the cash lying around that you need to pay for four or five years of schooling. Or, perhaps you never had the opportunity to go to college when you were younger, but now it feels like the right time. Maybe you just want to expand your education and go into a different field.

Whatever the reason, a student loan is designed to help you get through school. Most student loans defer your payments until you graduate, which means you don’t have to worry about it until you have that degree in hand. And, student loan interest rates are lower than what you can get with an installment loan or personal loan.

So, if you want to fund your education, a student loan is the best option for you.

Know the Best Loan Option For You

Knowing the terms and conditions of each type of loan before borrowing money is super important to make sure that you make an informed decision and choose the best option for your specific needs and financial situation.

For example, why pay an exorbitant interest rate on a personal loan for your car purchase, when interest rates on auto loans are far lower? Or, why take out a payday loan when your credit is in good shape and an installment loan may work better for your needs?

Regardless of the type of loan you choose, be sure you borrow responsibly and only take on debt that you can afford to repay in a timely and efficient manner. If you live in Idaho, Texas, or Wisconsin, Cash Store can help. Complete our prequalification application today to see how much cash you could receive to help with your financial needs.