Cash Store Blog

What Should You Be Looking for in a Lender?

Have you ever taken out a loan? Whether it be a personal loan, student loan, auto loan, or a mortgage, you’re not alone. An estimated 23.5 million Americans have loans. And perhaps even more interesting is that personal loans total $245 billion. Yikes! But really, that is not necessarily a bad thing.

Loans provide a great way to help you afford something when you don’t have the cash sitting at the ready to fund a purchase. But this begs two questions—how do you decide the right loan for you, and how do you find the best lender for your financial needs?

The truth is that not all lenders are the same. And, doing your homework can make sure that you don’t face any unexpected surprises in the process.

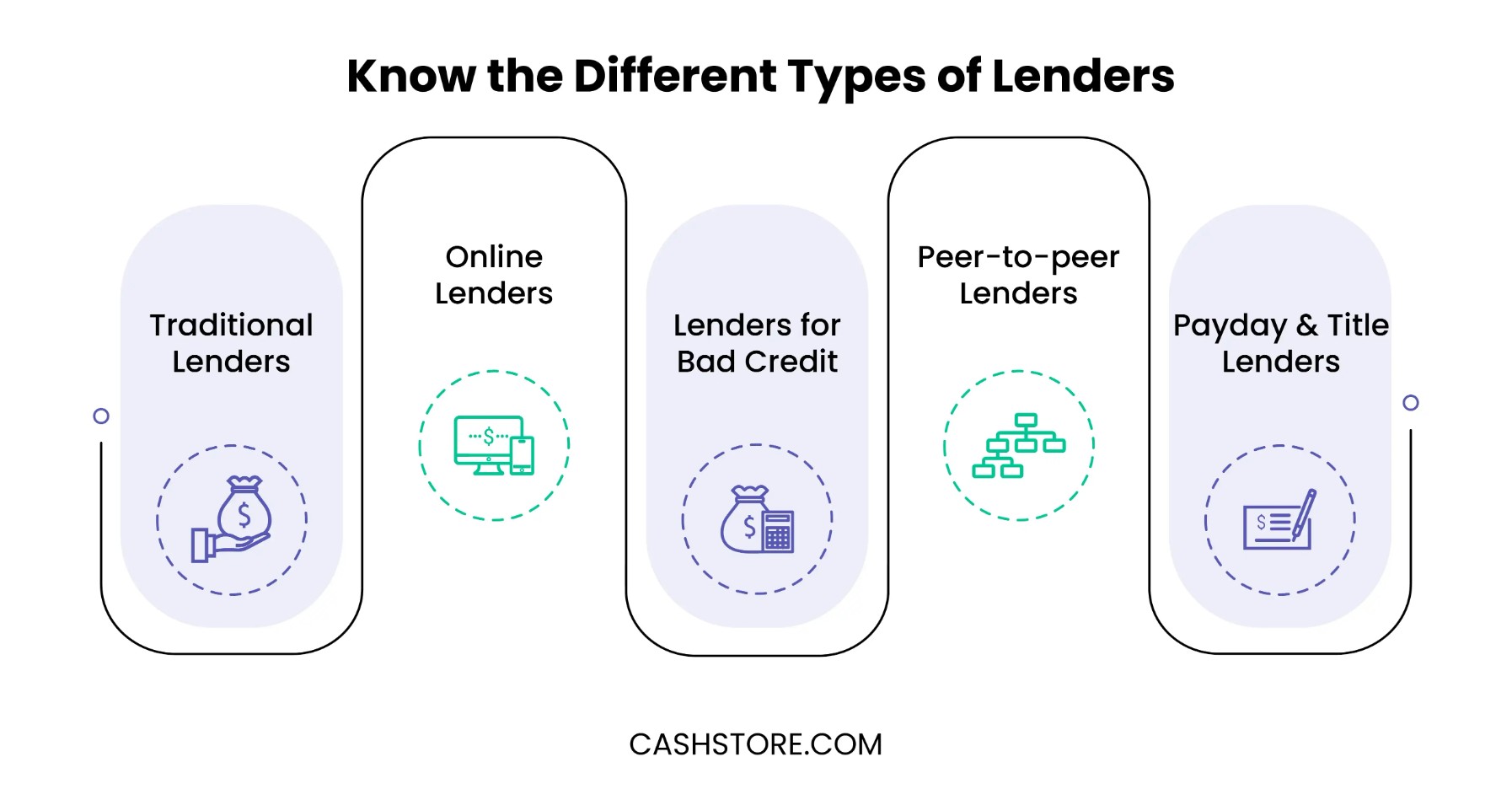

Know the Different Types of Lenders Before You Apply

In this article, we’ll talk about some of the things you should know when taking out a loan. But, before we do that, let’s align on what you should be looking for in a lender in the first place. As we said, not all lenders are the same. Let’s start with the different types of lenders that you may wish to consider.

- Traditional Lenders: These include banks and credit unions, which typically offer loans with competitive interest rates and more personalized service. However, they often have stricter eligibility requirements, making it harder for those with lower credit scores to qualify.

- Online Lenders: Online lenders are becoming more popular due to their convenience and speed. You can apply from home, and they may offer a wider range of loan options. However, interest rates can sometimes be higher, especially for those with lower credit scores.

- Lenders for Bad Credit: If your FICO score is below 580 or your VantageScore is below 601, you may need to work with lenders who specialize in loans for bad credit. These lenders are more flexible with credit requirements but often charge higher interest rates to offset the risk of lending to borrowers with poor credit.

- Peer-to-Peer (P2P) Lenders: These platforms connect borrowers directly with individual investors. While they may offer more flexible terms, interest rates can vary widely based on your credit profile.

- Payday and Title Lenders: These lenders offer short-term, high-interest loans, usually to people with bad credit or those who need money fast. These should be considered with caution due to high fees and risks.

5 Things to Look for in a Lender

Now that you know the different types of lenders, here is what you need to be on the lookout for. Understand that these things are important to know regardless of the type of lender you decide to work with.

1. Interest Rates

One of the first things to consider when choosing a lender is the interest rate they offer. The interest rate directly affects how much you’ll pay over the life of the loan, so it’s super important to compare rates from different lenders. Higher interest rates mean you’ll pay more in the long run, while lower rates can save you a lot of money.

For example, if you take out a $10,000 loan at the average rate of 12.35%, you would pay about $1,235 in interest over a year. However, if you have bad credit and get a loan at 17.80%, you’d pay about $1,780 in interest for the same loan amount. That’s a difference of over $500.

Also, make sure to check if the rate is fixed or variable, as variable rates can increase over time. Always shop around to find the most favorable rate for your financial situation.

2. Loan Terms

The loan term refers to how long you have to repay the loan. Loan terms can range from short-term (a few months) to long-term (several years). It’s important to choose a term that meets your financial goals.

Shorter terms usually have monthly payments that are a bit higher but lower overall interest costs, while longer terms can give you smaller monthly payments but cost more in interest over time. Review the loan term carefully to make sure it fits within your budget.

Typical loan terms on a personal loan are between one and seven years. But, some lenders offer shorter and longer terms as well.

3. Loan Amounts

Different lenders offer different loan amounts depending on the type of loan and your creditworthiness. Some lenders may have a minimum or maximum loan amount, so it’s important to know whether they can provide the amount you need.

For example, if you're seeking a larger loan for a major purchase like a home or car, make sure the lender can accommodate that. On the flip side, for smaller personal loans, find a lender that doesn't impose high minimum amounts.

And, we’d be remiss not to mention here the importance of borrowing only what you need. Keeping your debt-to-income ratio at 36% or less is always best.

4. Potential Fees

Lenders often charge various fees that can increase the cost of borrowing. The fees you may see include origination fees, late payment fees, and prepayment penalties. Origination fees are charged for processing the loan, while prepayment penalties occur if you pay off your loan early.

These fees can add up quickly, so it’s important to ask upfront what fees are involved and factor them into your decision. Always read the fine print and look for lenders with clear fee structures that are easy to understand.

Here are the fees to be on the lookout for:

- Prepayment Penalty: Also called an early payoff fee, this is the amount you will have to pay the lender if you pay your loan off early. Lenders who charge these fees will typically charge approximately 2% of the remaining loan balance.

- Late Payment Fee: A fee you are charged if you make your payment after the due date, though be aware that if you do not make up your payment within 30 days, the lender may charge your loan off to a collector, and this could impact your credit score by as much as 180 points

- Origination Fee: A fee the lender charges to cover processing the loan. In most cases, those who charge an origination fee will charge 0.5% to 1% of the loan amount.5.

5. Reputation and Customer Service

When looking for a lender, you need to consider their reputation and customer service. Look for lenders with positive reviews and a good track record. Check online reviews on sites such as Trustpilot and Google, and don’t hesitate to ask around to see what others have experienced with the lender.

Excellent customer service can help you feel confident throughout the loan process, from application to repayment. You want a lender who is easy to work with, responsive to questions, and provides clear communication at every step. Always check their customer service hours and how you can reach them, as well. The last thing you want is to take out a loan from a lender that is never available to help you, or makes you jump through hoops to reach them.

Application Process and Approval Time

At this point, you have a pretty good handle on what to look for in a lender. But one other thing we want to discuss here is what you can expect from the application process itself, and how long you might have to wait for the approval of your loan and receipt of your funds.

That said, you are probably wondering why we didn’t include this in the list above. The answer is simple—if you find a lender that meets the checkboxes we mentioned above, they will most likely also offer you a simple application process and a quick approval time. Plus, if you are in need of funds quickly, this is also a great opportunity to revisit your approach to budgeting and think about whether or not you really need the loan.

And with that, here is what you should expect from the typical loan application process.

Application Process

Most lenders offer a simple application process, whether online or in-person. You’ll typically need to provide personal information such as your name, address, and Social Security number, as well as details about your income and employment.

Required Documentation

Common documents you’ll need include proof of income (like pay stubs), proof of identity (a government-issued ID), and banking information. Some lenders may also request additional documentation depending on the type of loan.

Turnaround Time

With today’s fast-paced demand for instant decisions, many lenders offer quick approvals, often within minutes or hours. This allows you to know right away whether you’ve been approved or declined, especially when applying online.

How It Works at Cash Store

At Cash Store, we make the application process as simple as possible.

- Step 1: Begin your application online with our simple and secure form to save time.

- Step 2: Collect the necessary documents and bring them to your nearest Cash Store location.

- Step 3: Receive your cash the same day—no need to wait overnight!

Is Cash Store the Right Lender For You?

Now you’re in the know on what to look for in the right lender for you. And, at Cash Store, we offer installment loans that can help you get the money you need in your hands quickly.

Ready to get started? Complete our prequalification application today.